💸 Credit Card Tracker – Google Sheets Template

Protect your credit. Track your progress. Simplify your finances.

Whether you’re paying off debt or building credit from the ground up, this all-in-one tracker is your daily financial ally.

💡Why You Need It:

Managing multiple credit cards can be overwhelming. Late payments, missed bills, rising balances — it adds up fast.

This easy-to-use, beginner-friendly tracker helps you stay organized, pay on time, and improve your credit health — no matter where you are in your financial journey.

✨ Top Features You’ll Love:

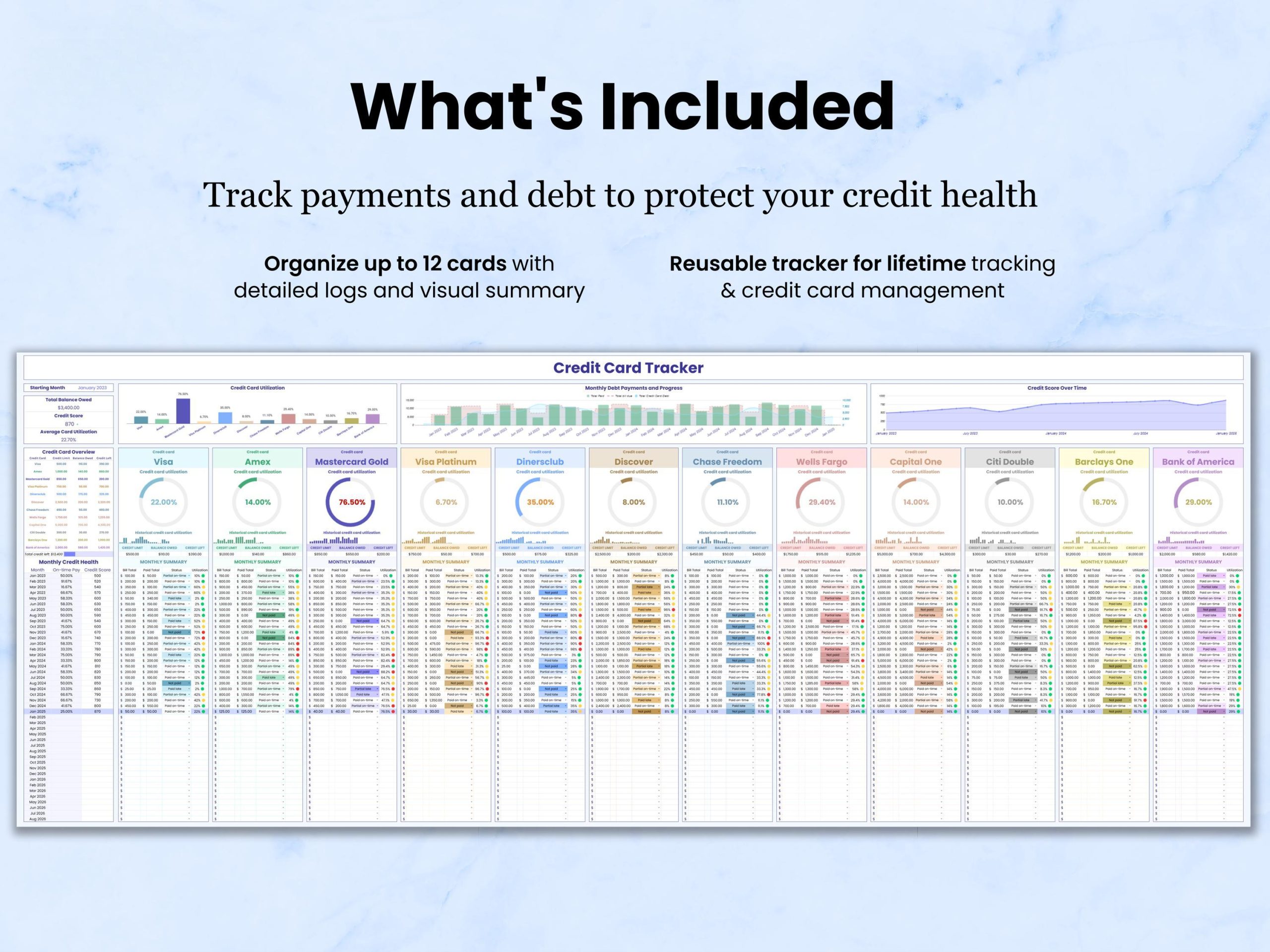

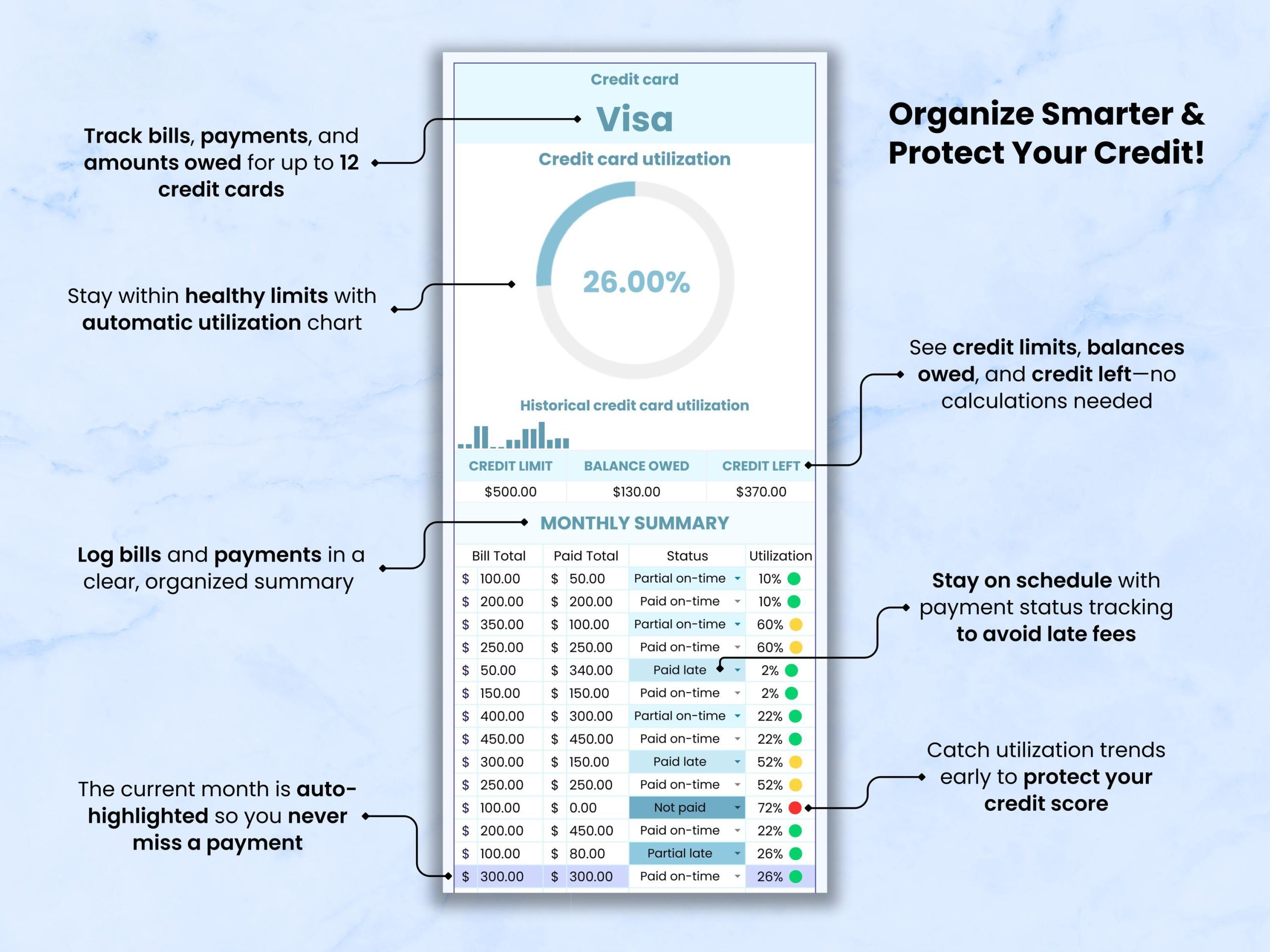

💳 Track Up to 12 Credit Cards

Log bills, due dates, payments, balances, and more — all in one place. No more forgetting what’s due or where you stand.

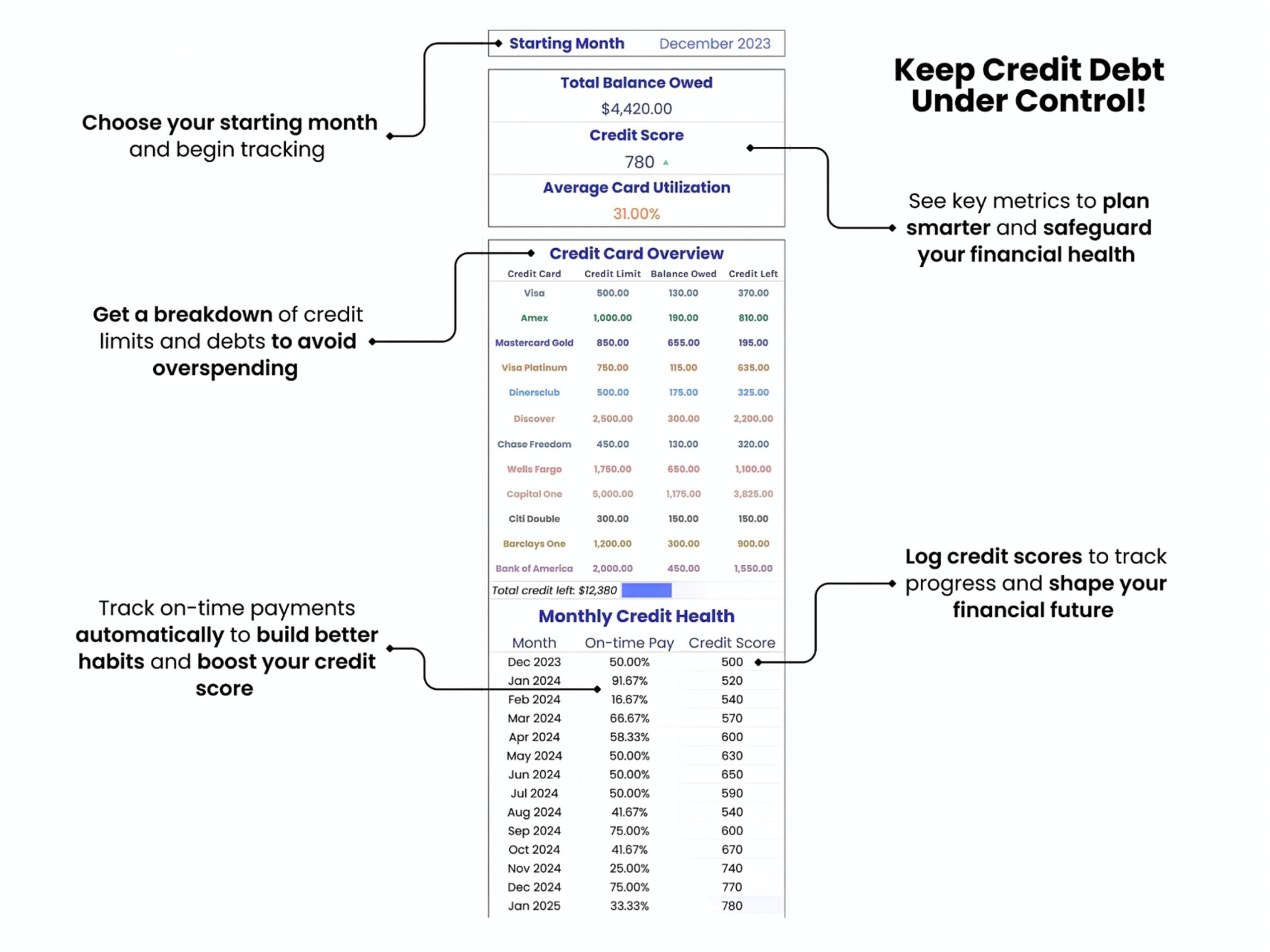

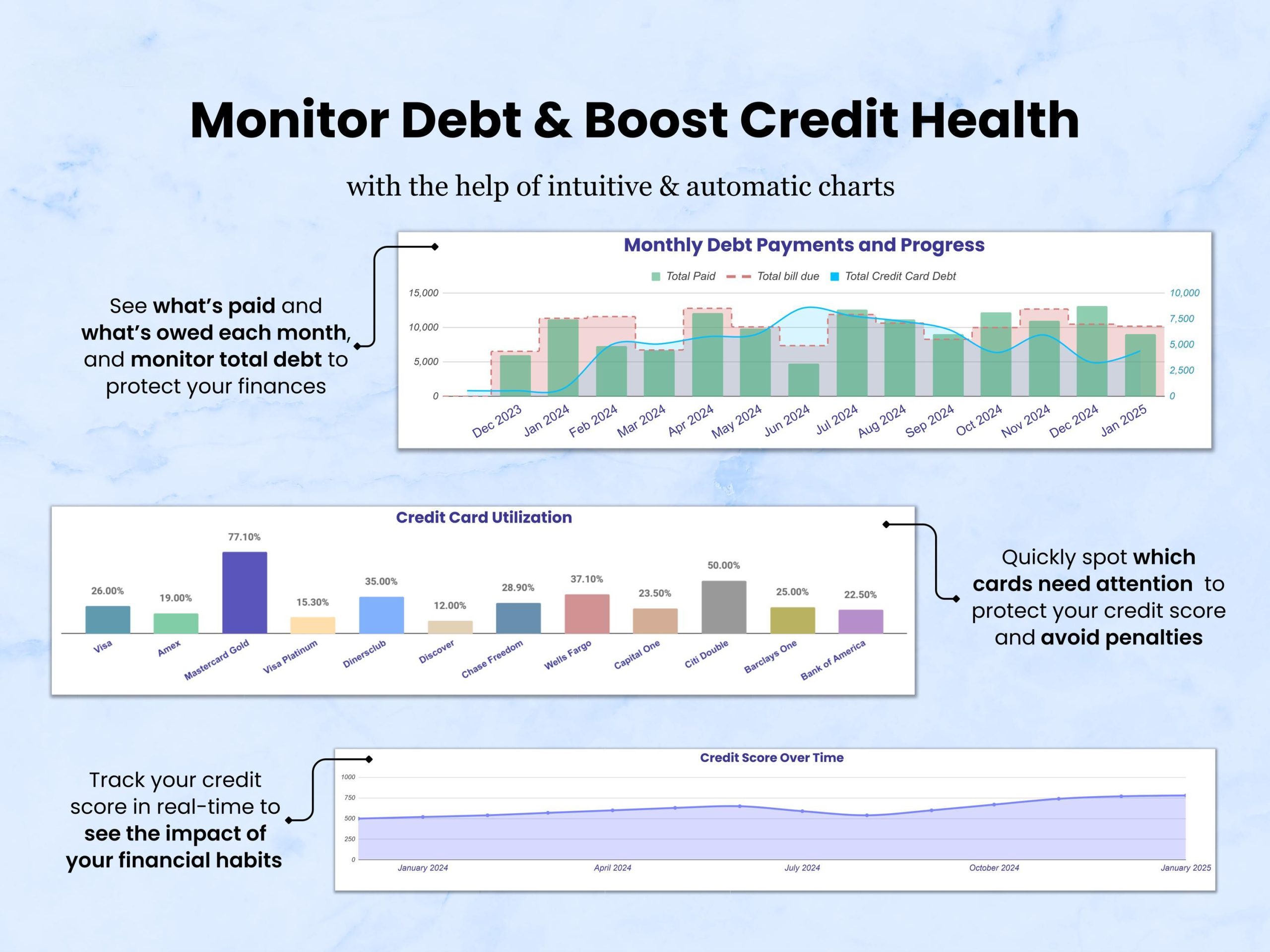

📊 Automatic Credit Utilization Calculations

Visualize how much credit you’re using and keep your usage healthy — a key factor in improving your score!

💱 Supports All Currencies

Perfect for U.S. and international users alike – easily customize the tracker to your preferred currency.

♻️ Reusable, Flexible Format

Start tracking any time of year and reuse it year after year with no expiration.

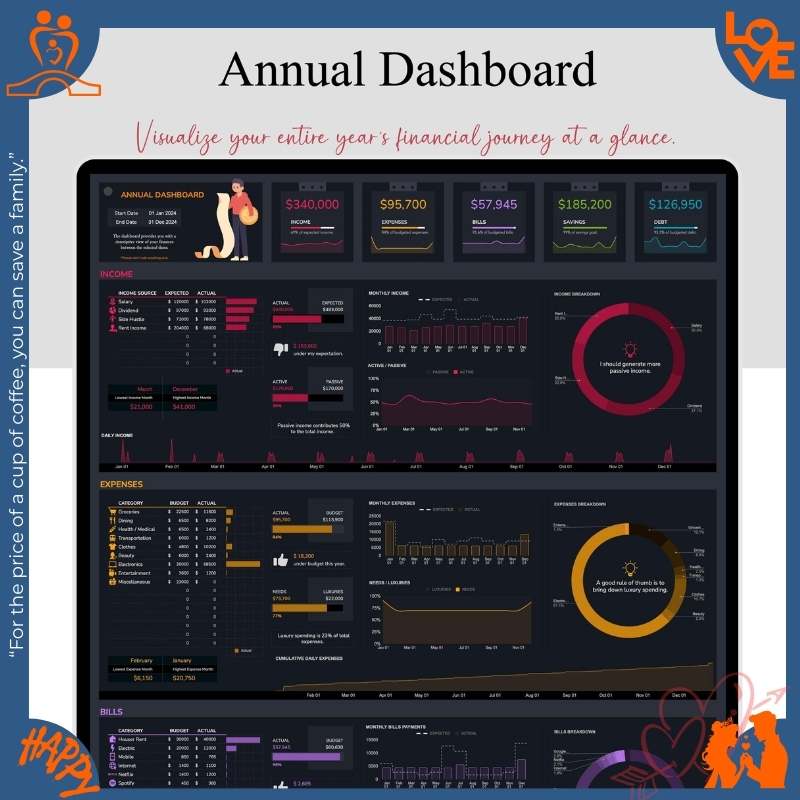

📈 Visual Progress Tools

See your credit score trends, payment patterns, and total balances with beautiful, easy-to-read charts.

🎨 Color-Coded Layout

Quickly spot risks, late payments, or high utilization with intuitive color highlights – no guesswork needed.

✅ Credit Score Habit Builder

Track on-time payments, reduce debt, and build consistency for better financial habits over time.

📦 What You’ll Receive:

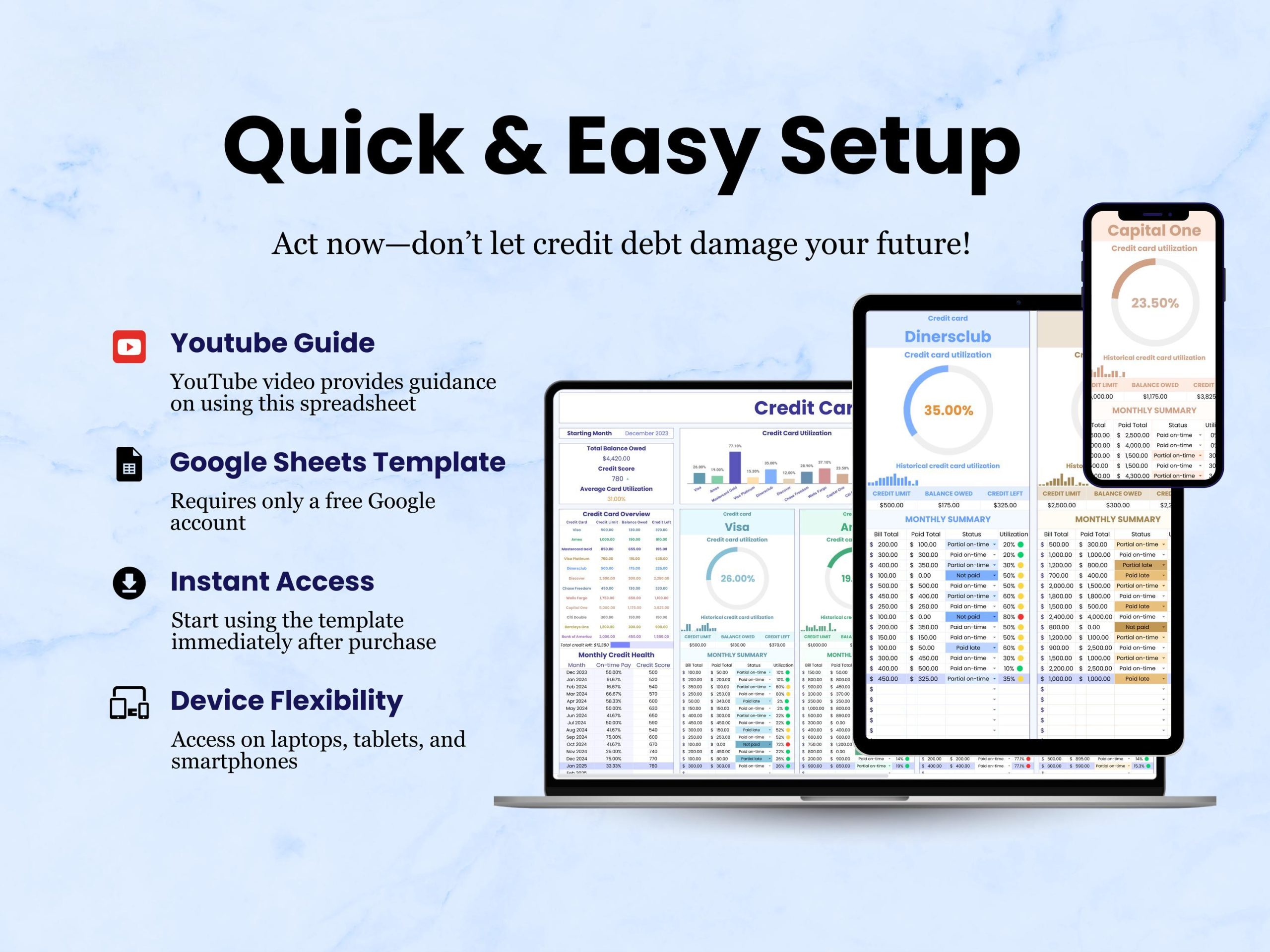

• 📎 1 PDF file – with a direct link to access the Google Sheets template

• 📝 Setup guide included inside the PDF (perfect for beginners!)

✦ Instant Access After Purchase:

You’ll get your PDF download right after checkout, plus a link sent to your email.

Still need help? Check the included FAQ or message us anytime — we’re happy to help.

📌 Important Notes:

• 🧾 Digital product only – no physical item will be shipped

• 💻 Works only with Google Sheets – not compatible with Excel

• 📧 Requires a free Google account – setup instructions included

• 📚 For personal use only – no resale or redistribution

⚠️ Disclaimer:

This is an informational and organizational tool and not financial or legal advice. All decisions based on the tracker are your responsibility. By purchasing, you agree to these terms.

🎁 Ready to take control of your credit health?

This tracker is your first step toward financial clarity and peace of mind.

👉 Grab it now and start building better money habits today.

Dennis Alexander –

I love that I can see exactly when each card will be paid off. The timeline visualization keeps me motivated even when progress feels slow. Best financial tool I’ve purchased.

Ronald Rodriguez –

The avalanche vs snowball comparison feature helped me choose the best strategy for my situation. Seeing the interest savings projected over time was eye-opening. Worth every cent!

Kathy Bryant –

This is a solid debt tracking tool. Took me a day to understand all the features, but once I got it, it’s been great. Would give 5 stars if the setup instructions were more detailed.

Betty Martinez –

I was drowning in credit card debt with no plan. This spreadsheet laid everything out clearly and now I can see the light at the end of the tunnel. Already paid off 5 cards!

Lawrence Gonzales –

The automated calculations save me hours every month. I just enter my payments and it updates everything. Seeing those balances drop is so satisfying! Highly recommend.

Donald Garcia –

Does what it promises. The automation is nice and saves time. Would be perfect if there was a mobile app version, but Google Sheets works fine on my phone.

Janet Foster –

My spouse and I were stressed about our credit card debt. This tracker helped us create a concrete plan we both understand. We’re making real progress for the first time in years!

Margaret White –

This tracker completely changed how I approach credit card debt. The snowball method visualization makes it so clear which card to focus on. I’ve paid off 31k in just 8 months!

Randy Simmons –

Overall very happy with this purchase. Does everything I need for credit card payoff. Only downside is I wish there were video tutorials, but the included guide works.

Edward Thompson –

Paying off credit cards felt impossible until I started using this tracker. The visual progress bars make small wins feel significant. Down from 52k to much less!

Andrea Butler –

I’ve tried multiple debt tracking apps but this simple spreadsheet beats them all. No subscriptions, full control, and the payoff calculator is incredibly motivating. Down 21k already!

Carol Martin –

I love that this works offline and I can customize it. Added my own notes column for motivation quotes. On track to be debt-free by next year! So grateful for this tool.

Keith Washington –

The avalanche vs snowball comparison feature helped me choose the best strategy for my situation. Seeing the interest savings projected over time was eye-opening. Worth every cent!

George Harris –

Good spreadsheet with essential features. The debt payoff strategies are helpful. Lost one star because customizing payment schedules was confusing at first.

Janice Flores –

Does what it promises. The automation is nice and saves time. Would be perfect if there was a mobile app version, but Google Sheets works fine on my phone.

Donna Jackson –

My financial advisor recommended a similar tool for $300. This does everything I need for a fraction of the cost. The debt-free date calculator is my favorite feature!

Terry Hughes –

I was drowning in credit card debt with no plan. This spreadsheet laid everything out clearly and now I can see the light at the end of the tunnel. Already paid off 2 cards!

Kenneth Thomas –

This spreadsheet holds me accountable in a way apps never did. Seeing all my cards in one place and tracking real progress has been transformative. Can’t recommend enough!

Julie Patterson –

This tracker completely changed how I approach credit card debt. The snowball method visualization makes it so clear which card to focus on. I’ve paid off 34k in just 6 months!

Sandra Anderson –

Overall very happy with this purchase. Does everything I need for credit card payoff. Only downside is I wish there were video tutorials, but the included guide works.

Roger Long –

I’ve been using this for 5 months and it’s helped me stay on track. Not the prettiest interface but it’s functional. Solid tool for the price.

Mark Wilson –

After 9 months of using this, I’ve made more progress than the previous 2 years combined. The snowball method visualization is genius and keeps me motivated daily.

Diana Powell –

Paying off credit cards felt impossible until I started using this tracker. The visual progress bars make small wins feel significant. Down from 43k to much less!

Lisa Rodriguez –

I was skeptical about another budgeting tool, but this one actually works. Simple interface, powerful calculations, and I own it forever. No recurring fees like those apps!

Samuel Perry –

I love that this works offline and I can customize it. Added my own notes column for motivation quotes. On track to be debt-free by 2026! So grateful for this tool.

Paul Martinez –

This is a decent spreadsheet for credit card tracking. The features are there, but the interface could be more intuitive. If you’re comfortable with Excel, you’ll be fine.

Joyce Jenkins –

This is a decent spreadsheet for credit card tracking. The features are there, but the interface could be more intuitive. If you’re comfortable with Excel, you’ll be fine.

Nancy Garcia –

For the price of a coffee, I got a tool that’s helping me pay off 41k in debt. The interest tracker alone has saved me thousands by helping me prioritize correctly.

Christopher Thompson –

This tracker made the debt payoff process actually manageable. Breaking it down card by card with clear targets has eliminated my financial anxiety. Already eliminated 4 cards!

Jennifer Martin –

I love that I can see exactly when each card will be paid off. The timeline visualization keeps me motivated even when progress feels slow. Best financial tool I’ve purchased.