Couples Budget Planner Bundle | 5 Finance Templates

Stop arguing about money and start building wealth together. This complete finance bundle gives you 5 essential Google Sheets templates designed specifically for couples managing money as a team.

📦 What’s included:

Couples Budget Planner • Family Budget Tracker • Income & Expense Tracker • Credit Card Payoff Planner • Debt Payoff Tracker (Snowball & Avalanche)

- Track shared expenses and split bills fairly

- Pay off debt faster with proven strategies

- Real-time collaboration – both partners can edit simultaneously

- Pre-built formulas do all calculations automatically

- 100% customizable to fit your unique situation

Instant Download

No Subscriptions

14-Day Guarantee

4.8/5 Rating

💑 Perfect for:

- Newlyweds combining finances

- Couples living together splitting expenses

- Engaged couples planning wedding budgets

- Partners tackling debt together

⚙️ Requirements: Free Google account. Works on desktop, tablet, mobile. No Excel needed. Setup in 10 minutes.

Money arguments are the #1 cause of stress in relationships. Without a clear system to track shared expenses, manage debt, and plan for the future, even the most loving couples struggle with financial transparency.

This bundle solves that problem by giving you 5 interconnected financial templates designed specifically for couples who want to manage money together—without the confusion or conflict.

Why This Bundle Works for Couples

Unlike generic budget templates, this bundle is built for two people managing finances together. Each template is designed for easy collaboration, with clear sections for shared expenses, individual spending, and joint financial goals.

Perfect for: Newlyweds combining finances • Couples living together splitting expenses • Partners paying off debt together • Engaged couples planning wedding budgets • Any relationship ready for financial transparency

Complete Financial Toolkit: 5 Essential Templates

📊 Couples Budget Planner

The foundation of your financial system. Track shared expenses, split bills proportionally or 50/50, and monitor both joint and individual spending categories. See exactly where your money goes each month with automated calculations and visual summaries.

Key Features:

- Shared expense tracking with customizable split ratios

- Individual spending categories for personal expenses

- Monthly and annual budget overview

- Automated calculations for total spending and savings

- Visual charts showing spending by category

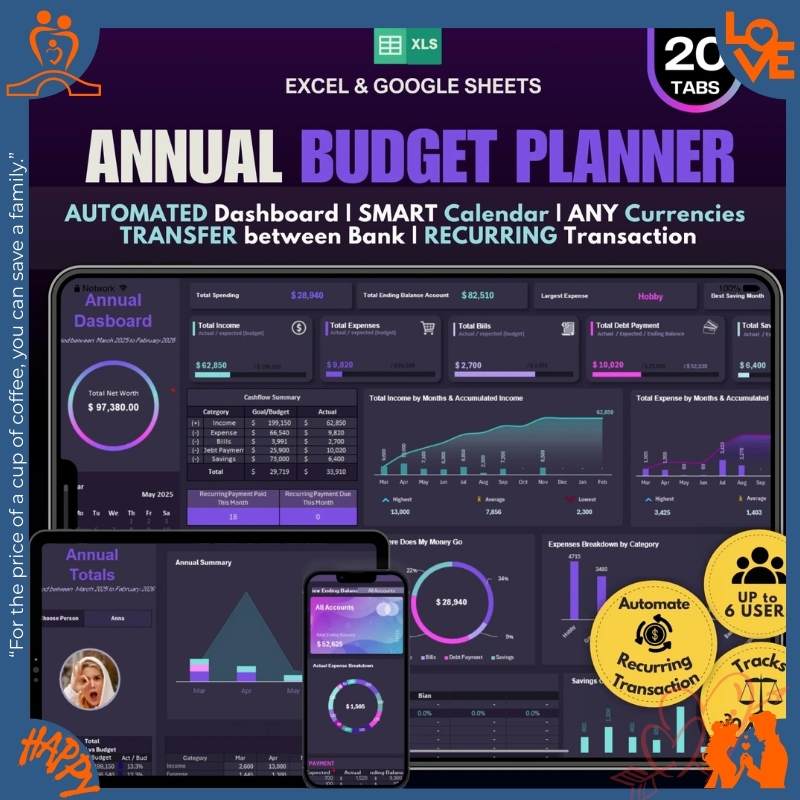

💰 Annual Family Budget Tracker & Financial Planner

Plan your long-term financial future together. Set yearly savings goals, track progress toward major milestones (house down payment, wedding, emergency fund), and manage both monthly and annual budgets in one comprehensive spreadsheet.

Key Features:

- 12-month budget planning with year-end summary

- Savings goal tracker for major life events

- Income vs. expenses comparison charts

- Emergency fund progress tracker

- Annual financial health dashboard

📈 Income and Expense Tracker

Monitor your monthly cash flow with precision. Track all income sources (salaries, side hustles, bonuses) and every expense down to the penny. Perfect for couples who want to understand their spending patterns and make data-driven financial decisions.

Key Features:

- Daily income and expense logging

- Automated monthly profit/loss calculations

- Category-based expense breakdown

- Cash flow trends and patterns analysis

- Customizable expense categories

💳 Credit Card Tracker & Payoff Planner

Take control of credit card debt as a team. Track multiple cards, monitor interest rates, log payments, and create a strategic payoff plan that minimizes interest charges. See how extra payments accelerate your debt-free date.

Key Features:

- Track unlimited credit cards in one place

- Interest rate calculator and total interest projections

- Payment schedule with payoff timeline

- Extra payment impact analyzer

- Credit utilization ratio tracker

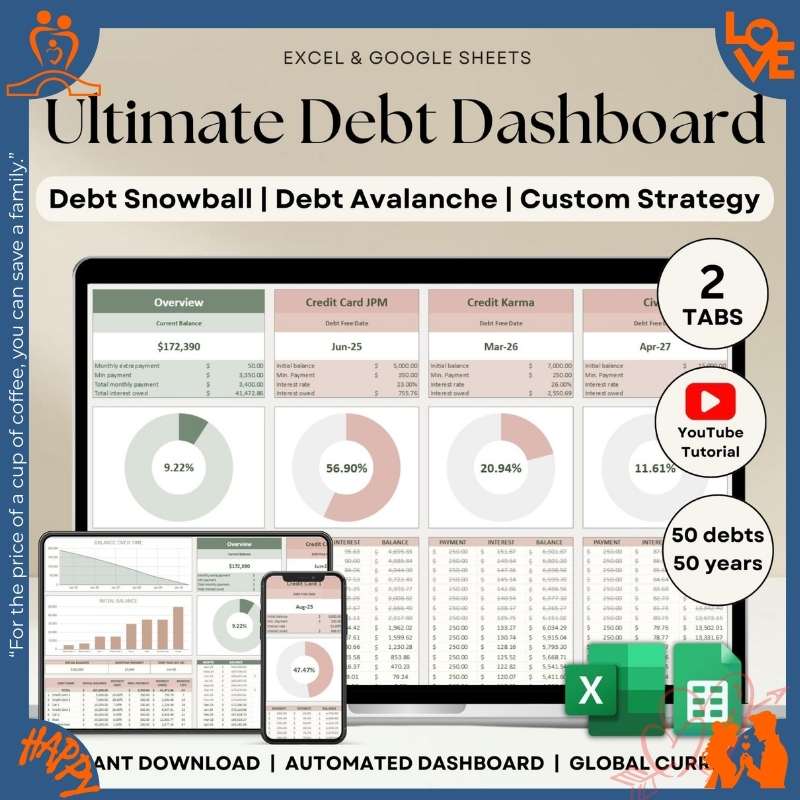

🎯 Debt Payoff Tracker (Snowball & Avalanche Methods)

Crush all types of debt faster using proven repayment strategies. Choose between the debt snowball method (smallest balance first) or avalanche method (highest interest first). Visualize your progress and celebrate each debt eliminated together.

Key Features:

- Side-by-side comparison of snowball vs. avalanche methods

- Track all debts: credit cards, student loans, car loans, personal loans

- Automated payoff order calculation

- Visual progress bars and debt-free date projections

- Total interest saved calculator

How These Templates Work Together

While each template is powerful on its own, they're designed to work as an integrated financial system:

- Start with the Couples Budget Planner to understand your monthly spending

- Use the Income & Expense Tracker to log daily transactions

- Reference your budget while planning payoff strategies in the Debt Trackers

- Set long-term goals with the Annual Family Planner

- Monitor credit card balances with the Credit Card Tracker

Real Results from Real Couples

"We paid off $12,000 in credit card debt in just 6 months using the debt snowball tracker. Having everything in one place made it so much easier to stay accountable together."

— Sarah & Mike T., Married 2 years

"No more money arguments! We can both see what's happening with our finances in real-time. Saved $5,000 in 4 months for our wedding using the annual planner."

— Rachel & Tom P., Engaged

"Finally understand where our money goes! The income tracker revealed we were spending $400/month on eating out. Cut it in half and redirected that to savings."

— David & Lisa K., Living together

"Setup took less than 10 minutes. The formulas do all the math automatically. We literally spent more time arguing about budgets than using these templates!"

— Marcus & Amy R., Newlyweds

"Paid off $8,000 in credit card debt using the avalanche method. Seeing the interest savings motivated us to throw extra money at it. Best $45 we ever spent!"

— Jennifer & Chris M., Married 3 years

Why Couples Choose This Bundle Over Others

🚀 Instant Setup, Zero Learning Curve

Pre-built formulas do all calculations automatically. No Excel expertise required. Simply enter your numbers and watch everything update in real-time.

👥 Built for Two People

Unlike generic templates, these are designed for couples. Both partners can access and edit simultaneously via Google Sheets' real-time collaboration features.

💡 Complete Financial Visibility

No more financial surprises or "I didn't know we spent that much!" conversations. See exactly where money goes and make informed decisions together.

⚡ Save 5+ Hours Every Month

Stop building spreadsheets from scratch or juggling multiple apps. Everything you need is in one organized, easy-to-use system.

🎨 Fully Customizable

Adapt every template to match your unique situation. Add categories, change formulas, adjust layouts—you have complete control over your financial system.

💰 No Monthly Subscriptions

Unlike budgeting apps that charge $10-15/month forever, this is a one-time purchase. Own it forever with free lifetime updates and support.

Bundle vs. Popular Budgeting Apps

| Feature | This Bundle | YNAB | Mint |

|---|---|---|---|

| One-time payment | ✓ | ✗ | ✓ |

| Designed for couples | ✓ | △ | ✗ |

| Real-time collaboration | ✓ | ✓ | △ |

| Full data ownership | ✓ | ✗ | ✗ |

| Fully customizable | ✓ | △ | ✗ |

| First year cost | $44.76 | $109 | Free |

* YNAB charges $14.99/month or $109/year. Mint is free but monetizes through ads and lacks couple-specific features.

Real-World Use Cases

🏠 Newlyweds Combining Finances

"We used the Couples Budget Planner to decide how to split our expenses fairly based on our income difference. The Annual Planner helped us save $15,000 for a house down payment in 18 months."

💍 Engaged Couple Planning Wedding

"The Income & Expense Tracker showed us exactly how much we could afford to spend monthly on wedding savings. Paid for our $12K wedding in cash without going into debt!"

💳 Couples Tackling Debt Together

"We had $28,000 in combined credit card and student loan debt. The Debt Payoff Tracker's snowball method kept us motivated—we celebrated each payoff together. Debt-free in 22 months!"

🏘️ Couples Moving In Together

"Before moving in, we weren't sure how to split rent and utilities fairly. The Couples Budget Planner let us try different scenarios until we found what felt right for both of us."

Frequently Asked Questions

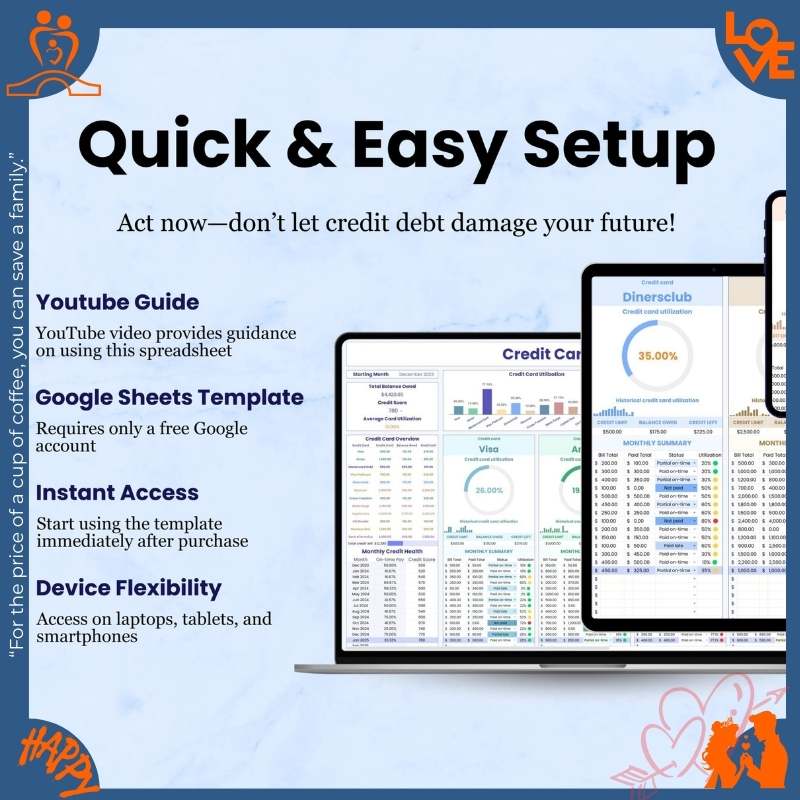

▶ Do I need Excel or special software?

No! All templates run on Google Sheets, which is 100% free. You just need a free Google account (Gmail). Google Sheets works on desktop computers, tablets, and smartphones (iOS & Android). No downloads or installations required.

▶ How do both partners access the same spreadsheet?

After purchase, you'll make a copy of each template to your own Google Drive. Then click the "Share" button and enter your partner's email address. They'll get instant access. Both of you can view and edit the spreadsheets simultaneously in real-time—you'll even see each other's cursor movements!

▶ Can I customize the templates to fit our specific needs?

Absolutely! Once you make a copy, the templates are 100% yours to modify. Add expense categories, change formulas, adjust layouts, add sheets—whatever you need. The formulas are visible (not locked), so you can see how everything works and adapt it freely.

▶ Are these templates difficult to set up?

Not at all! Each template comes with detailed instructions and is ready to use immediately. Simply enter your income, expenses, and financial goals—the formulas handle all calculations automatically. Most couples are up and running within 10-15 minutes.

▶ What if we need help or have questions?

You get lifetime email support with your purchase. If you're stuck setting up a template or need help customizing something, just email us. We typically respond within 24 hours (often much faster).

▶ Is this a one-time payment or subscription?

One-time payment only. No subscriptions, no recurring charges, no hidden fees. Pay once and own these templates forever. You'll also receive free updates whenever we improve or add features to the templates.

▶ Can we use these if we live in different countries or currencies?

Yes! The templates work with any currency. Simply change the currency symbol in the format settings. If you're in different countries, you can still collaborate in real-time through Google Sheets—just like working in the same room.

▶ What if I'm not satisfied with the bundle?

We offer a 14-day money-back guarantee. If you're not happy with the templates for any reason, just email us within 14 days of purchase for a full refund—no questions asked.

Technical Specifications

File Format

Google Sheets

Templates Included

5 spreadsheets

Requirements

Free Google account

Device Compatibility

Desktop, tablet, mobile

Operating Systems

Windows, Mac, iOS, Android

Delivery Method

Instant email download

Support

Lifetime email assistance

Updates

Free forever

License

Personal use (1 couple)

What You Get With Your Purchase

5 Professional Templates - Ready to use immediately

Detailed Instructions - Setup guide for each template

Pre-Built Formulas - All calculations automated

Lifetime Access - Own it forever, no expiration

Free Updates - Get improvements automatically

Email Support - Questions answered anytime

30% Discount - Save $19.19 vs. buying individually

14-Day Guarantee - Risk-free purchase

Related products

Annual Family Budget Tracker & Financial Planner Spreadsheet Google Sheets & Excel V4.6.8

Rated 4.41 out of 5$22.99Original price was: $22.99.$12.99Current price is: $12.99.Couples Living Together Bundle | 4 Essential Templates

Rated 4.95 out of 5$37.95Original price was: $37.95.$26.57Current price is: $26.57.Credit Card Tracker, Credit Card Payoff Planner, Credit Card Expense Log Google Sheets Template V3.1.2

Rated 4.62 out of 5$29.99Original price was: $29.99.$16.99Current price is: $16.99.Debt Payoff Tracker Debt Snowball Excel Debt Avalanche Calculator Google Sheets V3.1.3

Rated 4.52 out of 5$25.99Original price was: $25.99.$12.99Current price is: $12.99.

Reviews

There are no reviews yet.