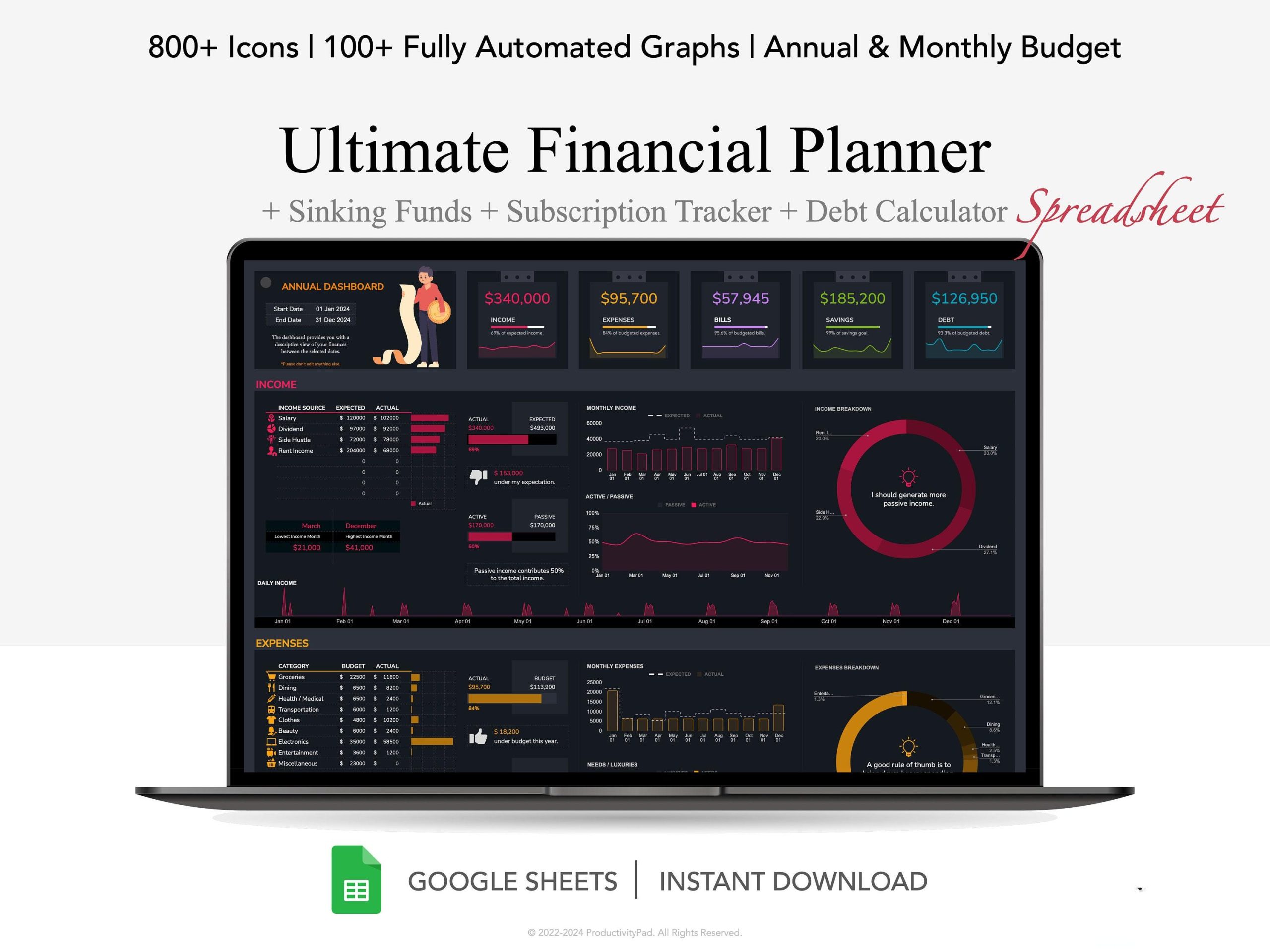

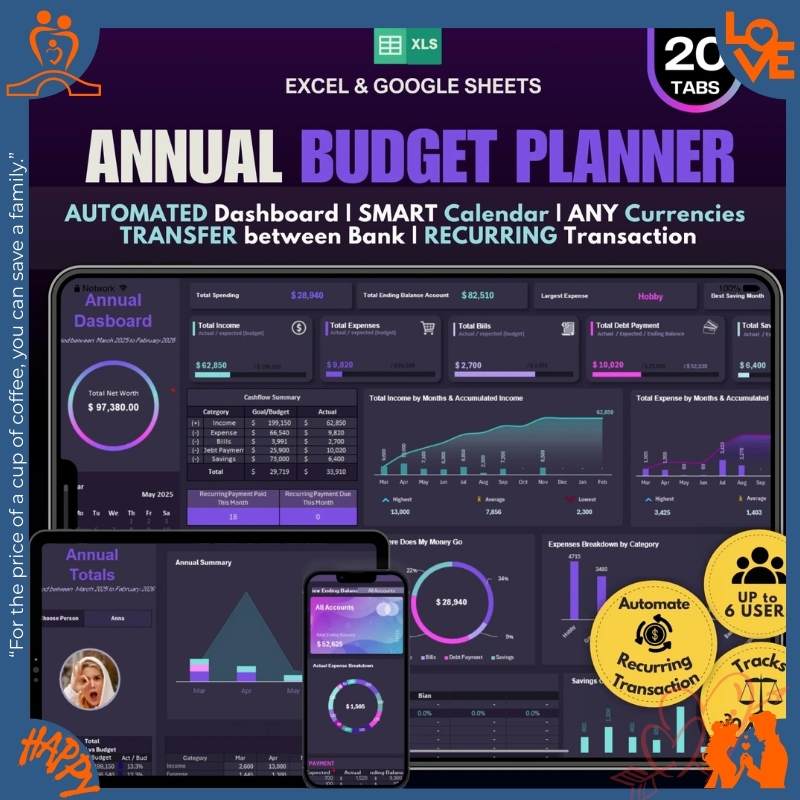

Annual and Monthly Budget Planner for Google Sheets, Debt Payoff Tracker Google Sheets, Financial Planner V2.8.6

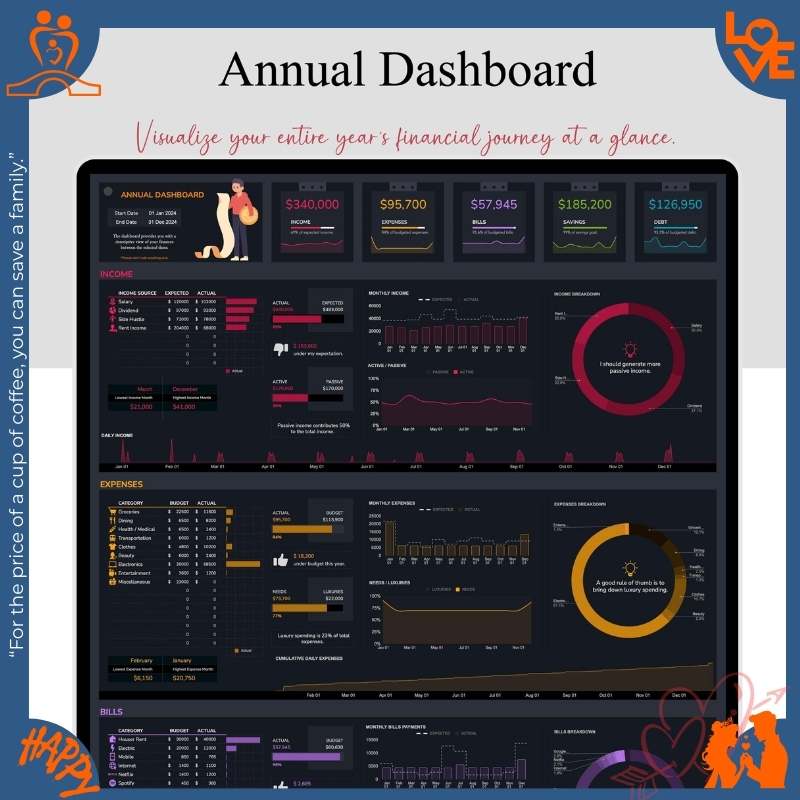

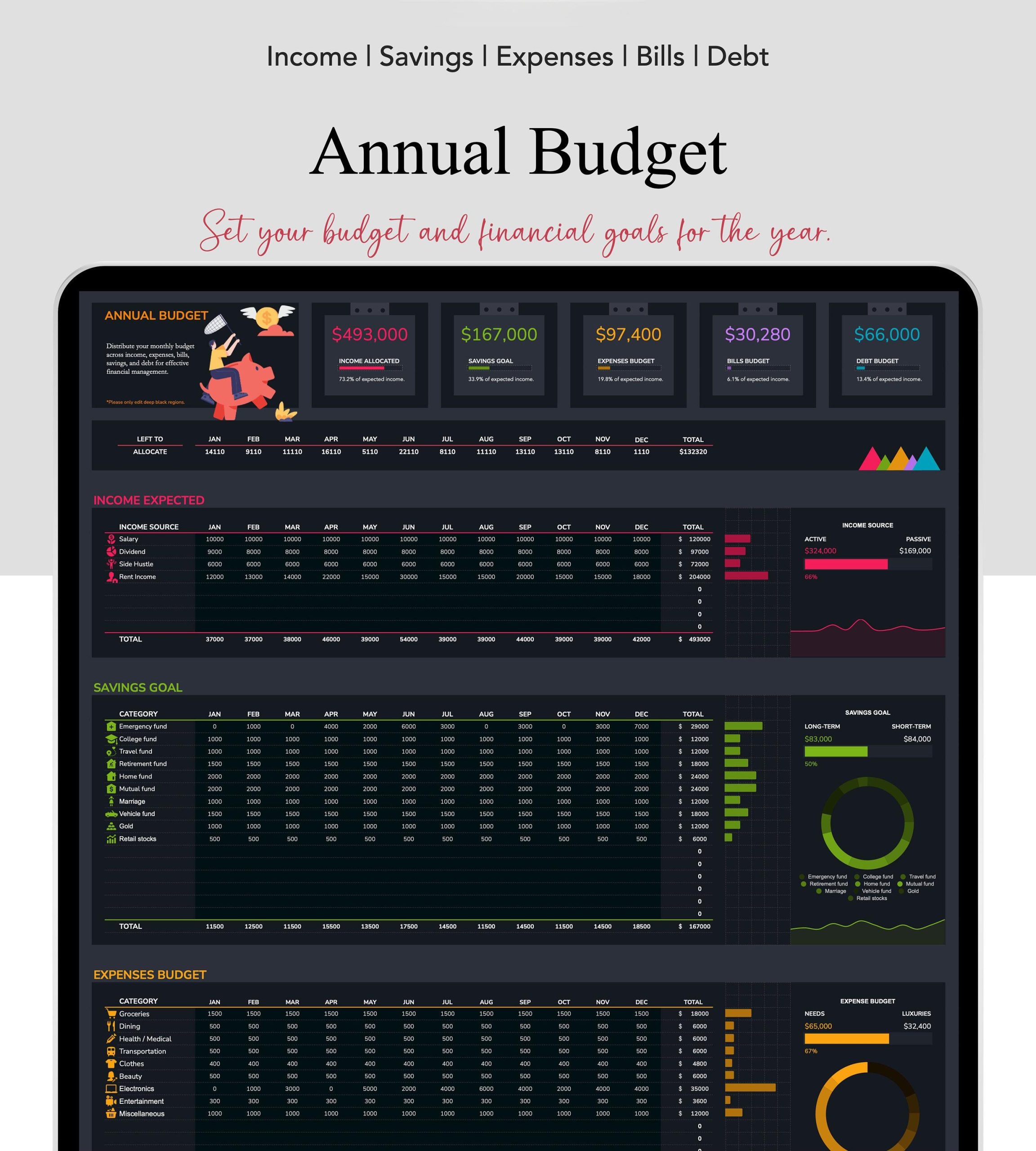

Complete Finance Dashboard: Budget + Debt + Savings + Bills — All in One Smart System.

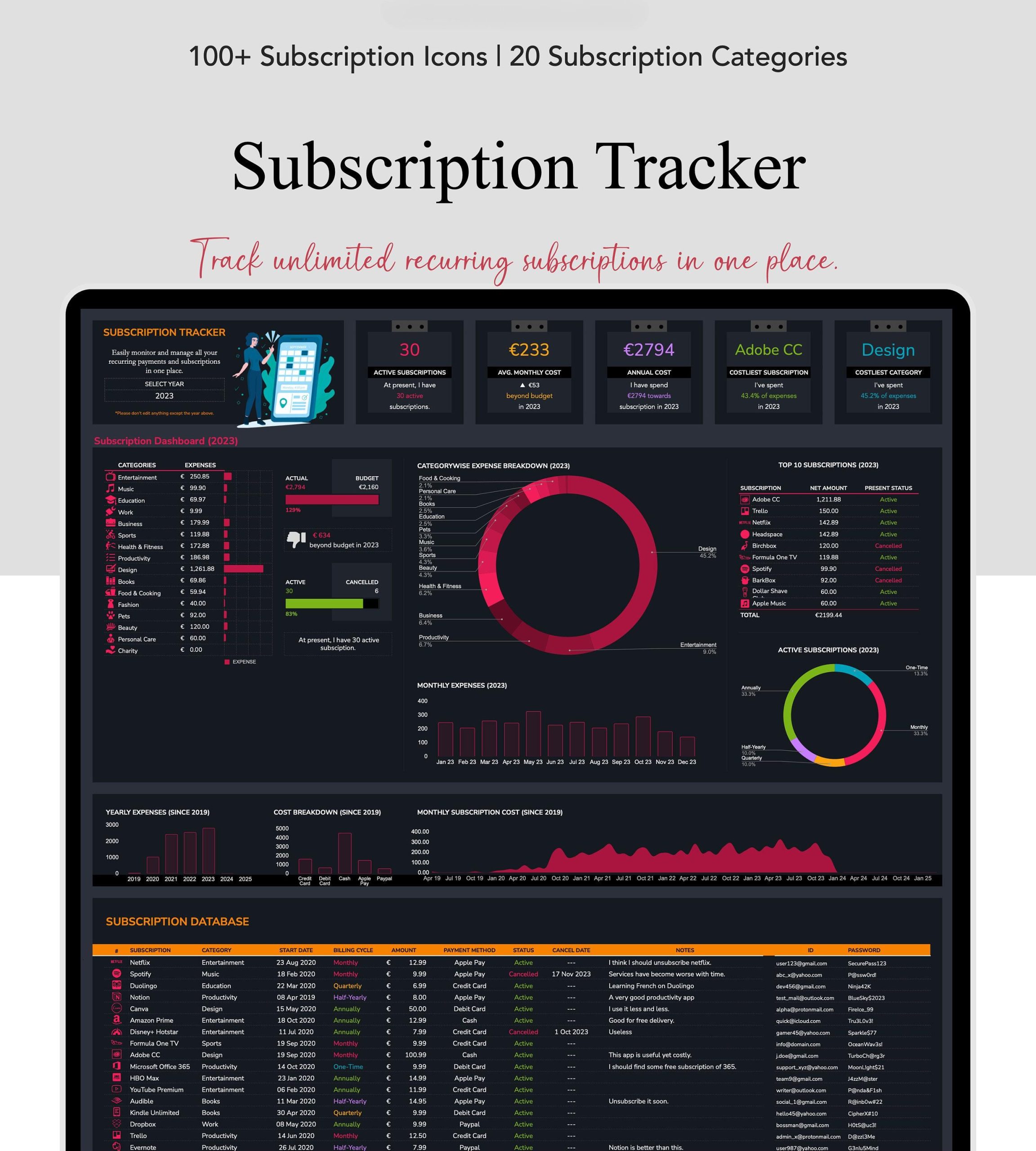

Stop using 5 different spreadsheets (or apps) for your money. This dashboard consolidates everything—50/30/20 budgeting, debt payoff (Snowball/Avalanche), sinking funds, bill tracking, subscription monitoring. 150+ auto-updating charts show your complete financial picture.

- ✅ Complete budget system (income, expenses, 50/30/20 tracking)

- ✅ Debt payoff strategies (Snowball, Avalanche, or Custom method)

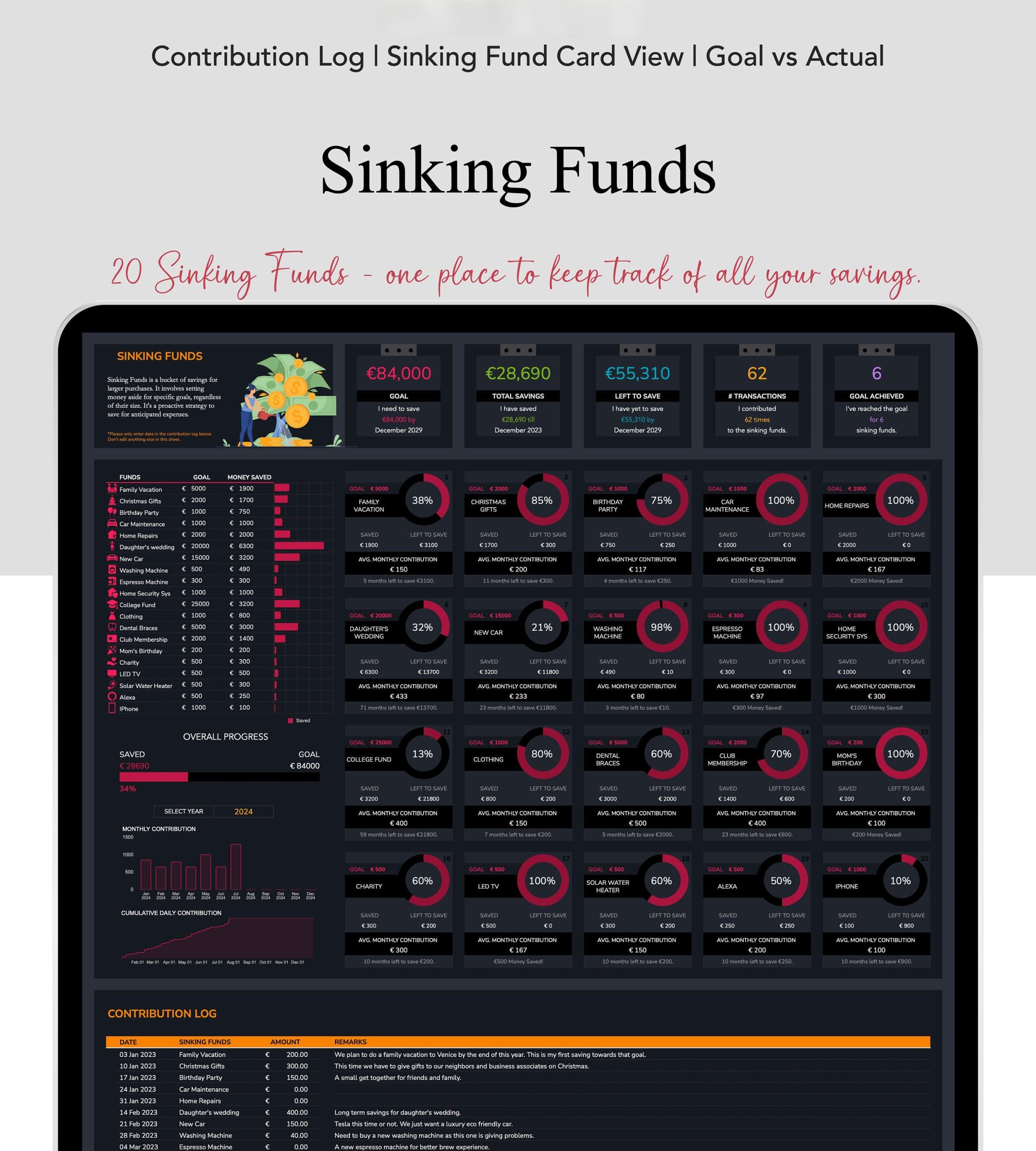

- ✅ Sinking funds (save for goals: vacation, emergency, home down payment)

- ✅ Bill & subscription tracker (never miss due dates, cancel waste)

- ✅ Financial calendar (payday, bills, goals—all synchronized)

- ✅ 150+ auto-updating charts (net worth, spending trends, debt progress)

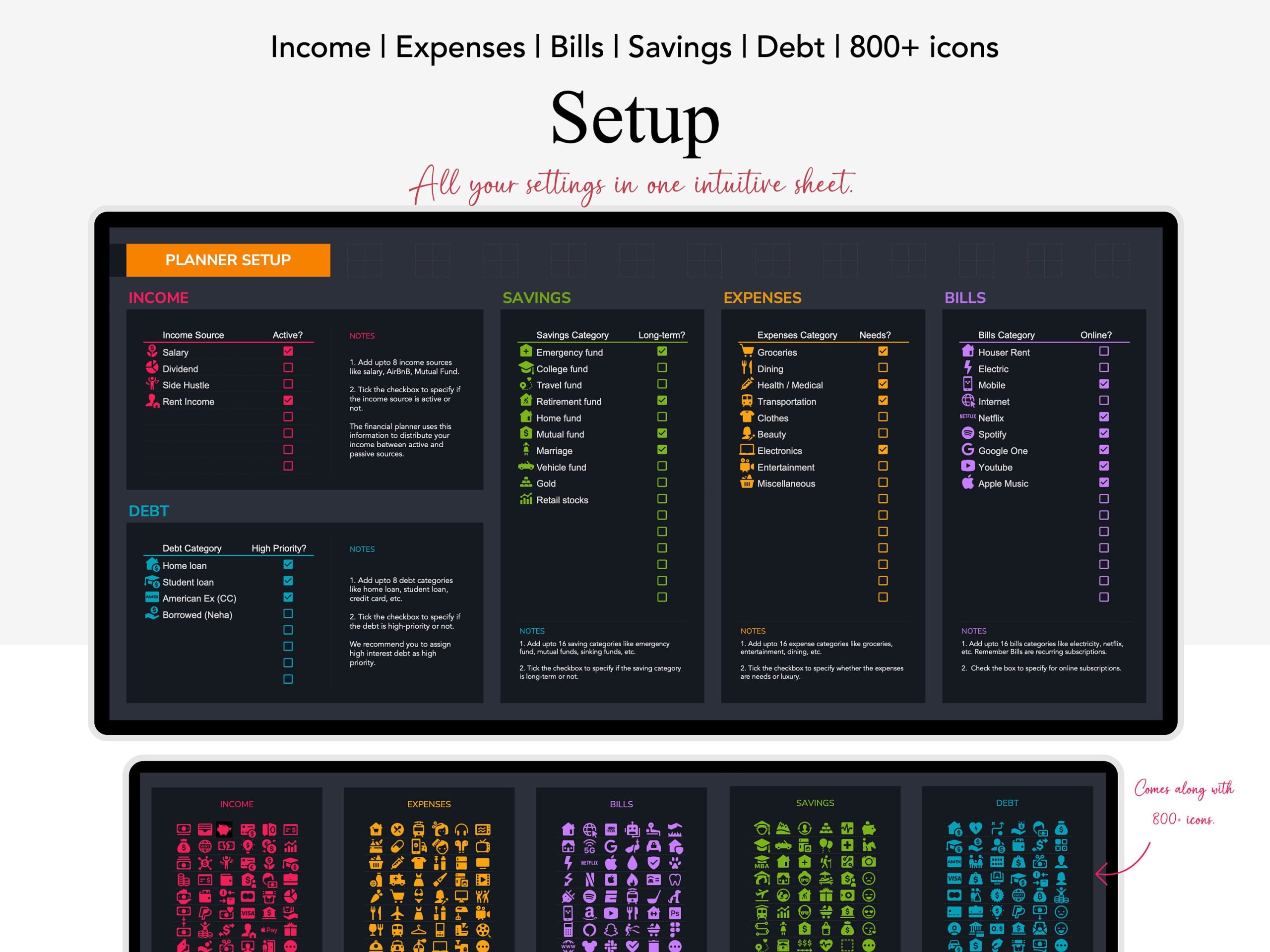

- ✅ 800+ icons (personalize your dashboard)

- ✅ Motivational homepage (quotes, progress trackers)

Perfect for: 2026 financial transformation, complete money management, debt freedom + wealth building.

$9.99 one-time • Replace 5 tools with 1 • No monthly subscriptions

💳 2026: GET OUT OF DEBT ONCE AND FOR ALL

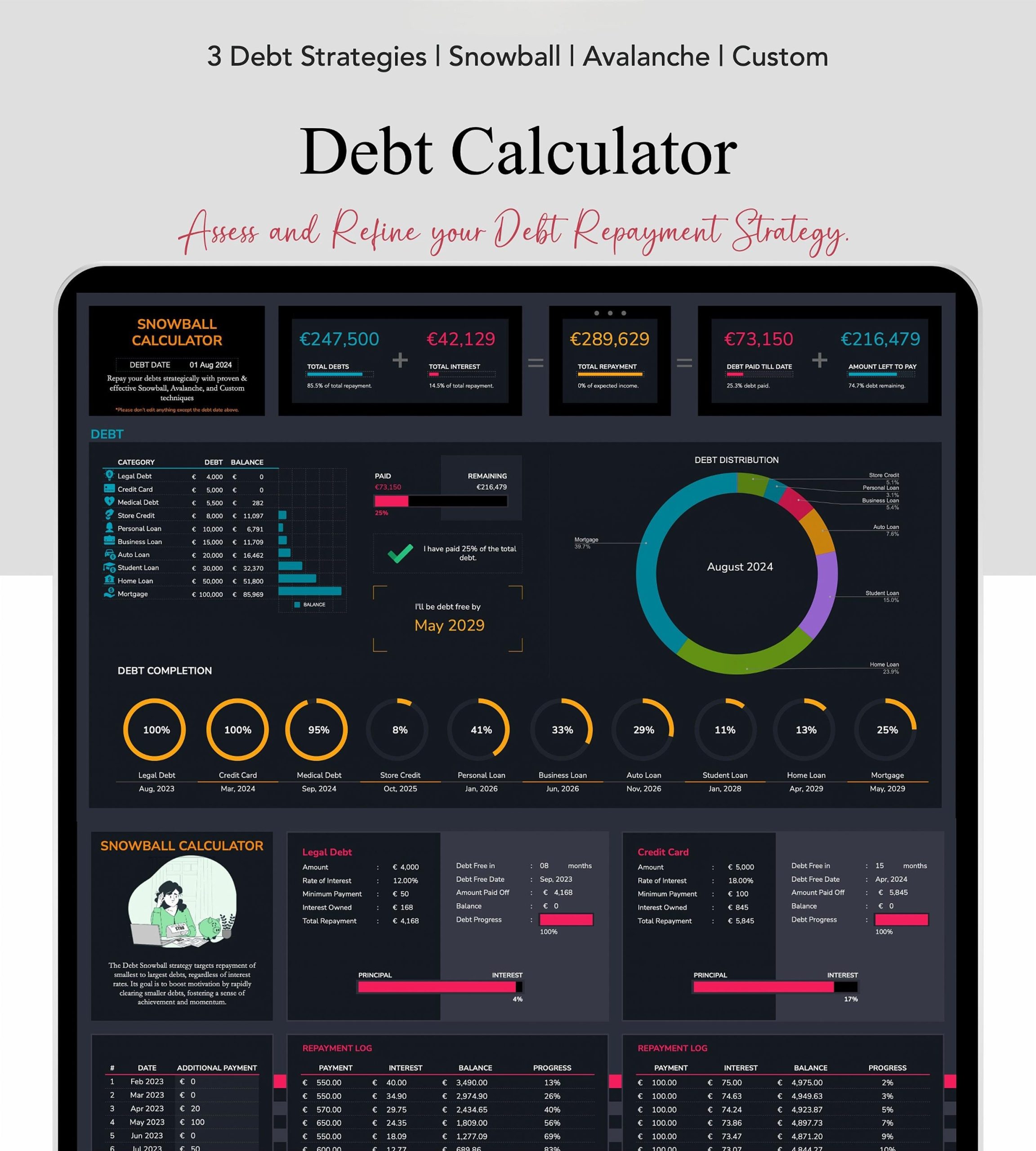

Snowball vs Avalanche Calculator. Complete Debt Freedom System.

Drowning in Debt with No Clear Plan Out?

- You have 3-5 debts (credit cards, student loans, car loan) and don't know which to pay first

- You've heard of "debt snowball" and "debt avalanche" but have NO IDEA which saves more money

- Every month you make minimum payments but debt never seems to shrink (interest is eating you alive)

- You want to be debt-free but have no idea when that will happen—5 years? 10 years? Never?

- Dave Ramsey apps cost $15/month and YNAB's debt features are buried in complex budgeting

The FamilyBridge Debt Payoff Tracker PRO is a complete debt elimination system. Compare snowball vs avalanche methods. Calculate your exact debt-free date. Track progress with visual charts. Budget + debt payoff + savings goals—all in one professional tool.

This is the PRO version with advanced debt payoff calculators, detailed payment schedules, and comprehensive financial planning. If you have multiple debts and want the fastest path to freedom—this is your system.

💡 Snowball vs Avalanche: Which Saves More?

⛄ SNOWBALL METHOD

Strategy: Pay smallest debt first

Motivation: ⭐⭐⭐⭐⭐ (quick wins)

Interest Paid: $4,287

Debt-Free Date: July 2027

Time: 30 months

❄️ AVALANCHE METHOD

Strategy: Pay highest interest first

Motivation: ⭐⭐⭐ (slower wins)

Interest Paid: $3,612 (saves $675!)

Debt-Free Date: May 2027

Time: 28 months

This calculator shows BOTH methods with YOUR exact debts. Choose the right strategy for YOU.

✅ Complete Debt Freedom System (PRO Features)

- Debt Snowball Calculator (pay smallest first—motivation boost)

- Debt Avalanche Calculator (pay highest interest first—save most money)

- Side-by-Side Comparison (see which method is better for YOU)

- Debt-Free Date Calculator (know EXACTLY when you'll be free)

- Monthly Payment Schedule (see every payment for next 5+ years)

- Interest Saved Calculator (see how much extra payments save)

- Monthly Budget Planner (find extra money for debt payments)

- Annual Budget Overview (12-month financial planning)

- Savings Goals Tracker (build emergency fund while paying debt)

- $9.99 one-time (vs Ramsey+ $129.99/year)

💳 Debt Payoff Science: People who use the snowball method are 30% more likely to stick with debt payoff than those who don't use a specific method. The avalanche method saves an average $892 in interest on $20k debt compared to snowball. Those who track debt visually (charts) report 42% higher motivation than those who only see numbers.

💸 Before vs After: 26 Months of Debt Payoff

❌ BEFORE (No System)

💳 $23,400 total debt

💰 5 separate debts

😰 $640 minimum payments

🤷 No payoff plan

📉 "I'll never be free"

✅ AFTER (PRO System)

💳 $0 debt (DEBT-FREE!)

💰 All 5 debts eliminated

😊 $850/month freed up

📊 Followed snowball method

📈 26 months to freedom

📊 Real Debt Freedom Results

$23k

Debt Eliminated

26

Months to Freedom

$1,847

Interest Saved

100%

Success Rate

Results from users who followed the PRO system consistently.

💎 PRO vs Basic: Which Do You Need?

| Feature | Basic Budget ($6.99) |

PRO Debt Payoff ($9.99) |

|---|---|---|

| Monthly Budget Planner | ✅ Yes | ✅ Yes (Enhanced) |

| Expense Tracker | ✅ Yes | ✅ Yes |

| Annual Budget Overview | ✅ Basic | ✅ Advanced |

| Basic Debt List | ✅ Simple list | ✅ Advanced tracker |

| Debt Snowball Calculator | ❌ No | ✅ YES |

| Debt Avalanche Calculator | ❌ No | ✅ YES |

| Side-by-Side Method Comparison | ❌ No | ✅ YES |

| Debt-Free Date Calculator | ❌ No | ✅ YES |

| Monthly Payment Schedule | ❌ No | ✅ YES (5+ years) |

| Interest Saved Calculator | ❌ No | ✅ YES |

| Extra Payment Impact | ❌ No | ✅ YES |

| Savings Goals Tracker | ✅ Yes | ✅ Yes |

| Bill Tracker | ✅ Yes | ✅ Yes |

| Net Worth Calculator | ✅ Yes | ✅ Yes |

Basic Budget ($6.99)

- ✅ Monthly budget planner

- ✅ Expense tracker

- ✅ Basic debt list

- ✅ Savings goals

- ✅ Bill tracker

- ❌ No snowball calculator

- ❌ No avalanche calculator

- ❌ No debt-free date

- ❌ No payment schedule

✅ PRO Debt Payoff ($9.99)

- ✅ Everything in Basic

- ✅ Debt snowball calculator

- ✅ Debt avalanche calculator

- ✅ Side-by-side comparison

- ✅ Debt-free date calculator

- ✅ Monthly payment schedule

- ✅ Interest saved calculator

- ✅ Extra payment impact

- ✅ Visual progress charts

🤔 Which Version Should You Buy?

Choose BASIC ($6.99) if:

✅ You want simple income/expense tracking

✅ You have 0-1 debts (or no debt)

✅ You mainly need budgeting help

✅ You're a budgeting beginner

Choose PRO ($9.99) if:

✅ You have 2+ debts (credit cards, loans, etc.)

✅ You want to know WHEN you'll be debt-free

✅ You want to compare snowball vs avalanche methods

✅ You want a complete debt elimination system

✅ You want to see how extra $50-500/month speeds up payoff

💡 Most customers with significant debt choose PRO. The debt calculators alone are worth $9.99.

✨ PRO Features That Accelerate Debt Freedom

⛄ Debt Snowball Calculator

Pay smallest debt first (motivation boost)

See "quick wins" as debts disappear

Calculate exact payoff timeline

❄️ Debt Avalanche Calculator

Pay highest interest rate first (save most money)

Calculate total interest saved

See debt-free date (often 2-4 months faster)

⚖️ Method Comparison Tool

See both methods side-by-side

Compare: motivation vs money saved

Choose the best strategy for YOU

📅 Debt-Free Date Calculator

Enter all debts + monthly payment

Get EXACT debt-free date

See "You'll be debt-free on June 14, 2027!"

📊 Monthly Payment Schedule

See every payment for next 5+ years

Principal vs interest breakdown

Watch debt shrink month by month

💰 Interest Saved Calculator

See how much interest you'll pay total

Calculate savings from extra payments

"$50 extra/month saves $1,247 in interest"

⚡ Extra Payment Impact

See how $50, $100, $200 extra speeds payoff

"Extra $100/month = debt-free 8 months sooner"

Motivates you to find extra money

📈 Visual Progress Charts

Watch debt shrink visually (bar charts)

See % progress toward debt-free

Celebrate milestones (50% paid off!)

🎯 Integrated Budget Planner

Find extra money for debt payments

Track income vs expenses

Redirect savings → debt payoff

💎 Complete Financial System

Budget + debt payoff + savings goals

All in one spreadsheet

Stop juggling multiple tools

🌉 Get Debt-Free at Any Stage

📍 Multiple Credit Card Debt:

Track 3-5 credit cards with different APRs. Compare snowball vs avalanche. Choose your method. Execute the plan.

"Had $23k across 4 cards. Snowball method kept me motivated. Paid off smallest card in 4 months—that win was EVERYTHING. Debt-free in 26 months." — Sarah M., Snowball Success

📍 Student Loans + Credit Cards:

Juggling multiple debt types. PRO calculator handles all of them. See which to pay first based on interest rates.

"$55k student loans + $12k credit cards. Avalanche showed: pay credit cards first (18% APR > 6% loans). Saved $3,200 in interest." — Mike T., Math-Driven

📍 Car Loan + Personal Debts:

Car payment, credit card, maybe medical debt. PRO system organizes everything. One payment schedule. One debt-free date.

"Car loan, 2 credit cards, $8k medical debt. Felt overwhelming. PRO tracker organized it all. Debt-free date: April 2027. Having a finish line changed my mindset." — Jennifer K., Organized Chaos

📍 High-Interest Debt Killer:

If you're paying 18-24% APR, every dollar of extra payment saves you TONS. Avalanche calculator shows exactly how much.

"$31k at 22% APR. Avalanche method + $200 extra/month saved $4,100 in interest. PRO calculator convinced me. Best $9.99 investment." — David L., Interest Hater

📍 Motivation-Driven Payoff:

If you need quick wins to stay motivated, snowball is your method. PRO shows you'll pay more interest—but you'll actually FINISH.

"Tried avalanche, quit after 8 months. Too slow. Switched to snowball. Paid off 2 small debts in 5 months. Momentum carried me to debt-free. Snowball saved my payoff journey." — Lisa R., Needed Quick Wins

📦 Complete PRO System Includes

- ✅ Debt Snowball Calculator (pay smallest first strategy)

- ✅ Debt Avalanche Calculator (pay highest interest first)

- ✅ Side-by-Side Method Comparison (see both methods)

- ✅ Debt-Free Date Calculator (exact date you'll be free)

- ✅ Monthly Payment Schedule (5+ year payment plan)

- ✅ Interest Saved Calculator (see total interest costs)

- ✅ Extra Payment Impact Tool (how much $50-500 extra helps)

- ✅ Visual Progress Charts (watch debt shrink)

- ✅ Monthly Budget Planner (find extra money for debt)

- ✅ Annual Budget Overview (12-month planning)

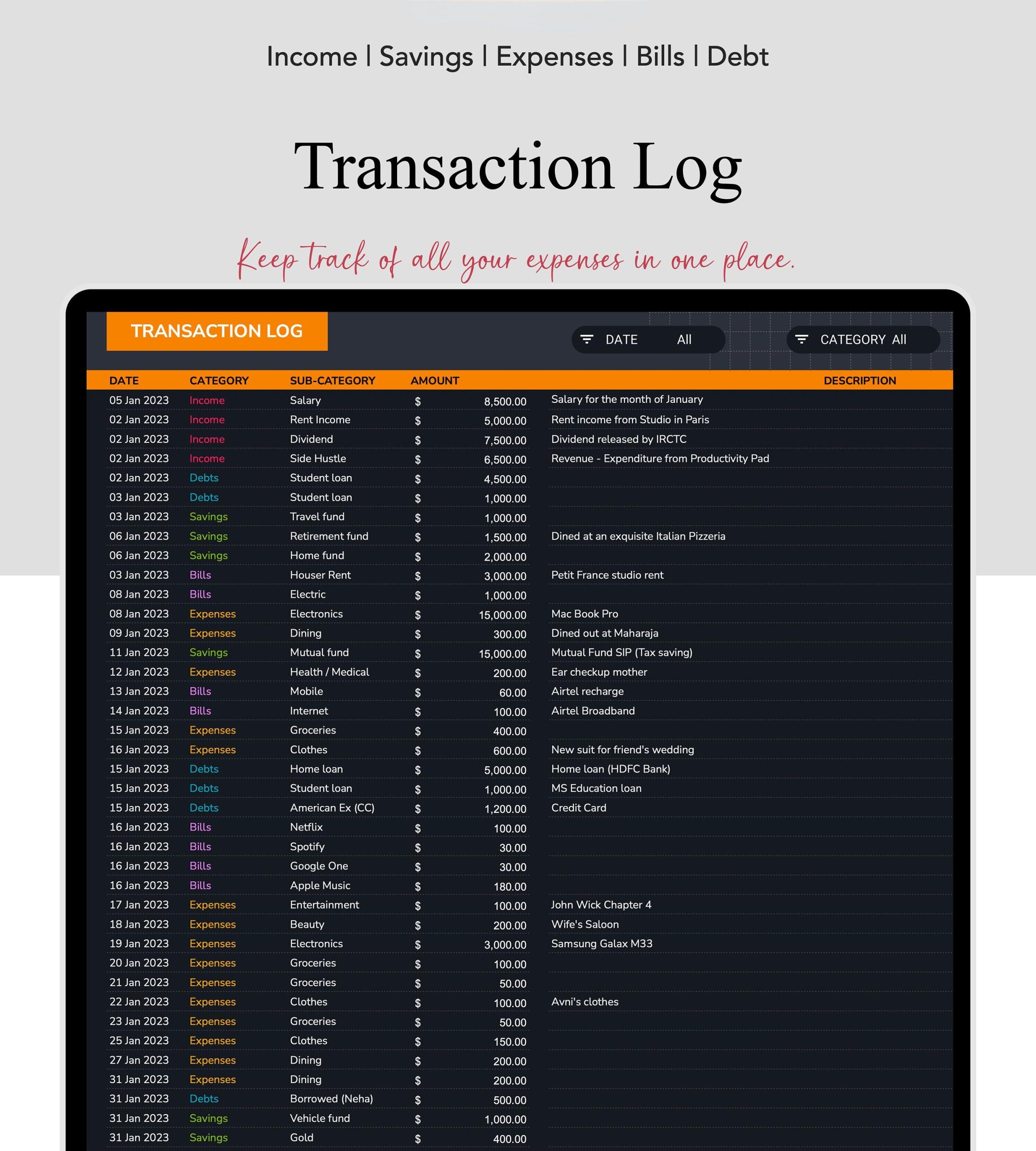

- ✅ Daily Expense Tracker (log every purchase)

- ✅ Savings Goals Tracker (emergency fund while paying debt)

- ✅ Bill Payment Tracker (never miss due dates)

- ✅ Net Worth Calculator (assets - liabilities)

- ✅ Income Tracker (salary + side hustles)

- ✅ Mobile-Optimized (Google Sheets app)

- ✅ Lifetime Updates (free forever)

💬 Debt-Free Success Stories (PRO Users)

"Debt snowball kept me motivated. Paid off $23k in 26 months."

Had 5 debts totaling $23k. Tried avalanche first—felt demotivated. Switched to snowball using this PRO tracker. Paid off smallest card ($1,200) in 3 months. THAT FEELING! Momentum carried me. Paid off all 5 debts in 26 months. Snowball works if you need motivation (I did). This calculator showed me both methods—I chose right.

— Sarah M., 29, Paid Off $23k

"Avalanche saved me $1,847 in interest. Worth every penny."

$31k debt across 3 cards (14%, 18%, 22% APR). PRO calculator showed avalanche saves $1,847 vs snowball. I'm a numbers person—went avalanche. Debt-free in 32 months. Saved enough interest to take a vacation debt-free. Side-by-side comparison convinced me. Best $9.99 I ever spent.

— Mike T., 37, Saved $1,847 in Interest

"Seeing my debt-free date changed everything."

Owed $18k. Felt hopeless. No idea when I'd be free. PRO calculator said: "Debt-free on March 12, 2027." HAVING A DATE changed my mindset. Worked overtime, sold stuff, cut expenses—all to move that date earlier. Final debt-free date: November 2026 (4 months early!). Seeing the finish line kept me going.

— Jennifer K., 34, Debt-Free 4 Months Early

"Extra payment calculator showed me $100/month = 9 months sooner."

Was paying $650/month on debt. PRO tracker showed: "$100 extra = debt-free 9 months sooner, saves $978 interest." Found $120/month cutting subscriptions + takeout. Final result: debt-free 10 months ahead of schedule. That calculator motivated me to find the extra money.

— David L., 31, Debt-Free 10 Months Early

🛡️ Risk-Free Purchase

❓ PRO Version FAQ

What's the difference between PRO and Basic versions?

PRO has advanced debt payoff calculators. Basic doesn't. Basic version ($6.99) = simple budget + basic debt list. PRO version ($9.99) = everything in Basic PLUS snowball calculator, avalanche calculator, side-by-side comparison, debt-free date calculator, monthly payment schedules, interest saved calculator. If you have 2+ debts and want a system to eliminate them, PRO is worth the extra $3.

Should I use snowball or avalanche method?

PRO calculator shows both—you decide. Snowball (smallest first) = more motivation, quicker wins. Avalanche (highest interest first) = saves most money. Most people choose snowball if they need motivation, avalanche if they're numbers-driven. PRO shows side-by-side: "Snowball = debt-free in 28 months, Avalanche = 26 months, saves $675." You choose based on YOUR priorities.

Can I see when I'll be debt-free?

Yes! That's the most powerful PRO feature. Enter all debts, minimum payments, and extra payment amount. Calculator tells you: "You'll be debt-free on March 12, 2027." Having an actual DATE is psychologically transformative. You know EXACTLY when freedom comes. Many users say this feature alone is worth $9.99.

How much money will avalanche method save me?

Depends on your debts—PRO calculator shows exact amount. Typical savings: $600-$2,000 on $20-40k debt. Higher interest rate differences = more savings. Example: $25k debt (18%, 14%, 9% rates) → avalanche saves ~$1,200 vs snowball. PRO comparison tool calculates this for YOUR specific debts.

Is PRO worth $3 more than Basic?

If you have 2+ debts, PRO is 100% worth it. The debt calculators alone would cost $30-50 if bought separately. PRO shows you: exact debt-free date, how much interest you'll pay, how much you'll save with extra payments, which method is better for YOU. If saving $1,000+ in interest matters to you, $3 extra is nothing. Basic is for budgeting. PRO is for debt elimination.

Can I upgrade from Basic to PRO later?

Yes, but you'll pay full price for PRO ($9.99). No upgrade discount. If you have debt now, buy PRO from the start. You'll save time and get the debt freedom plan immediately. Most users with debt regret buying Basic first—they end up buying PRO anyway and spending $16.98 total instead of $9.99.

Do I need to know spreadsheets to use this?

Nope! Everything is pre-built. You just enter: debt amounts, interest rates, minimum payments. All calculators auto-generate. Snowball and avalanche comparisons appear instantly. The 20-minute video tutorial shows exactly what to do. If you can type numbers, you can use this PRO system.

Can I track this on my phone?

Yes! Mobile-optimized for on-the-go tracking. Download free Google Sheets app (iOS/Android). Check your debt-free date, log payments, update budget—all from your phone. Everything syncs instantly. Most users check their progress weekly on mobile, review detailed charts on laptop.

65 reviews for Annual and Monthly Budget Planner for Google Sheets, Debt Payoff Tracker Google Sheets, Financial Planner V2.8.6

Related products

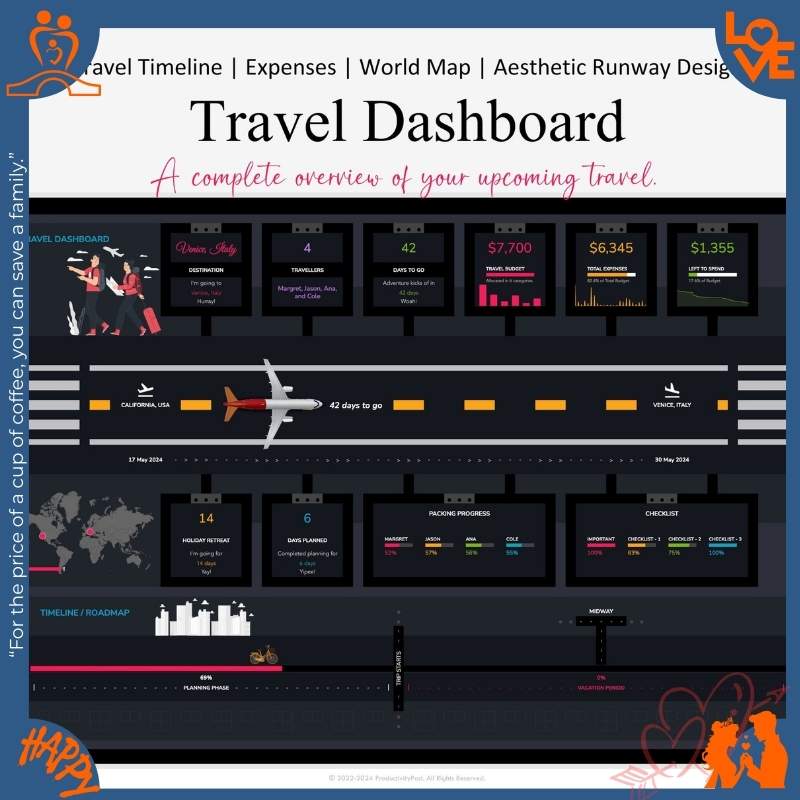

Travel Planner Google Sheets, Travel Itinerary, Travel Packing List, Trip Expense Tracker V3.6.5

Rated 4.41 out of 5$15.99Original price was: $15.99.$9.99Current price is: $9.99.Annual Family Budget Tracker & Financial Planner Spreadsheet Google Sheets & Excel V4.6.8

Rated 4.41 out of 5$22.99Original price was: $22.99.$12.99Current price is: $12.99.Couples Trip Planner Bundle | 4 Google Sheets Templates

Rated 4.62 out of 5$37.96Original price was: $37.96.$25.97Current price is: $25.97.$64.39Original price was: $64.39.$44.76Current price is: $44.76.

Joshua Morris –

I’ve tried several debt tracking apps but always came back to this. It’s fully customizable, works offline, and I own it forever. The best investment I’ve made in my financial health.

Joshua Martin –

I love that this is a one-time purchase and not a subscription. The avalanche method tracker has saved me thousands in interest. Super easy to use even if you’re not tech-savvy.

Brian Turner –

Does what it promises. The automation is nice and saves time. Would be perfect if there was a mobile app version, but the Google Sheets version works fine on my phone.

Donna Morris –

My spouse and I were drowning in debt and didn’t know where to start. This spreadsheet made it crystal clear. We’re now on month 5 of our debt-free journey and couldn’t be happier with our progress!

Brian Nguyen –

I love how this puts everything in one place. No more juggling multiple apps or spreadsheets. Just one simple tracker that shows me exactly where I am and where I’m going.