Stop the Cycle of Couples Fighting About Money: A Guide to Financial Intimacy

The New Year's Resolution to Stop Couples Fighting About Money for Good. The festive lights are down, but the glow from your credit card statements is just starting to burn bright. If the arrival of holiday bills has reignited familiar tension, you’re not alone.

It’s a primary reason for couples fighting about money, a cyclical conflict that can erode even the strongest partnerships. But what if this year, you could make a resolution that actually sticks—one that ends the financial friction for good? The truth is, the reason so many couples fighting about money never find a solution is that the argument isn't really about the budget.

You're not fighting over a specific purchase; you're clashing over deeply held beliefs about security, freedom, and trust. These arguments are symptoms of a much deeper issue: a fundamental misunderstanding of each other's "money personality." This guide will help you decode the hidden motivations behind your financial decisions. By identifying your and your partner's unique money personalities, you can finally move beyond blame, understand your financial triggers, and transform conflict into a powerful form of connection and teamwork known as financial intimacy. Let's make this the year you invest in your relationship's bottom line.

Why You're Really Fighting: Uncovering Deeper Financial Triggers

Constant arguments about spending are rarely about the dollars themselves. They are about what money represents to each of you. Your beliefs around security, freedom, status, and responsibility drive your financial habits. These core ideas form your financial values in a relationship. Often learned in childhood, they create a silent blueprint for how you think money should be handled. When your blueprint clashes with your partner’s, conflict is almost certain. Understanding these values is the first step to stopping the fights.

Understanding Your Spouse's Financial Triggers

A financial trigger is an action or event that causes an immediate, emotional reaction. Think about a surprise purchase showing up on a credit card statement. This might trigger a fear of scarcity in one partner. A dismissive comment about debt could trigger a feeling of being controlled in the other. By understanding your spouse's financial triggers, you can see past the anger. You can start to recognize the underlying fear that fuels the conflict. This insight changes the conversation from blame to empathy.

The most damaging issues are often the ones left unsaid. Financial infidelity, such as hidden debt or secret bank accounts, destroys the foundation of trust in a relationship. It creates a power imbalance that is difficult to repair. Similarly, a significant income disparity can lead to feelings of resentment or inadequacy. These silent problems must be brought into the open with care. Addressing them is crucial for building true financial intimacy and moving forward as a team.

The Core of the Conflict: What Is Your Money Personality?

To truly make progress, you must identify your financial archetype. Most people fall into one of five key money personalities. Each one has a different motivation and approach to managing funds. Understanding which one you and your partner embody is key to resolving financial disagreements. It provides a framework for your discussions and helps you find common ground.

The 5 Key Money Personalities Explained

The Saver: You find comfort and security in a growing bank balance. Saving is your top priority, and you avoid financial risks at all costs. You often delay gratification for long-term security.

The Spender: You believe money is a tool for creating joy and experiences. You enjoy generosity and living in the moment. You might struggle with impulsive purchases.

The Worrier: You feel constant anxiety about your financial future, no matter how much you have saved. You may obsessively check accounts and fear economic collapse.

The Avoider: You feel overwhelmed by finances and prefer not to deal with them. You ignore bank statements and delegate all money tasks to your partner.

The Gambler: You see money as a way to win big. You are drawn to high-risk, high-reward investments and get a thrill from financial speculation.

Why Opposites Attract—And Then Clash Over a Bank Account

It is very common for different money personalities to pair up. A Spender is often drawn to the stability a Saver provides. A Worrier might feel safe with a grounded Saver. In the beginning, these differences can feel complementary and create balance. However, over time, these same traits often become major points of friction. The Saver sees the Spender as reckless. The Spender views the Saver as restrictive. This dynamic is a common source for couples fighting about money.

The Interactive Money Personality Quiz for Couples

Instructions: Take This Quiz Separately, Then Compare

Answer the following questions honestly based on your first instinct. Do not try to guess what your partner would choose. The goal is to get a clear picture of your own tendencies. Once you both have your results, sit down together to compare your answers and discuss them without judgment.

1. An unexpected $1,000 bonus arrives. You immediately:- a) Transfer it to your high-yield savings account.

- b) Book a spontaneous weekend trip.

- c) Worry that it won’t be enough for the next emergency.

- d) Let your partner decide what to do with it.

- e) Look for a hot stock to invest it in.

- a) Confident, because you have a solid plan.

- b) Excited for the travel and hobbies you’ll enjoy.

- c) Anxious that you'll never have enough money.

- d) Overwhelmed and prefer not to think about it.

- e) Optimistic you'll hit it big before then.

- a) A well-budgeted trip planned months in advance.

- b) A luxurious all-inclusive resort.

- c) A staycation to save money and avoid financial stress.

- d) Whatever your partner wants to do.

- e) A trip to Las Vegas or another city with a casino.

- a) Ignore it; it's not a planned expense.

- b) Feel a rush of excitement and buy it.

- c) Check the price vs. your savings and feel stressed.

- d) Not even check the price or your balance.

- e) Consider if the resale value makes it a good risk.

- a) Review every transaction to ensure accuracy.

- b) Pay the minimum or full amount without looking too closely.

- c) Feel a pit in your stomach regardless of the balance.

- d) Leave the envelope unopened for weeks.

- e) Look for capital you can free up for new ventures.

- a) A dangerous thing to be avoided at all costs.

- b) A normal part of living a full life.

- c) A constant source of fear and sleepless nights.

- d) Something you don't really think about or track.

- e) Leverage that can lead to a bigger payout.

- a) Focus on why you should wait or find a cheaper option.

- b) Focus on the joy or convenience it will bring.

- c) Focus on the "what if" disasters if you spend that money.

- d) Hope they make the final decision so you don't have to.

- e) Focus on whether it has high-reward potential.

- a) Immediate panic and an audit of your spreadsheet.

- b) Shrug it off; money comes and goes.

- c) Utter despair about your future security.

- d) You didn't notice because you rarely check it.

- e) Frustration that you don't have enough to "play the game."

- a) Put it straight into your savings jar.

- b) Go out and treat yourself to a nice lunch.

- c) Worry about why you lost it in the first place.

- d) Put it on a table and probably forget about it again.

- e) Use it to buy a lottery ticket or a micro-cap stock.

- a) Satisfied and in control.

- b) Bored and restricted.

- c) Terrified that the numbers won't add up.

- d) Confused and mentally exhausted.

- e) Impatient for bigger, riskier financial moves.

Interpreting Your Results: Mostly A's: Saver | Mostly B's: Spender | Mostly C's: Worrier | Mostly D's: Avoider | Mostly E's: Gambler.

Interpreting Your Results: What Your Archetype Means for Your Relationship

Tally your answers. The letter you chose most often corresponds to a money personality.

- Mostly A's: You are a Saver. Your need for security is your primary driver.

- Mostly B's: You are a Spender. You are motivated by joy and experiences.

- Mostly C's: You are a Worrier. Your decisions are guided by anxiety and fear.

- Mostly D's: You are an Avoider. You find finances stressful and disempowering.

- Mostly E's: You are a Gambler. You are driven by the thrill of risk.

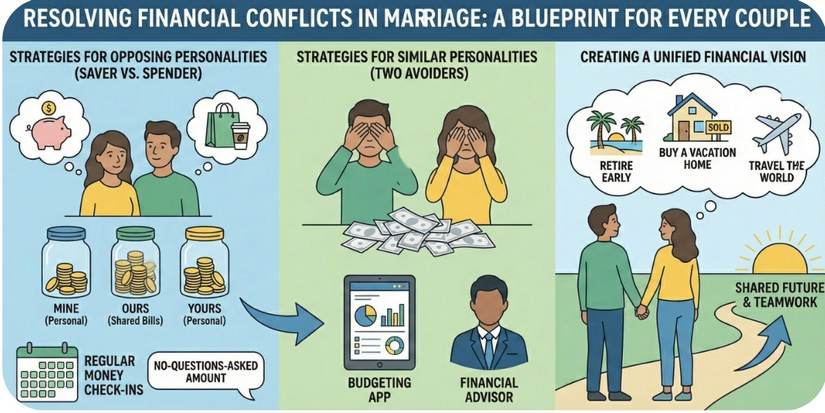

How to Resolve Financial Conflicts in Marriage: A Blueprint for Every Couple

Once you understand your different personalities, you can build a system that works for both of you. The right strategy can provide a clear path for how to resolve financial conflicts in marriage. It transforms your differences from a source of conflict into a balanced strength. You can create a financial plan that honors both of your needs and values.

Strategies for Opposing Personalities (e.g., Saver vs. Spender)

A "yours, mine, and ours" account system is a powerful tool. Each partner gets their own account for personal spending, and a joint account covers shared bills. This gives the Spender freedom and the Saver security. Also, agree on a "no-questions-asked" spending amount for each person per month. Finally, schedule regular, low-pressure money check-ins. These brief meetings prevent issues from building up over time.

Strategies for Similar Personalities (e.g., Two Avoiders)

When both partners share a personality, it creates shared blind spots. Two Avoiders might completely neglect their finances, leading to future crises. The best solution is often to bring in a neutral third party. A financial advisor can provide structure and accountability. Budgeting apps can also help by automating tracking and simplifying money management. This makes it easier for Avoiders to stay engaged without feeling overwhelmed.

Creating a Unified Financial Vision Based on Your Personalities

The most effective way to work as a team is to focus on shared goals. Sit down and dream together. Do you want to retire early, buy a vacation home, or travel the world? When you create a unified vision, daily spending decisions become easier. You are no longer just saving or spending. You are actively working together toward a future that excites both of you. This fosters a sense of teamwork and shared purpose.

The Art of Marriage and Money Communication: Talking Without the Fight

Effective communication is the engine that drives all of these strategies. Learning how to talk about money without it turning into a fight is a skill. Good marriage and money communication requires intention and practice. It involves setting up the right environment and using the right language to ensure both partners feel heard and respected.

How to Schedule and Structure a "Money Date"

Set a specific time and place for your financial conversations. Choose a neutral location like a coffee shop, not the bedroom right before sleep. Keep the meeting focused and relatively short. Establish ground rules beforehand. Agree that there will be no blaming, interrupting, or raising voices. This structure removes the emotional charge from the topic and makes it feel like a productive planning session.

Speaking the Same Language: From Accusation to Understanding

The words you choose matter. Avoid accusatory "you" statements, such as "You spend too much money." Instead, use "I feel" statements to express your emotions without placing blame. For example, say "I feel anxious when I see large credit card bills because I worry about our savings." This simple shift in language can transform a potential argument into a moment of connection and understanding.

Building the Foundation for Lasting Financial Intimacy

Ultimately, the goal is to build lasting financial intimacy. This means creating a relationship where money is no longer a source of shame, secrecy, or conflict. Financial intimacy is built on a foundation of complete transparency and trust. It is the ability to work as a team toward your shared goals, celebrating your successes and navigating challenges together. It’s a powerful bond that strengthens your entire partnership.

Conclusion: From Financial Friction to Lasting Intimacy

Transforming your financial arguments into a source of strength is not about creating the perfect budget; it's about building understanding and a shared vision. By recognizing your unique money personalities, addressing hidden financial triggers, and learning to communicate with empathy, you can stop the cycle of conflict. This approach allows you to build lasting financial intimacy, turning money from a weapon of division into a tool for teamwork that strengthens your entire partnership.

Frequently Asked Questions

1. Why do we fight about money even when it’s a small amount?

Arguments over small purchases are rarely about the money itself. They are symptoms of a deeper conflict between your "money personalities." These fights are triggered by what money represents to each of you, such as security, freedom, or trust. A minor expense can activate a significant underlying fear in your partner, like a fear of future scarcity or a feeling of being controlled.

2. What are the five main money personalities?

The five key money personalities are:

The Saver: Finds security in a growing bank balance and avoids financial risk.

The Spender: Believes money is a tool for creating joy and living in the moment.

The Worrier: Feels constant anxiety about the financial future, regardless of savings.

The Avoider: Feels overwhelmed by finances and prefers to delegate money management.

The Gambler: Is drawn to high-risk, high-reward investments for the thrill.

3. I’m a Saver and my partner is a Spender. How can we ever agree on finances?

A powerful strategy for opposing personalities is the "yours, mine, and ours" account system. A joint account covers shared bills and goals, providing security for the Saver. Separate personal accounts give each partner the freedom to spend a certain amount as they wish, no questions asked, which satisfies the Spender's need for autonomy and enjoyment.

4. What is a "money date" and how can we have one without fighting?

A "money date" is a scheduled, structured meeting to discuss finances calmly. To ensure it remains productive, hold it in a neutral place (like a coffee shop), keep it brief, and set ground rules beforehand, such as no blaming or interrupting. Use "I feel" statements (e.g., "I feel anxious about our debt") instead of accusatory "you" statements ("You spend too much") to foster understanding over conflict.

Summary

This article provides a guide for couples to stop fighting about money by addressing the root causes of financial conflict. It explains that arguments are often not about money itself but about clashing "money personalities" and underlying values related to security and freedom. The guide identifies five distinct money personalities—Saver, Spender, Worrier, Avoider, and Gambler—and includes an interactive quiz for couples to discover their types. It offers specific strategies for conflict resolution, such as creating a "yours, mine, and ours" account system, and emphasizes building a shared financial vision. The article concludes with practical advice on improving communication through structured "money dates" and using empathetic language to foster lasting financial intimacy.