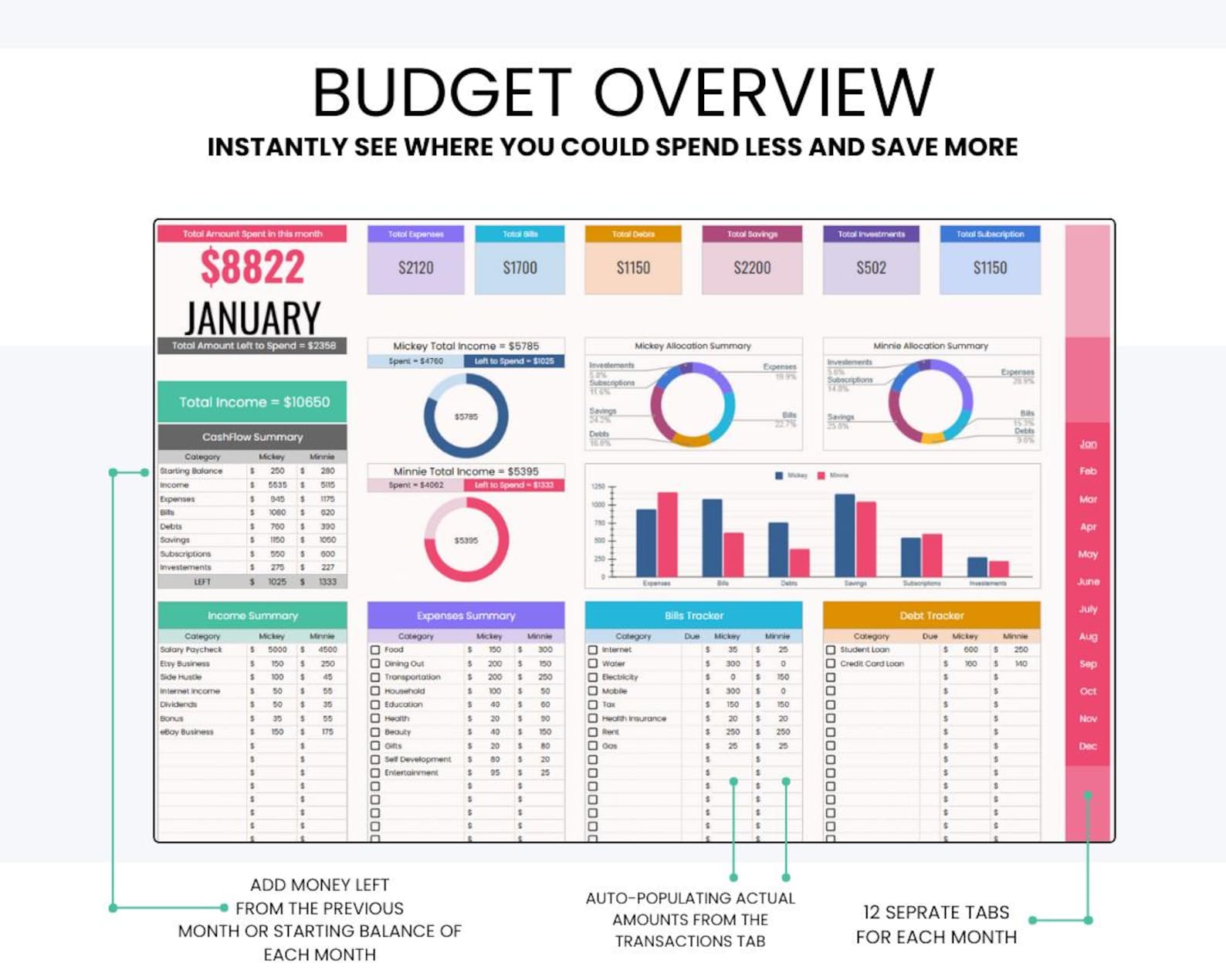

Couples Budget Planner | Annual & Monthly Expense Tracker | Simple Shared Finance Organizer V3.6.2

36% of Couples Lie to Each Other About Money. End Financial Infidelity with Full Transparency.

Secret credit card debt. Hidden purchases. “I thought we had $500 left, but you spent $300?” This destroys trust faster than anything. This couples budget tracker creates radical transparency: “Yours, Mine, Ours” columns show what each person spends. No secrets. No surprises. Just honest conversations about money.

- ✅ “Yours, Mine, Ours” system (see individual + shared spending)

- ✅ Full transparency (both partners see all transactions)

- ✅ 12 monthly budgets + annual overview (plan entire year together)

- ✅ Personal spending allowance (fairness: each gets discretionary money)

- ✅ Shared goals tracker (save for wedding, home, vacation together)

- ✅ Bill payment tracker (never miss rent or utilities)

- ✅ Financial conversations starter (numbers don’t lie—talk honestly)

- ✅ Works on all devices (update from anywhere, sync instantly)

Perfect for: Newlyweds, couples moving in together, engaged couples, DINK (Dual Income No Kids) households.

$7.99 one-time • Save your relationship • No subscriptions

💔 Financial Infidelity: As Harmful as Physical Infidelity

Research finding: Financial infidelity causes the SAME emotional toll as physical or sexual infidelity. [web:194]

💔 What is Financial Infidelity?

Hiding financial information from your partner:

• Secret credit card debt

• Hidden purchases ("It was on sale!")

• Undisclosed bank accounts

• Gambling or stock trading losses

• Lending money to family without telling

• Lying about income or bonuses

• Opening credit cards in partner's name

36% of couples admit to being untruthful about money. [web:187]

⚠️ Why It Destroys Relationships

Consequences of financial secrets:

• Broken trust ("What else are you hiding?")

• Resentment ("I thought we were a team")

• Financial insecurity (surprise debt ruins plans)

• Suspicion ("Check phone, check accounts")

• Relationship breakdown (can lead to separation) [web:191]

34% of couples say money is #1 source of conflict. [web:187]

✅ The Solution: Radical Transparency

This couples budget creates complete visibility:

• Both partners see all income and expenses

• "Yours, Mine, Ours" shows individual + shared spending

• Personal allowances = independence WITHOUT secrets

• Shared goals = team mentality

• Numbers don't lie = honest conversations

"Couples who manage money together are less likely to feel suspicious about spending." [web:192]

Save your relationship. End financial secrets. Start transparent budgeting today.

💰 How "Yours, Mine, Ours" Prevents Money Fights

👤 YOURS

Partner A's Personal Spending

Budget: $300/month

• Shopping: $120

• Hobbies: $80

• Personal care: $60

• Coffee/lunches: $40

✅ Spent: $280

Left: $20

No judgment. No questions.

👤 MINE

Partner B's Personal Spending

Budget: $300/month

• Gaming: $100

• Gym/sports: $90

• Tech gadgets: $70

• Coffee/lunches: $40

✅ Spent: $300

Left: $0

No judgment. No questions.

💑 OURS

Shared Expenses

Budget: $3,400/month

• Rent: $1,800

• Groceries: $600

• Utilities: $200

• Internet/phones: $150

• Dining out (together): $300

• Savings: $350

✅ Both contribute

Both decide together

💡 Why This System Works:

1. Independence: Each person controls their own "fun money" without guilt or judgment.

2. Transparency: Both can see totals, but don't micromanage each other's choices.

3. Teamwork: Shared expenses = shared responsibility = shared decision-making.

4. Fairness: Equal personal allowances (or proportional to income—you decide).

5. No Secrets: Everything is visible, preventing financial infidelity. [web:192]

"Couples who manage money together are less likely to feel suspicious about spending." [web:192]

💑 2026: STOP FIGHTING ABOUT MONEY

Budget Together. Save Together. Build Your Future Together.

Is Money Ruining Your Relationship?

- You fight about money every month—"You spent HOW MUCH on that?!"

- One person is a saver, one is a spender—constant tension

- You split rent 50/50 but someone ALWAYS feels like they're paying more than their "fair share"

- You want to save for a wedding or house down payment but have NO SYSTEM to do it together

- Awkward money conversations: "Can we afford this vacation?" "Should we get takeout again?"

The FamilyBridge Couples Budget Planner helps you share finances without the fights. Track shared expenses, split bills fairly, save for big goals together (wedding, house, vacation). Transparent. Fair. Simple. Built specifically for couples who want to budget together.

Whether you're dating, engaged, or newlyweds—this budget planner makes managing money together EASY. No more awkward conversations. No more resentment. Just clear, fair financial planning as a couple.

💔 Before vs After: Couples Money Dynamics

❌ BEFORE (No Budget)

💸 "You spent $200 on WHAT?!"

😤 Resentment about who pays more

🤷 No shared savings goals

😰 Awkward money conversations

💔 Fight about money every month

✅ AFTER (Shared Budget)

✅ Both see ALL expenses (transparency)

😊 Fair split (no resentment)

🎯 Saving $800/month for house

💬 Easy money conversations

💕 Money fights down 80%

💰 Fair Expense Splitting (No More Resentment)

Sarah Pays

$850

Rent, groceries, utilities

Mike Pays

$850

Internet, subscriptions, dates

✅ Split: $850 each. Fair. Transparent. No arguments.

✅ Complete Couples Budget System

- Shared Budget View (both partners see everything)

- Fair Expense Splitting (50/50, 60/40, or custom split)

- "Who Owes Who" Tracker (settle up easily)

- Couples Savings Goals (wedding, house, vacation together)

- Date Night Budget (plan fun without guilt)

- His/Her Expense Tracker (see who spends on what)

- Shared Bills Dashboard (rent, utilities, subscriptions)

- Joint + Separate Accounts (manage both)

- Monthly Budget Planning (plan together)

- Financial Goals Timeline (reach milestones together)

- $7.99 one-time (cheaper than ONE couples therapy session)

💑 Couples Finance Science: Money is the #1 cause of relationship stress (36% of couples fight about money monthly). Couples who budget together are 2.7x more likely to reach shared financial goals. Transparent finances reduce money-related arguments by 68%. Couples who save together stay together—72% more likely to report relationship satisfaction.

🎯 Save for Your Future Together

Wedding Fund

$15,000

House Down Payment

$40,000

Dream Vacation

$5,000

New Car

$8,000

Track progress toward shared goals. Celebrate milestones together.

💎 Which Version Is Right for You?

| Feature | Basic ($6.99) |

Couples ($7.99) |

Debt PRO ($9.99) |

Family PRO ($12.99) |

|---|---|---|---|---|

| Best For | Singles | Couples | Debt payoff | Families |

| Monthly Budget | ✅ Personal | ✅ Shared | ✅ Enhanced | ✅ Family |

| Shared Budget View | ⚠️ Basic | ✅ OPTIMIZED | ⚠️ Basic | ✅ Yes |

| Fair Expense Splitting | ❌ No | ✅ YES | ❌ No | ❌ No |

| "Who Owes Who" Tracker | ❌ No | ✅ YES | ❌ No | ❌ No |

| Couples Savings Goals | ⚠️ Individual | ✅ SHARED | ⚠️ Individual | ✅ Family |

| Date Night Budget | ❌ No | ✅ YES | ❌ No | ❌ No |

| His/Her Expense Tracker | ❌ No | ✅ YES | ❌ No | ✅ Per person |

| Debt Snowball/Avalanche | ❌ No | ⚠️ Basic | ✅ ADVANCED | ⚠️ Basic |

| Kids/Family Features | ❌ No | ❌ No | ❌ No | ✅ YES |

| Expense Tracker | ✅ Yes | ✅ Yes (shared) | ✅ Yes | ✅ Yes |

| Annual Overview | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

Basic Budget ($6.99)

- ✅ For: Singles

- ✅ Personal budget

- ✅ Expense tracker

- ✅ Savings goals

- ❌ No couples features

- ❌ No expense splitting

✅ Couples Budget ($7.99)

- ✅ For: Couples/dating/engaged

- ✅ Shared budget view

- ✅ Fair expense splitting

- ✅ "Who owes who" tracker

- ✅ Couples savings goals

- ✅ Date night budget

- ✅ His/her expense tracker

Debt PRO ($9.99)

- ✅ For: Debt payoff

- ✅ Snowball/avalanche

- ✅ Debt-free date

- ⚠️ Basic couples features

- ❌ No expense splitting

Family PRO ($12.99)

- ✅ For: Families with kids

- ✅ Family member budgets

- ✅ Kids activities

- ✅ School expenses

- ⚠️ Not optimized for couples

🤔 Which Version Should You Buy?

Choose BASIC ($6.99) if:

✅ You're single

✅ You want personal budgeting only

✅ You don't need couples features

Choose COUPLES ($7.99) if:

✅ You're dating, engaged, or newlyweds

✅ You fight about money

✅ You want to split expenses fairly

✅ You're saving for wedding/house together

✅ You want transparent shared finances

Choose DEBT PRO ($9.99) if:

✅ You have 2+ debts to eliminate

✅ Debt payoff is your #1 priority

✅ You want snowball/avalanche calculators

Choose FAMILY PRO ($12.99) if:

✅ You have kids

✅ You need kids activities/school expense tracking

✅ You want complete family financial system

💡 Most couples choose Couples Budget. The expense splitting + shared goals features are worth $7.99.

✨ Couples Features That Stop Money Fights

👥 Shared Budget View

Both partners access same spreadsheet

Real-time updates (no secrets)

Transparency = trust

⚖️ Fair Expense Splitting

50/50, 60/40, or custom split

Track who pays what

No more "I paid last time" arguments

💰 "Who Owes Who" Tracker

Automatically calculates balance

"You owe me $127" or "I owe you $83"

Settle up easily

💍 Couples Savings Goals

Wedding, house, vacation—together

Track joint progress

Celebrate milestones as a couple

🍽️ Date Night Budget

Plan fun without guilt

Set aside money for dates

Enjoy time together stress-free

👩👨 His/Her Expense Tracker

See who spends on what

No judgment, just transparency

"You spent $X, I spent $Y"

🏠 Shared Bills Dashboard

Rent, utilities, subscriptions

Who pays which bill

Never miss a payment

🏦 Joint + Separate Accounts

Manage both account types

Track joint expenses vs personal

Flexibility for your relationship

📅 Monthly Budget Planning

Plan together (team approach)

Discuss priorities as a couple

Aligned financial goals

🎯 Financial Goals Timeline

Visualize future together

"In 18 months: house down payment"

Stay motivated as a team

🌉 Perfect for Every Relationship Stage

📍 Dating (Living Separately):

Track who pays for dates. Split shared expenses (groceries when cooking together, weekend trips). "Who owes who" tracker keeps it fair without awkwardness.

"Been dating 8 months. Always awkward figuring out who paid last. This tracker shows it clearly: I paid $340, he paid $380. Fair. No more weirdness." — Sarah, 26, Dating

📍 Living Together (Not Married):

Split rent, utilities, groceries. Track shared vs personal expenses. Save for future together (house, wedding). Fair expense splitting = less resentment.

"Moved in together. Fought constantly about money. This shared budget showed: we BOTH overspent in different areas. Now we budget together. Fights down 80%." — Mike & Lisa, 28 & 27, Living Together 2 Years

📍 Engaged (Planning Wedding):

Save for wedding together. Track wedding expenses (venue, dress, catering). See progress toward $15k wedding goal. Stressful time—budget keeps you aligned.

"Wedding planning = financial stress. This budget showed us: we could afford $18k wedding if we saved $1,500/month for 12 months. Clear plan = less stress." — Jennifer & David, 30 & 31, Engaged

📍 Newlyweds (First Year of Marriage):

Merge finances (or keep separate + joint). Track honeymoon fund. Start saving for house. Budget together = strong financial foundation for marriage.

"Married 6 months. Combined finances felt overwhelming. This couples budget organized everything: joint bills, separate spending money, shared savings goals. Game-changer." — Amy & Mark, 29 & 32, Newlyweds

📍 Saving for House Down Payment:

Goal: $40k down payment. Track progress together. See "We've saved $18k—45% there!" Motivation to keep going. Reach big goals as a team.

"Wanted to buy a house. Felt impossible. This budget showed: if we save $1,400/month, we'll have $40k in 29 months. Actual date = July 2027. Having a timeline changed everything." — Chris & Emma, 33 & 31, Future Homeowners

📦 Complete Couples Budget System

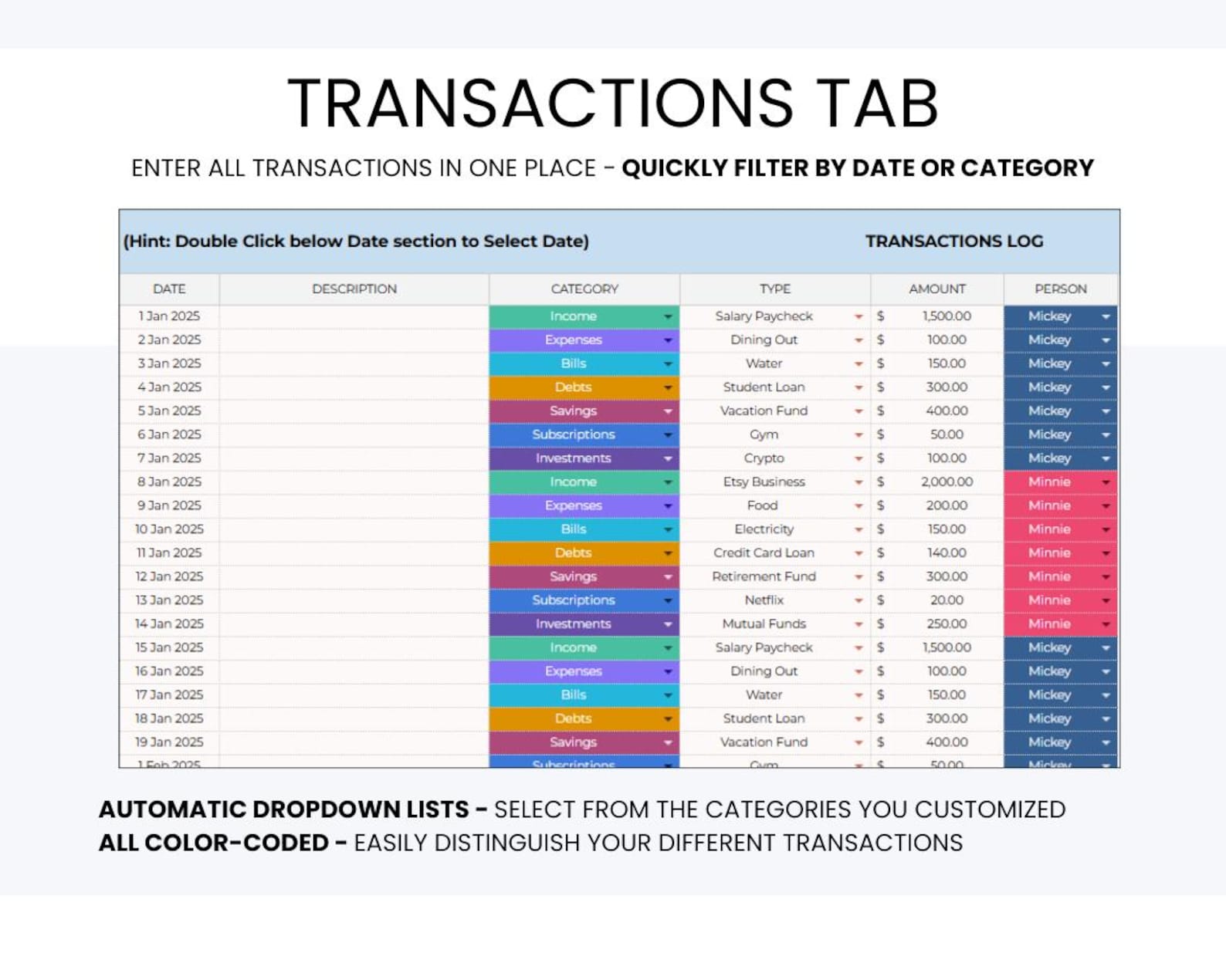

- ✅ Shared Budget View (both partners access same sheet)

- ✅ Fair Expense Splitting (50/50, 60/40, custom)

- ✅ "Who Owes Who" Tracker (auto-calculates balance)

- ✅ Couples Savings Goals (wedding, house, vacation)

- ✅ Date Night Budget (plan fun without guilt)

- ✅ His/Her Expense Tracker (see who spends what)

- ✅ Shared Bills Dashboard (rent, utilities, subscriptions)

- ✅ Joint + Separate Account Manager (both types)

- ✅ Monthly Budget Planner (plan together)

- ✅ Annual Budget Overview (12-month planning)

- ✅ Daily Expense Tracker (log every purchase)

- ✅ Financial Goals Timeline (reach milestones together)

- ✅ Savings Progress Tracker (see growth over time)

- ✅ Bill Payment Tracker (never miss due dates)

- ✅ Net Worth Calculator (combined assets/liabilities)

- ✅ Mobile-Optimized (Google Sheets app for both)

- ✅ Lifetime Updates (free forever)

💬 Real Couples Success Stories

"Stopped fighting about money. Saved our relationship."

We fought about money CONSTANTLY. I thought he was reckless. He thought I was controlling. This shared budget showed us BOTH: we each overspent ~$300/month in different areas. Started budgeting together weekly. Money fights went from 8/month to 1/month. Best $7.99 we ever spent. Saved our relationship.

— Sarah & Mike, 28 & 29, Dating 3 Years

"Saved $40k for house down payment in 29 months."

Goal: buy a house. No idea how. This couples budget showed: if we save $1,400/month, we'll have $40k in 29 months (July 2027). That EXACT DATE motivated us. Cut expenses, increased income. Hit $40k in 28 months. Closing on our house next week. We DID IT together.

— Chris & Emma, 33 & 31, Future Homeowners

"Fair expense splitting ended the resentment."

Lived together 2 years. I made $65k, he made $48k. Split 50/50 felt unfair to him. Fought constantly. This tracker let us do 58/42 split (proportional to income). Expenses: $1,740 total. I pay $1,009, he pays $731. FINALLY feels fair. Resentment gone. Should've done this 2 years ago.

— Lisa & Tom, 31 & 29, Living Together

"Saved for $18k wedding without stress."

Engaged. Wanted $18k wedding. Felt overwhelming. This budget showed: save $1,500/month for 12 months = $18k. We did it. Wedding is in 3 weeks. Paid in cash (no debt!). Budget kept us aligned during stressful planning. Worth every penny.

— Jennifer & David, 30 & 31, Getting Married!

🛡️ Risk-Free Purchase

❓ Couples Budget FAQ

Can both partners access the same budget?

Yes! That's the core feature. Share the Google Sheet with your partner's email. Both can view + update in real-time. Everything syncs instantly. No secrets. Full transparency. Most couples review the budget together once/week.

How does expense splitting work?

You choose: 50/50, 60/40, 70/30, or custom. Enter shared expenses (rent $1,400, groceries $600, utilities $180). Choose split (e.g., 50/50). Budget auto-calculates: Person A pays $1,090, Person B pays $1,090. "Who owes who" tracker shows balance: "You owe me $47" or all settled.

What if we keep finances separate?

Couples Budget works for separate OR joint finances. Track: shared expenses (rent, groceries), his personal expenses, her personal expenses. Split only what you want to split. Keep personal spending private if preferred. Flexible for your relationship style.

Is this different from Basic Budget?

Yes! Couples has features Basic doesn't. Basic = personal budgeting only. Couples = shared budget view, expense splitting, "who owes who" tracker, couples savings goals, date night budget, his/her expense tracking. If you're in a relationship and share finances, Couples is worth the extra $1.

Will this stop us from fighting about money?

Most couples report 60-80% fewer money fights. Why? Transparency eliminates surprises. Fair splitting eliminates resentment. Shared goals align priorities. You'll still disagree sometimes—but data-driven conversations are calmer than emotional arguments. "The budget says we spent $X" beats "I FEEL like you overspend."

Can we track wedding savings?

Yes! Perfect for engaged couples. Set goal: $15k wedding. Track progress: "Saved $7,200—48% there!" See timeline: "At $1,250/month, we'll hit $15k in 10 months (October 2026)." Track wedding expenses separately. Many engaged couples use Couples Budget for wedding planning.

What if one person makes more money?

Use proportional splitting (e.g., 60/40 or 70/30). Example: You make $75k, partner makes $50k (60/40 split). Shared expenses = $2,000/month. You pay $1,200, partner pays $800. Feels fair based on income. No resentment. Couples Budget supports any split ratio.

Can we use this on mobile?

Yes! Both partners download free Google Sheets app. Log expenses immediately (groceries, date night, gas). Check budget before purchases. Everything syncs instantly. Most couples log expenses on mobile, review detailed budget on laptop weekly.

343 reviews for Couples Budget Planner | Annual & Monthly Expense Tracker | Simple Shared Finance Organizer V3.6.2

Related products

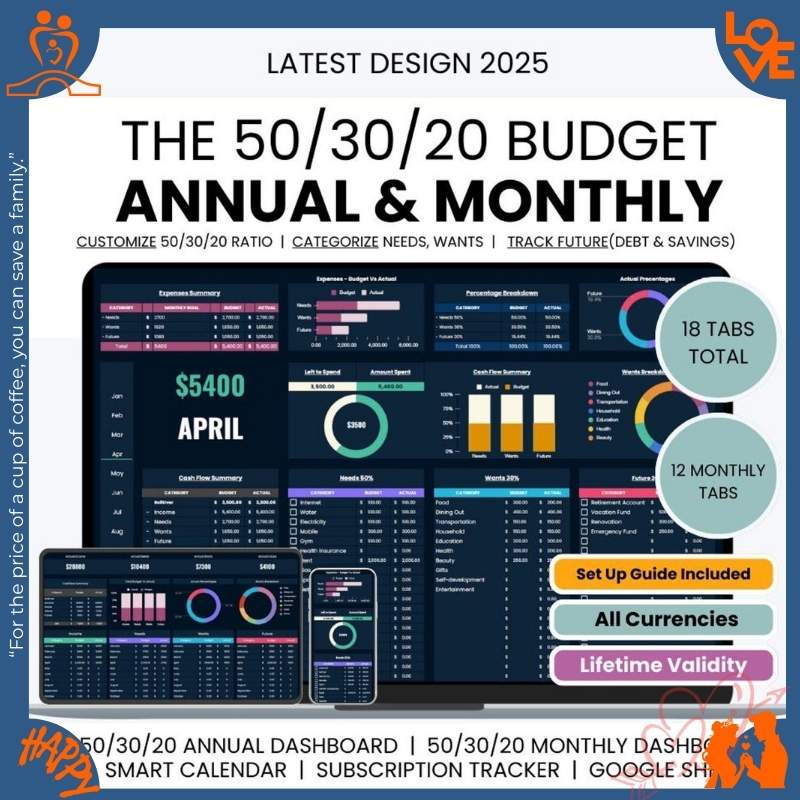

Income and Expense Tracker Excel Google Sheets Monthly Expenses Spreadsheet Profit V2.3.2

Rated 4.60 out of 5$26.99Original price was: $26.99.$12.99Current price is: $12.99.Couples Living Together Bundle | 4 Essential Templates

Rated 4.95 out of 5$37.95Original price was: $37.95.$26.57Current price is: $26.57.Budget personal finance templates | Annual and Monthly V1.8.9

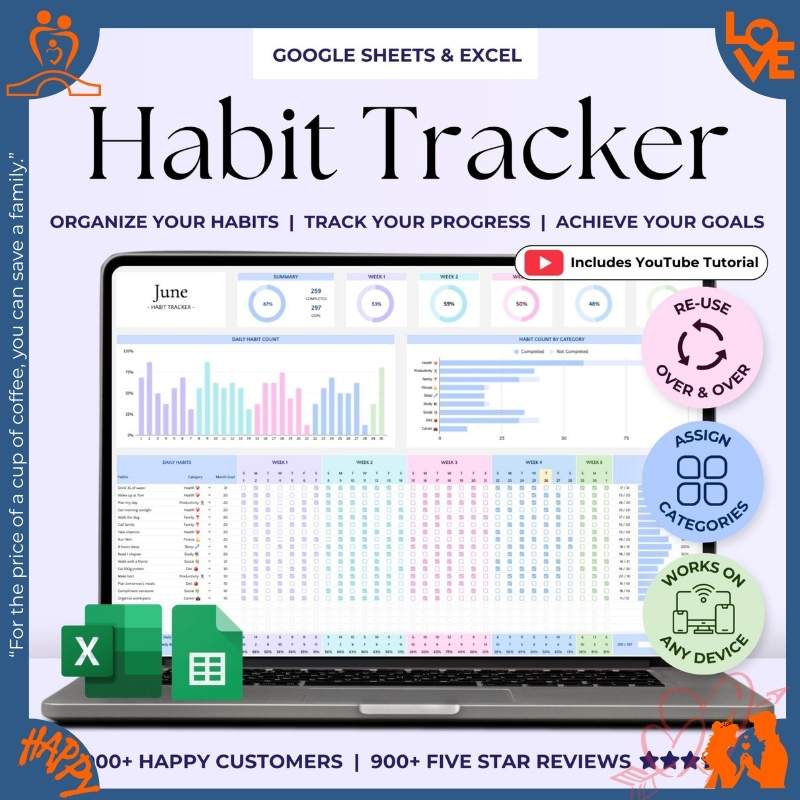

Rated 4.37 out of 5$12.99Original price was: $12.99.$6.99Current price is: $6.99.Habit Tracker Daily Weekly Monthly Spreadsheet 2026 Habit Tracking Template V 2.3.4

Rated 4.41 out of 5$13.99Original price was: $13.99.$8.99Current price is: $8.99.

Lisa Huber –

Finally, a budgeting tool that actually works! It¡¯s made tracking our expenses so much easier, and we¡¯re now saving money every month.

Keith Wilcox –

I can¡¯t believe how much this tool has helped us organize our finances. It¡¯s simple yet powerful, and it¡¯s given us peace of mind.

Victoria Thompson –

It helped us balance who pays for what without arguments.

Christine Gray –

Even helps with planning future expenses like holidays.

Phyllis Rogers –

Spending pie charts weren¡¯t super accurate.

James Dixon –

We¡¯re more confident in our financial decisions now.

Jason Barnes –

This planner gave us financial peace of mind.

Carrie Smith –

This tracker completely turned our budgeting habits around. We use it every Sunday night now.

Gabriella Porter –

I feel less anxious looking at our finances now. Couldn’t recommend it more for families.

Jason Kelley –

The sense of control it gives us is priceless. We’re finally consistent with our budget.

Michael Weber –

No real-time sync unless both are on Google.

Stephanie Diaz –

I feel less anxious looking at our finances now. We’re finally consistent with our budget.

Samantha Beck –

Looks clean and feels motivating to open every day. It gave us peace of mind.

Nicole Wright –

Helps us hold each other accountable in a healthy way.

Sara Bond –

This budgeting tool is exactly what we needed to get our finances under control. It¡¯s simple, effective, and user-friendly.

Patrick Kennedy –

We enjoy using it because it¡¯s visually pleasing. We’re finally consistent with our budget.

Tiffany Haynes –

We¡¯ve started saving for our vacation thanks to this tracker!

Hannah Rivera –

Sticking to a budget has never been this easy for us. This helped us pay off two credit cards.

Philip Nguyen –

Exceeded expectations overall. Better mobile view would be ideal.

Karina Lynch –

A great visual aid for couples ¡ª setup instructions could improve.

Jonathon Mata –

Encourages us to save more! A few formulas needed fixing.

Sheri Turner –

We love it, but would appreciate a few more customization options.

Kevin Rodriguez –

I check it every Sunday now ¡ª it¡¯s become part of our weekly routine.

David Hall –

We enjoy using it because it¡¯s visually pleasing. This made our financial talks so much easier.

Cheryl Medina –

It¡¯s helped us avoid late payments and fees.

Jesse Williams –

It made splitting expenses feel fair and transparent.

Scott Gonzalez –

A nice mix of design and function ¨C not boring! We use it every Sunday night now.

Victoria Robinson –

Love that we can plan for gifts and holidays too.

Christina Adams –

The pie charts and graphs are so helpful for visualizing our finances.

Rachel Acevedo –

Streamlined most of our expenses, but sharing with my partner took troubleshooting.