TL;DR — Key Takeaways ✅

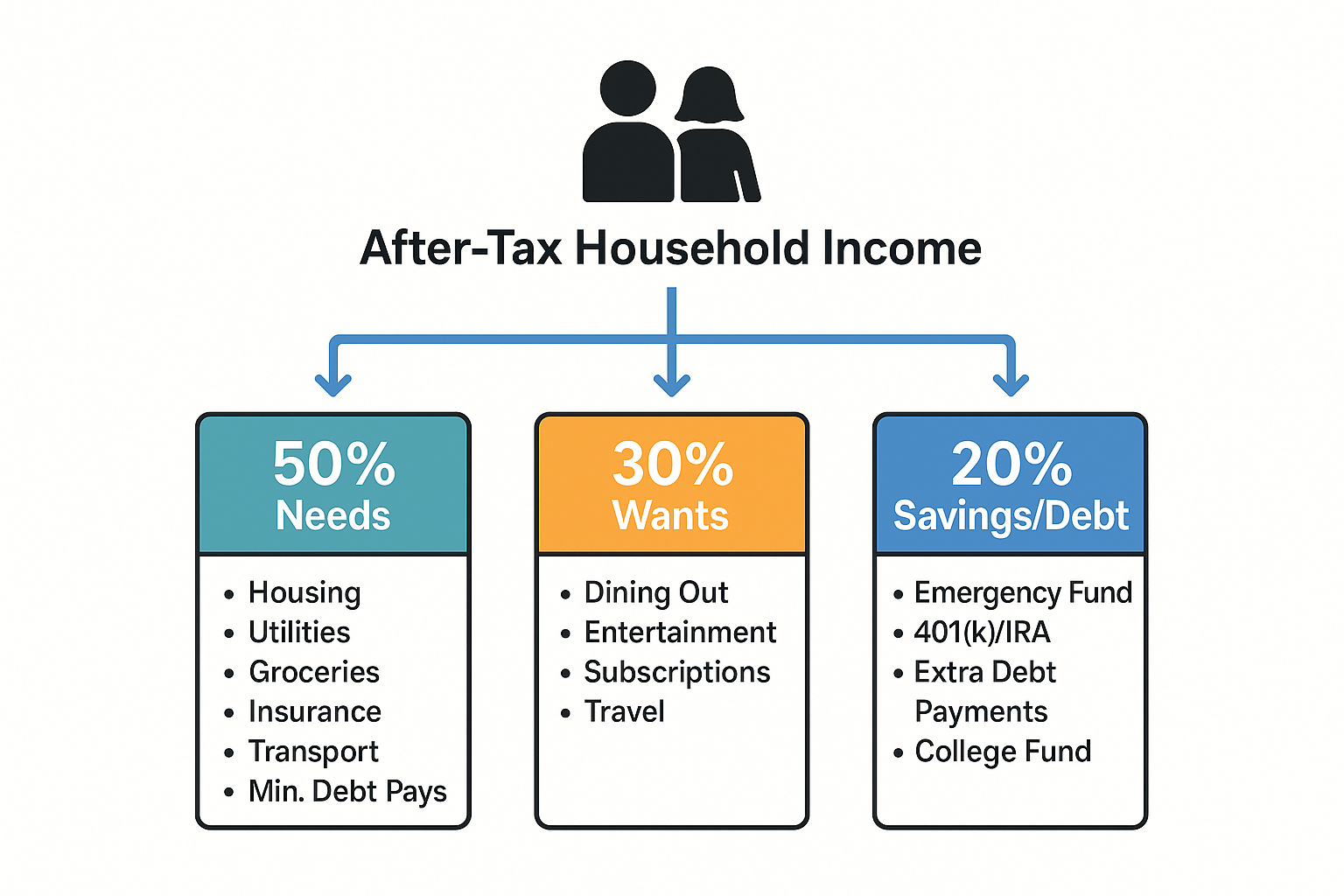

Clear definition: The 50/30/20 rule = 50% Needs, 30% Wants, 20% Savings/Debt, based on after-tax household income.

Couples-first approach: Use proportional splits or the three-account method to keep things fair and calm.

Google Sheets SOP: Build Setup → Transactions → Budget → Dashboard in ~45 minutes with dropdowns, SUMIFs, and conditional formatting.

Flex for 2025: In high-cost areas, adjust to 60/30/10 temporarily; automate small increases in saving.

Template included: Copy our FamilyBridge Google Sheets template directly into your Drive (see below).

Definition: The 50/30/20 rule divides a couple’s after-tax household income into 50% needs, 30% wants, and 20% savings/debt payoff; it’s a flexible framework rather than a rigid law.

Why couples care: You’re juggling rent, daycare, debt, and two paychecks. A shared, living spreadsheet turns the rule into a weekly system you both can see, adjust, and trust.

1) Understand the 50/30/20 rule—specifically for couples

After-tax income only. Build the rule on the dollars that actually hit your bank accounts. If your employer auto-withholds retirement contributions, your “net” is smaller; additional contributions can still count toward the 20% goal.

It’s adaptable. High-cost cities or pricey childcare may push Needs above 50%. Running a 60/30/10 split for a season is fine if you set a path back toward 20% saving.

Anchor to reality. Compare your categories (housing, transport, food, insurance, childcare) to your own past months and national norms; large gaps are coaching moments, not failures.

Pro tip: If you can’t hit 20% yet, lock in 10–15% automatic saving and step up by +1–2% each quarter.

2) Pick a fair cost-sharing method before you budget

Agree on how to fund the 50% Needs bucket and, if you want, some Wants.

50/50 split: Simple, but feels unfair when incomes differ a lot.

Proportional to income (recommended for many): Each partner pays the same % of their income toward joint needs. This scales automatically when incomes change.

Category split: “You cover rent, I cover groceries.” Works if categories are stable—review quarterly.

Hybrid: Mix methods and revisit at life changes (new job, move, baby).

The three-account setup: Each partner keeps an individual account + one shared account. You both contribute to the shared account per your method; the spreadsheet calculates how much and when. Weekly money check-ins keep tensions low.

3) Build your Couples 50/30/20 in Google Sheets (step-by-step)

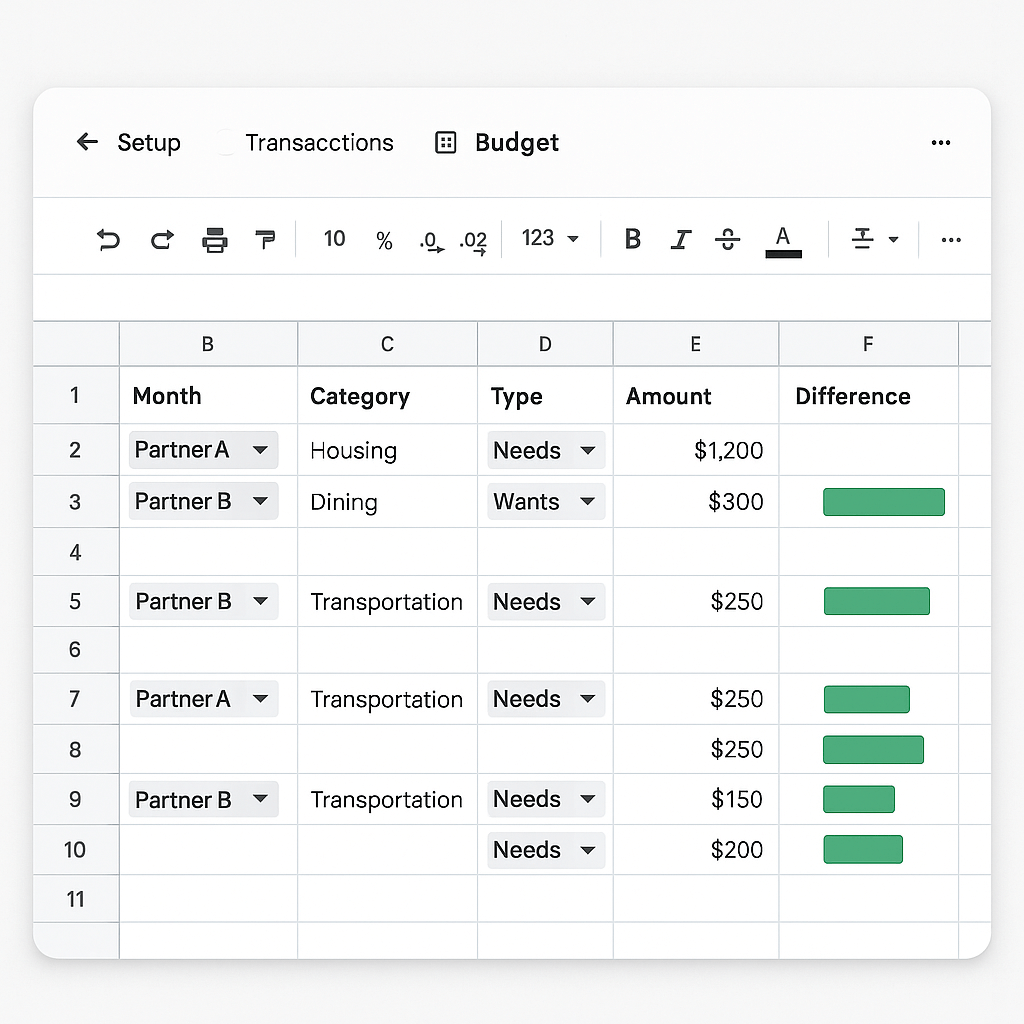

Template Preview 📊

👉 Get the free template: /templates/couples-50-30-20-google-sheets

(Click “Make a copy” to save it into your own Google Drive.)

Below is a screenshot preview so you know what to expect:

(Insert screenshot of Setup / Transactions / Budget / Dashboard tabs with visible dropdowns and conditional formatting.)

3.1 Create the file and sheets

Create a new Google Sheet named “FamilyBridge Couples 50/30/20”.

Add four sheets: Setup, Transactions, Budget, Dashboard.

3.2 Setup sheet (inputs & targets)

| Cell | Field | Example |

|---|---|---|

| B2 | Partner A after-tax monthly income | 5,800 |

| B3 | Partner B after-tax monthly income | 3,700 |

| B5 | Split method | Dropdown: 50/50, Proportional |

| B7 | Total after-tax income | =B2+B3 |

| B9–B11 | 50/30/20 targets | Needs =B7*0.5 ; Wants =B7*0.3 ; Savings =B7*0.2 |

How to set dropdowns (data validation):

Select B5 → Data → Data validation → Dropdown → add options 50/50, Proportional.

Create similar dropdowns later in Transactions for Partner and Type.

3.3 Transactions sheet (one line per expense/inflow)

Columns (A–F): Date, Partner, Category, Type, Amount, Notes

Partner dropdown: A or B.

Type dropdown: Needs, Wants, Savings/Debt.

Category examples: Rent, Utilities, Groceries, Insurance, Transport, Childcare, Dining Out, Subscriptions, Emergency Fund, Debt Extra, etc.

Data entry tip: Keep a rolling “Category” list on the Setup sheet and use it as the source for a dropdown, so spelling stays consistent.

3.4 Budget sheet (roll-ups & comparisons)

Add these named ranges for readability:

tx_amount→Transactions!E:Etx_type→Transactions!D:Dtx_partner→Transactions!B:BOptional:

tx_category→Transactions!C:C

Actual totals by bucket:

Needs:

=SUMIF(tx_type,"Needs",tx_amount)Wants:

=SUMIF(tx_type,"Wants",tx_amount)Savings/Debt:

=SUMIF(tx_type,"Savings",tx_amount)

Variance vs targets:

Needs variance:

=Actual_Needs - Setup!B9Wants variance:

=Actual_Wants - Setup!B10Savings variance:

=Actual_Savings - Setup!B11

Conditional formatting (early warning system):

If

Actual_Needs > Setup!B9, highlight the cell red; if<=target, highlight green.Do the same for Wants and Savings.

Add a “Status” column with a simple formula like

=IF(Actual_Needs>Setup!B9,"Over","On Track").

3.5 Fair-share math for the shared account

On Budget, calculate contributions.

If 50/50: each contributes

=Setup!B9/2to joint Needs (and any shared Wants if you choose).If Proportional:

A share

%==Setup!B2/Setup!B7B share

%==Setup!B3/Setup!B7A dollars to joint Needs =

% * Setup!B9; B likewise.

This ensures each contributes the same % of their income toward the joint bucket.

3.6 Dashboard sheet (glanceable controls)

Donut charts for Needs/Wants/Savings vs targets.

Progress bars: Use conditional formatting on cells showing

% of target met.Monthly trend (optional): Use a pivot table on the Transactions sheet grouped by month and Type.

Sharing & protection tips:

Give both partners edit access; lock the Setup sheet and formula ranges.

Keep the Transactions tab as the main place to edit to reduce errors.

💡 Editor’s note (real-world experience):

When I first tested this with my partner, I forgot to lock the Setup tab. Within a week, a formula got overwritten and broke the dashboard. Since then, I always “Protect range” for formulas and keep only the Transactions tab open for editing. This small step prevents headaches.

4) Make the rule fit your life in 2025

4.1 High-cost cities (HCOL)

If rent + childcare push Needs to 55–65%, formalize a temporary 60/30/10 plan and schedule a review (lease renewal, next raise, end of daycare). The rule is a direction, not dogma—treat deviations as a season with an exit plan.

4.2 Irregular income

Base your monthly target on a 3-month average net pay.

Send windfalls (bonuses, tax refunds) directly to the 20% bucket.

Tag bonuses as “Income–Variable” to keep them visible in the Dashboard.

4.3 Debt vs. retirement

If you carry high-interest debt (>15%), prioritize accelerated payoff within the 20% slice.

Still aim to capture any employer match in retirement accounts.

If you’re far from 20% saving, start with 10–15% and ratchet up.

Sanity check: Compare your spend mix to your past 6–12 months. Use the Dashboard trend to spot the one or two categories that drive most overruns.

5) Case study: Two incomes, one household

Scenario:

Partner A nets $5,800/mo; Partner B nets $3,700/mo; Total $9,500/mo.

Targets: Needs $4,750; Wants $2,850; Savings/Debt $1,900.

Split method: Proportional.

Fair-share math:

A share = 5,800 / 9,500 = 61.05% → A funds Needs ≈ $2,899.

B share = 38.95% → B funds Needs ≈ $1,851.

Optionally split some Wants proportionally (e.g., date nights); keep personal hobbies in individual accounts.

Three things that broke the budget & the fixes

Needs at 58% → Negotiate rent at renewal; shop auto insurance; re-tag two subscriptions to Wants and cut one.

Savings only 14% → Automate an extra $100/week to HYSA; funnel A’s first $2,000 of bonus into the emergency fund.

Partner friction → Weekly 15-minute “money check-in” (agenda: transactions, overage flags, next week’s big purchases).

6) Inline Q&A (the quick hits)

Q: Is the 50/30/20 rule after-tax or before-tax?

A: After-tax (net) income. Use the dollars that actually reach your accounts.

Q: We’re in a pricey city—can we use 60/30/10?

A: Yes. Treat it as a temporary adjustment and set review dates to work back toward 20% savings.

Q: How do retirement contributions fit?

A: Pre-tax payroll deferrals reduce your “net” and effectively contribute to long-term savings. If there’s a match, try not to leave it on the table.

Q: What belongs in “Needs”?

A: Housing, utilities, basic groceries, insurance, transportation, and minimum debt payments—the expenses required to live and work.

Q: Why use Google Sheets instead of a static template?

A: Shared editing, transparent formulas, dropdowns, and conditional formatting give you real-time control and accountability.

Q: How often should we review?

A: Weekly 15-minute check-ins; monthly reset; quarterly % review—keep it short and consistent.

7) One-page execution checklist (print this ✅)

Agree on a split (50/50 or proportional) and the three-account setup.

Create the Sheets file & four tabs; lock formulas.

Add dropdowns (Partner/Type/Category).

Enter both after-tax incomes; auto-calculate 50/30/20 targets.

Log a week of transactions; fix mis-tags.

Turn on conditional formatting for overages.

Review Dashboard every Sunday; adjust categories; schedule a monthly reset.

Re-aim your percentages quarterly (e.g., 55/25/20 → 50/30/20).

FAQ

Can 50/30/20 work if we have daycare and student loans?

Yes—tune to 55–65% Needs for a season and plan a glidepath back.Do minimum debt payments count as “Needs”?

Yes; extra payments go in the 20% bucket.How do we split fairly with unequal incomes?

Use proportional contributions so each partner pays the same % of income toward joint needs.What about irregular/bonus income?

Base targets on a 3-month average; send windfalls to Savings/Debt first.Do pre-tax retirement contributions “count” toward 20%?

They reduce net income and effectively contribute to long-term savings; still prioritize the employer match if available.Where can I sanity-check our spending mix?

Use your Dashboard trends and past months to spot the outliers; adjust the biggest drivers first.

Authoritative References & Official Resources

Analyzing Budgets (50–30–20 Activity) — CFPB

401(k) Limit Increases to $23,500 for 2025 — IRS (IR-2024-285)