💸 Credit Card Tracker – Google Sheets Template

Protect your credit. Track your progress. Simplify your finances.

Whether you’re paying off debt or building credit from the ground up, this all-in-one tracker is your daily financial ally.

💡Why You Need It:

Managing multiple credit cards can be overwhelming. Late payments, missed bills, rising balances — it adds up fast.

This easy-to-use, beginner-friendly tracker helps you stay organized, pay on time, and improve your credit health — no matter where you are in your financial journey.

✨ Top Features You’ll Love:

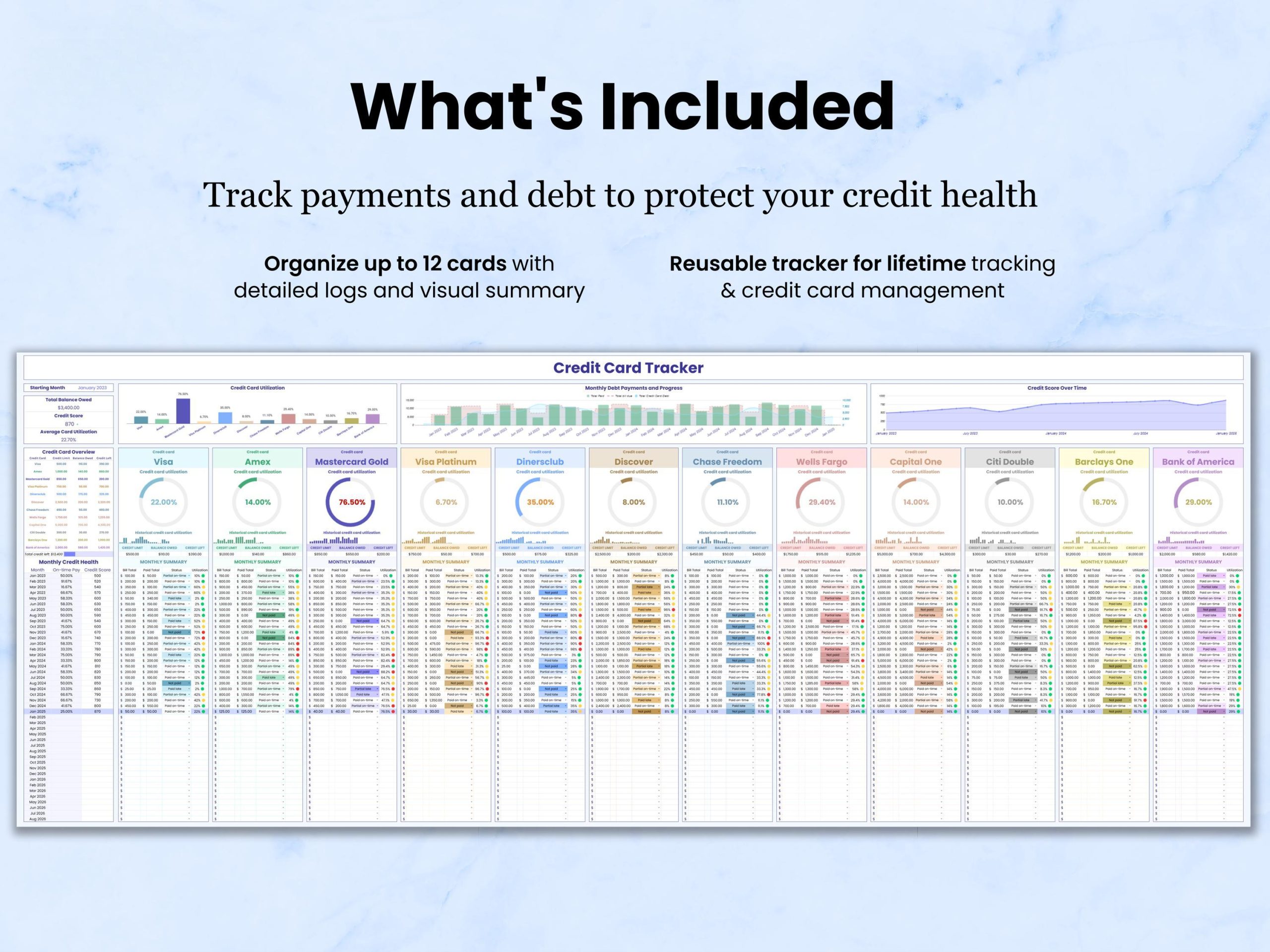

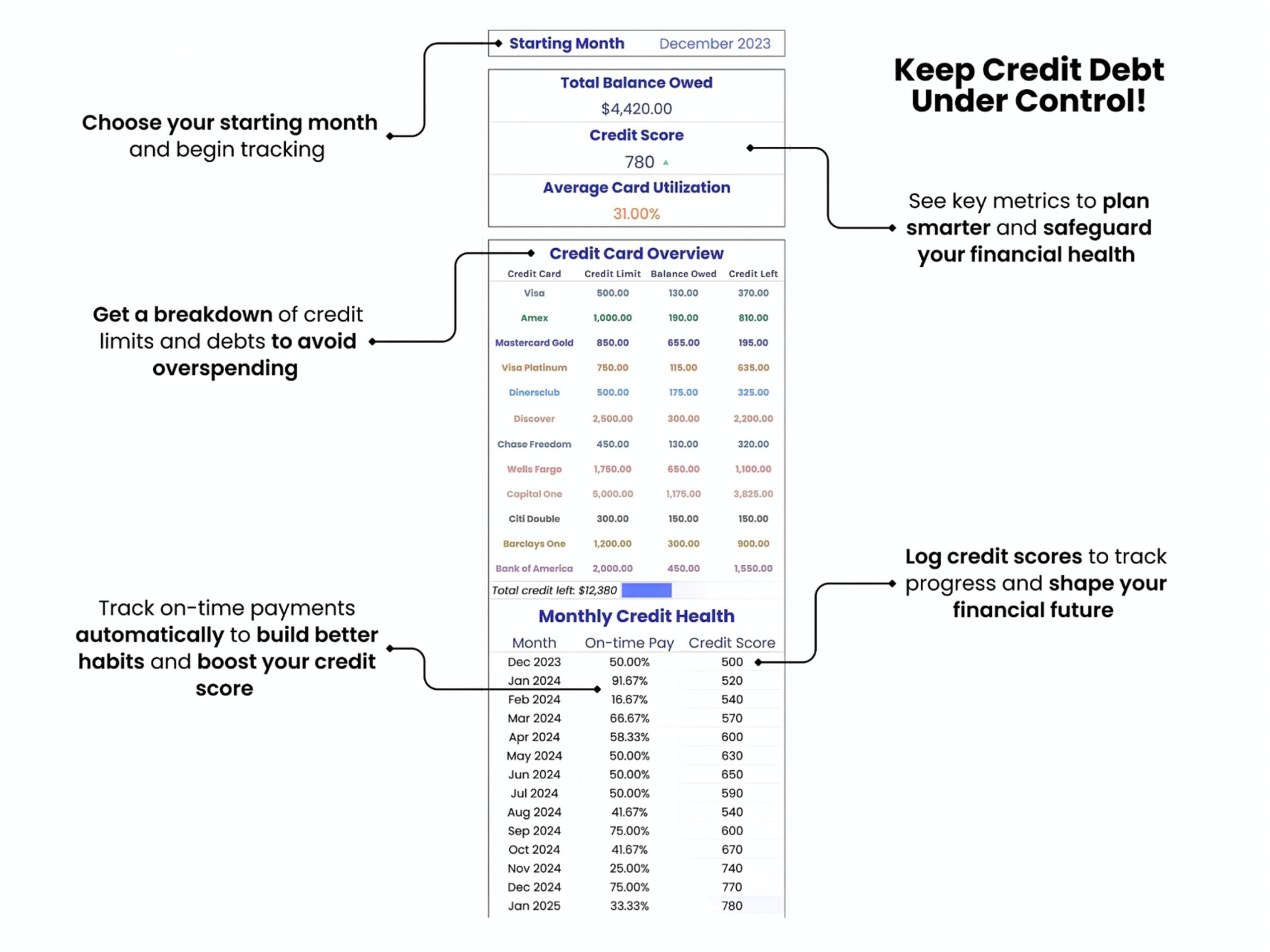

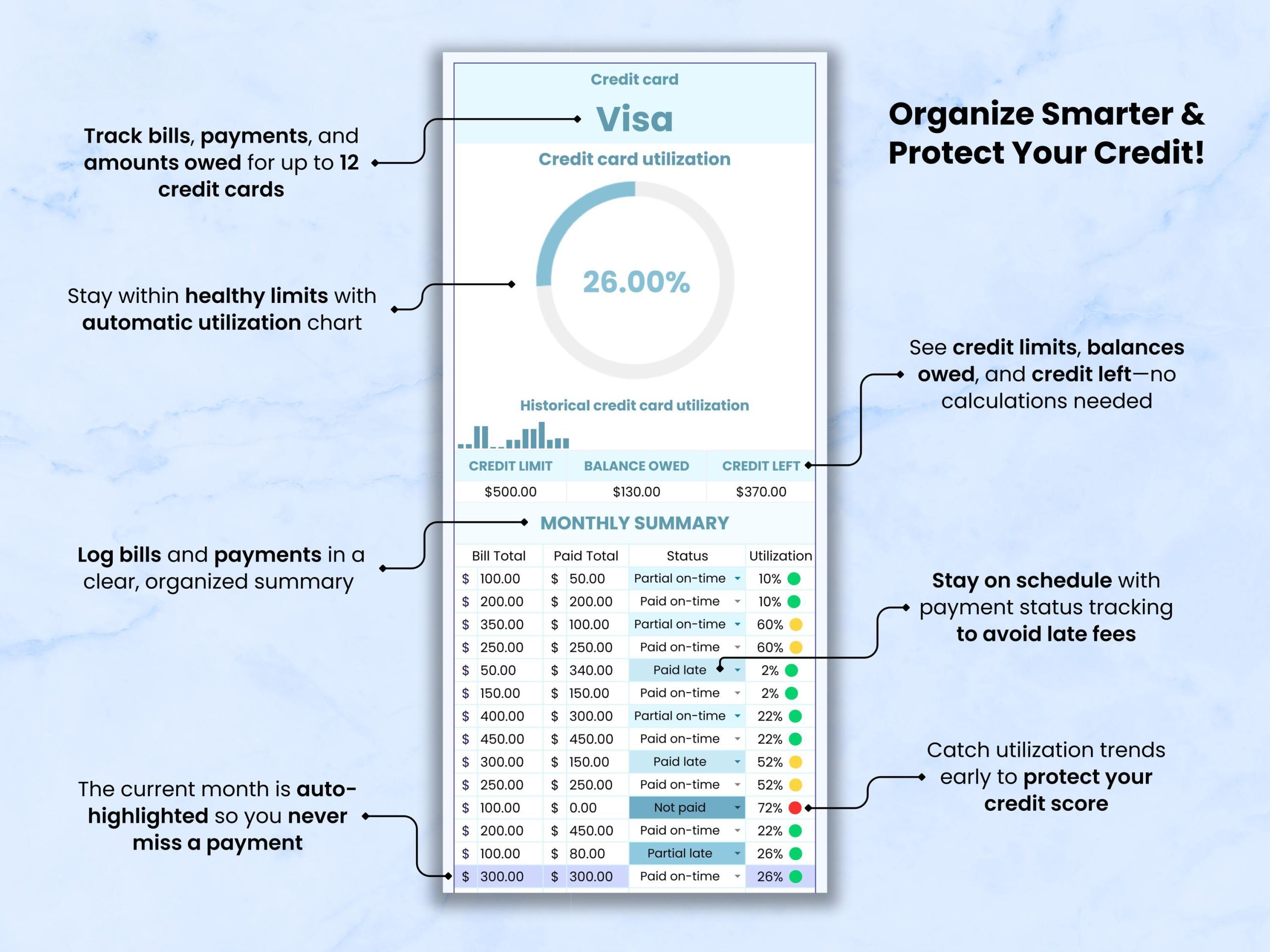

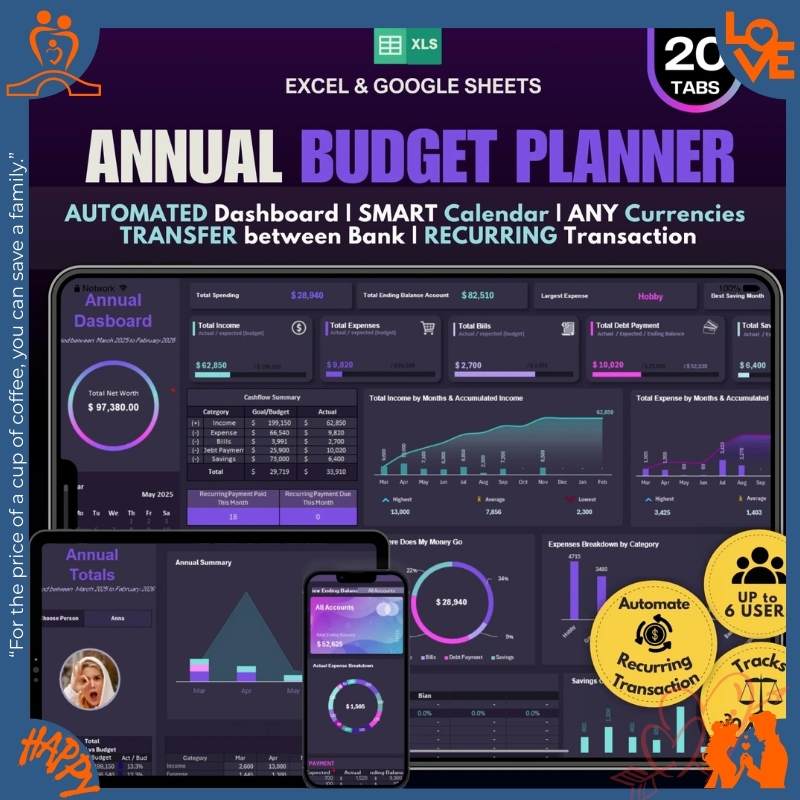

💳 Track Up to 12 Credit Cards

Log bills, due dates, payments, balances, and more — all in one place. No more forgetting what’s due or where you stand.

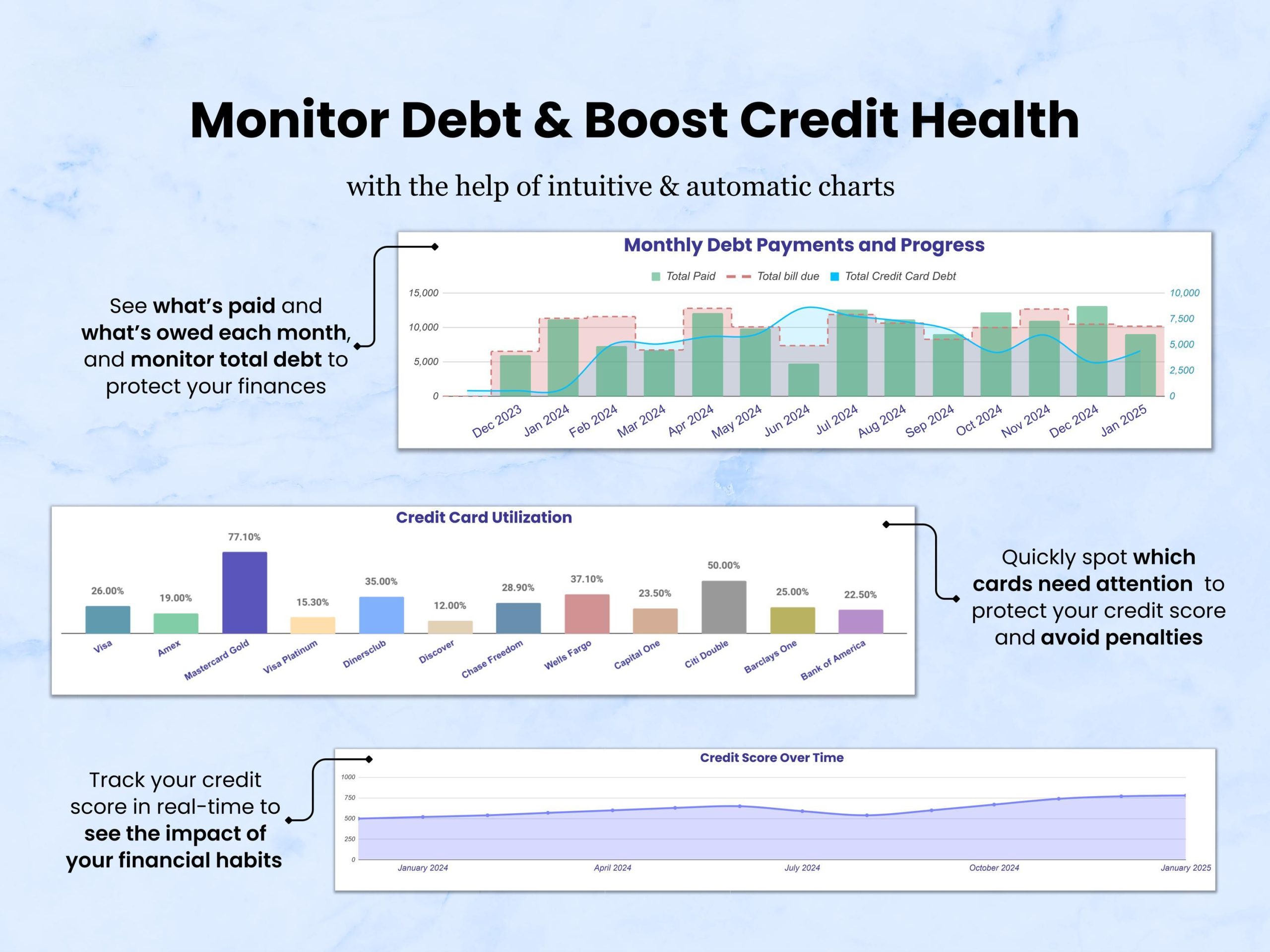

📊 Automatic Credit Utilization Calculations

Visualize how much credit you’re using and keep your usage healthy — a key factor in improving your score!

💱 Supports All Currencies

Perfect for U.S. and international users alike – easily customize the tracker to your preferred currency.

♻️ Reusable, Flexible Format

Start tracking any time of year and reuse it year after year with no expiration.

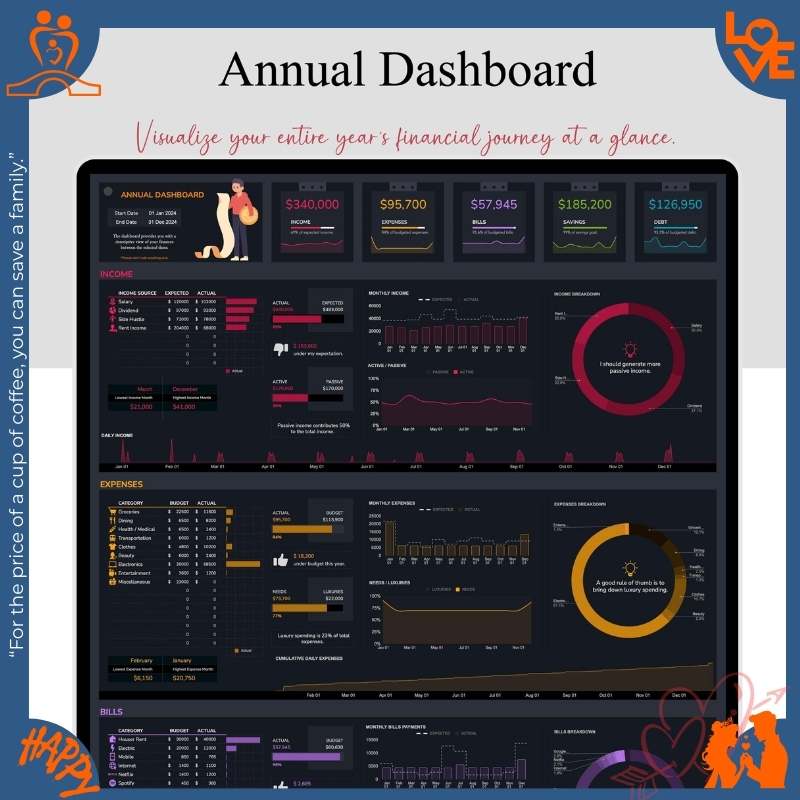

📈 Visual Progress Tools

See your credit score trends, payment patterns, and total balances with beautiful, easy-to-read charts.

🎨 Color-Coded Layout

Quickly spot risks, late payments, or high utilization with intuitive color highlights – no guesswork needed.

✅ Credit Score Habit Builder

Track on-time payments, reduce debt, and build consistency for better financial habits over time.

📦 What You’ll Receive:

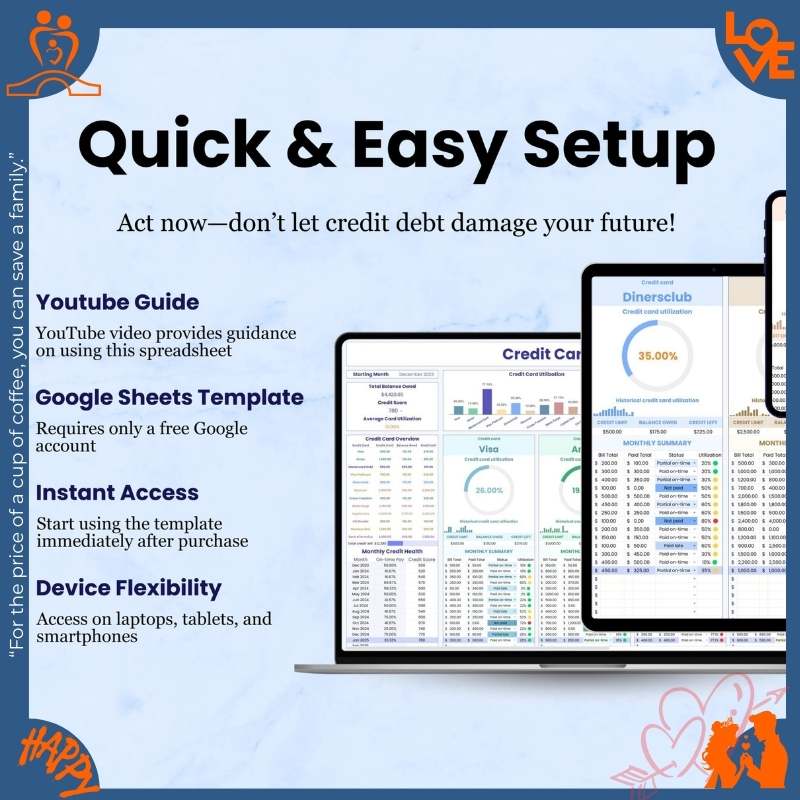

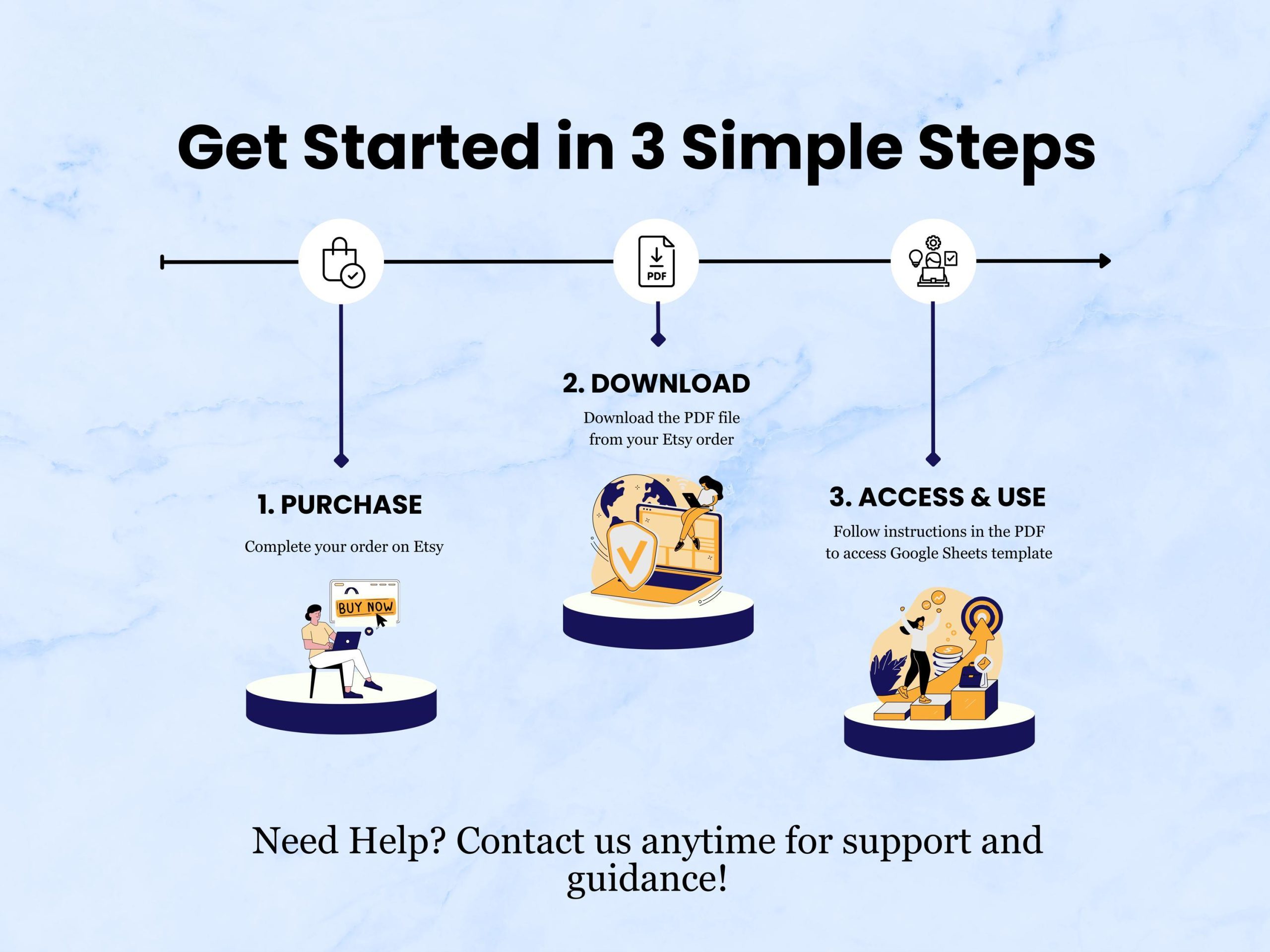

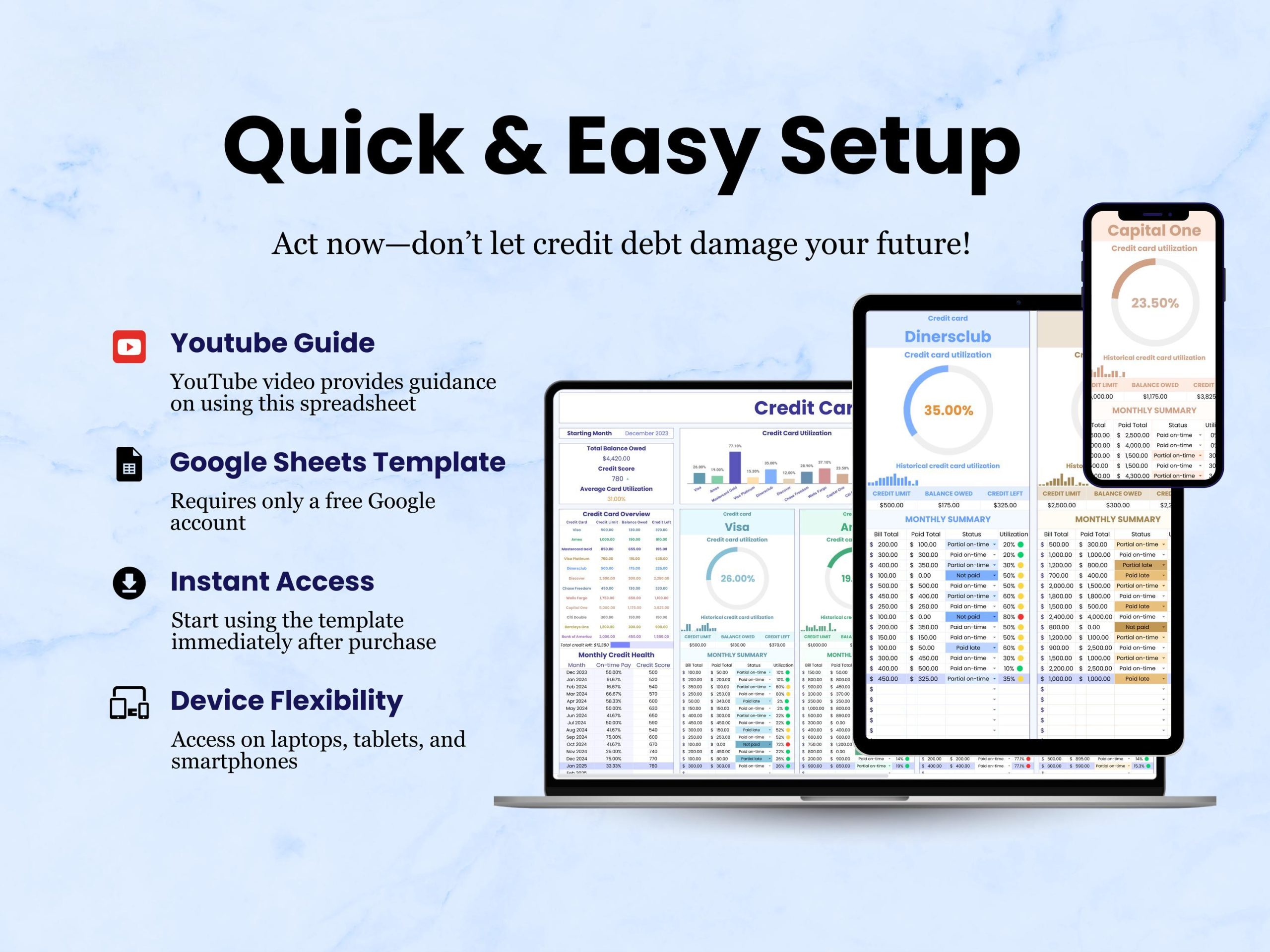

• 📎 1 PDF file – with a direct link to access the Google Sheets template

• 📝 Setup guide included inside the PDF (perfect for beginners!)

✦ Instant Access After Purchase:

You’ll get your PDF download right after checkout, plus a link sent to your email.

Still need help? Check the included FAQ or message us anytime — we’re happy to help.

📌 Important Notes:

• 🧾 Digital product only – no physical item will be shipped

• 💻 Works only with Google Sheets – not compatible with Excel

• 📧 Requires a free Google account – setup instructions included

• 📚 For personal use only – no resale or redistribution

⚠️ Disclaimer:

This is an informational and organizational tool and not financial or legal advice. All decisions based on the tracker are your responsibility. By purchasing, you agree to these terms.

🎁 Ready to take control of your credit health?

This tracker is your first step toward financial clarity and peace of mind.

👉 Grab it now and start building better money habits today.

Daniel Harris –

I’ve been using this for 2 months and it’s helped me stay on track. Not the prettiest interface but it’s functional. Solid tool for the price.

Elizabeth White –

The automated calculations save me hours every month. I just enter my payments and it updates everything. Seeing those balances drop is so satisfying! Highly recommend.

Matthew Jackson –

My spouse and I were stressed about our credit card debt. This tracker helped us create a concrete plan we both understand. We’re making real progress for the first time in years!

Susan Thomas –

I’ve tried multiple debt tracking apps but this simple spreadsheet beats them all. No subscriptions, full control, and the payoff calculator is incredibly motivating. Down 38k already!

Joseph Anderson –

Great concept and execution. Made good progress on my debt using this. Docking one star because I had to Google how to use some features, but overall satisfied.

Barbara Taylor –

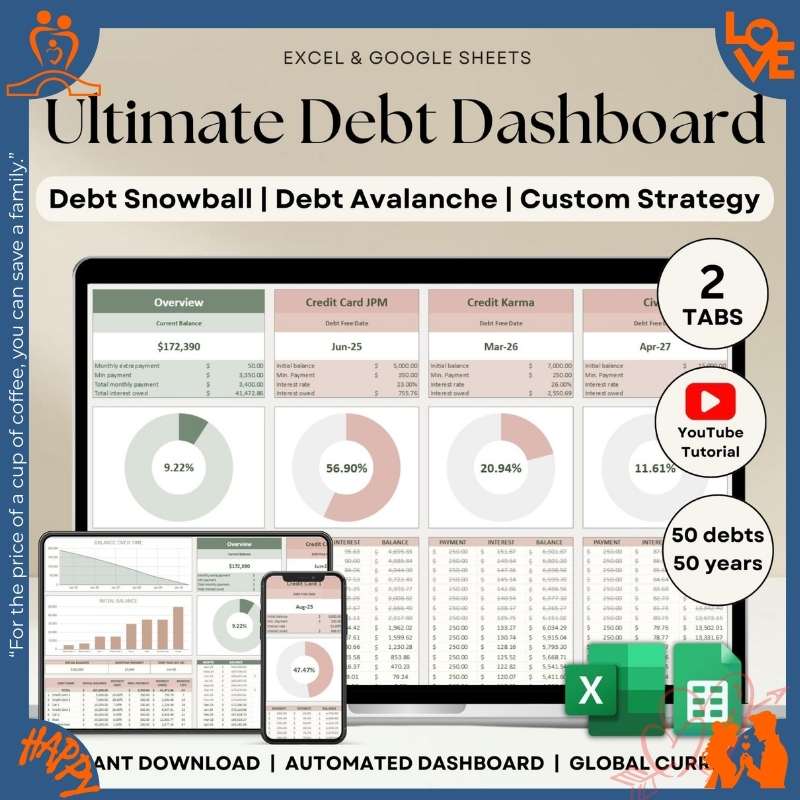

The avalanche vs snowball comparison feature helped me choose the best strategy for my situation. Seeing the interest savings projected over time was eye-opening. Worth every cent!

Charles Martinez –

I was drowning in credit card debt with no plan. This spreadsheet laid everything out clearly and now I can see the light at the end of the tunnel. Already paid off 2 cards!

Mary Rodriguez –

It does the job, but it’s not as user-friendly as I hoped. The debt tracking works once you set it up, but I had to figure out a lot on my own. Acceptable for the price.

Andrew Davis –

This tracker completely changed how I approach credit card debt. The snowball method visualization makes it so clear which card to focus on. I’ve paid off 24k in just 4 months!

Patricia Miller –

Very functional and worth the money. The snowball calculator is exactly what I needed. My only critique is that some formulas could be better explained.

Thomas Garcia –

Paying off credit cards felt impossible until I started using this tracker. The visual progress bars make small wins feel significant. Down from 45k to much less!

Karen Anderson –

I love that this works offline and I can customize it. Added my own notes column for motivation quotes. On track to be debt-free by mid-2026! So grateful for this tool.

Steven Johnson –

My financial advisor recommended a similar tool for $300. This does everything I need for a fraction of the cost. The debt-free date calculator is my favorite feature!

Laura Martinez –

Does what it promises. The automation is nice and saves time. Would be perfect if there was a mobile app version, but Google Sheets works fine on my phone.

Brian Wilson –

This spreadsheet holds me accountable in a way apps never did. Seeing all my cards in one place and tracking real progress has been transformative. Can’t recommend enough!

Michelle Taylor –

After 7 months of using this, I’ve made more progress than the previous 2 years combined. The snowball method visualization is genius and keeps me motivated daily.

Kevin Brown –

I’ve been using this for 4 months and it’s helped me stay on track. Not the prettiest interface but it’s functional. Solid tool for the price.

Rachel Garcia –

I was skeptical about another budgeting tool, but this one actually works. Simple interface, powerful calculations, and I own it forever. No recurring fees like those apps!

Daniel Moore –

For the price of a coffee, I got a tool that’s helping me pay off 28k in debt. The interest tracker alone has saved me thousands by helping me prioritize correctly.

Jessica White –

This tracker made the debt payoff process actually manageable. Breaking it down card by card with clear targets has eliminated my financial anxiety. Already eliminated 3 cards!

Christopher Davis –

Good spreadsheet with essential features. The debt payoff strategies are helpful. Lost one star because customizing payment schedules was confusing at first.

Lisa Anderson –

I love that I can see exactly when each card will be paid off. The timeline visualization keeps me motivated even when progress feels slow. Best financial tool I’ve purchased.

Robert Thompson –

The automated calculations save me hours every month. I just enter my payments and it updates everything. Seeing those balances drop is so satisfying! Highly recommend.

Jennifer Lee –

My spouse and I were stressed about our credit card debt. This tracker helped us create a concrete plan we both understand. We’re making real progress for the first time in years!

David Martinez –

Overall very happy with this purchase. Does everything I need for credit card payoff. Only downside is I wish there were video tutorials, but the included guide works.

Amanda Wilson –

I’ve tried multiple debt tracking apps but this simple spreadsheet beats them all. No subscriptions, full control, and the payoff calculator is incredibly motivating. Down 32k already!

Michael Chen –

The avalanche vs snowball comparison feature helped me choose the best strategy for my situation. Seeing the interest savings projected over time was eye-opening. Worth every cent!

Emily Rodriguez –

I was drowning in credit card debt with no plan. This spreadsheet laid everything out clearly and now I can see the light at the end of the tunnel. Already paid off 4 cards!

James Parker –

This is a solid debt tracking tool. Took me a day to understand all the features, but once I got it, it’s been great. Would give 5 stars if the setup instructions were more detailed.

Sarah Mitchell –

This tracker completely changed how I approach credit card debt. The snowball method visualization makes it so clear which card to focus on. I’ve paid off 18k in just 5 months!