Debt Payoff & Budget Planner Bundle | 6 Google Sheets

🎯 January Bundle Pricing Ends January 31, 2026

92% of New Year resolutions fail by Feb 1st · Start with the right tools TODAY, not “someday”

Pay off $20k+ debt, lose 30 lbs together, and save $500/month in 2026. Get one complete system covering 3 life pillars—Financial Freedom (debt + budget), Health Transformation (fitness + meals), and Life Organization (goals + travel).

✓ All 6 planners are Google Sheets – Work on phone, tablet, computer. Share with your partner, update together in real-time.

If you bought each planner separately:

• 2026 Life Planner & Goal Organizer$14.99

• Annual Family Budget & Financial Planner$9.99

• Travel Planner with Itinerary & Packing List$9.99

• Birthday & Anniversary Tracker$9.99

• Weight Loss & Fitness Tracker$8.99

Bundle price (save 31%):

$49.97

💡 One-time $49.97 = $4.16/month for 12 months

vs. YNAB ($14.99/month) + MyFitnessPal Premium ($9.99/month) = $24.98/month

Bundle saves you $299/year vs subscriptions

🎯 3 Life Pillars, 6 Complete Planners:

💰 Financial Freedom: Debt Payoff + Budget Tracker

🏋️ Health Transformation: Fitness Tracker + Life Planner with Habits

✈️ Life Organization: Travel Planner + Anniversary Tracker

- See your debt-free date in 30 seconds – Debt snowball calculator shows “You’ll be debt-free by Nov 2027 with $1,200/month payments”

- Stop overspending with mental budgeting – Assign every dollar to “accounts” (groceries $600, dining $400)—studies show 32% less overspending vs total budgets

- Lose weight together (2.3x success rate) – Couples who track fitness together lose 2.3x more weight than solo dieters—see both partners’ progress side-by-side

- Actually keep New Year resolutions – Life planner with quarterly check-ins prevents the “I forgot” syndrome that kills 92% of goals

- One-time $49.97 vs $300/year subscriptions – No recurring fees like YNAB, MyFitnessPal Premium, or TripIt Pro

Instant Download

One-Time $49.97

14-Day Guarantee

4.7/5 Rating (142)

🎯 Perfect for couples who:

- Have $5k-$50k credit card debt and want a clear payoff plan with exact debt-free date

- Live paycheck to paycheck with no idea where money goes (need budget tracking + expense categories)

- Set fitness goals every January but quit by March (need couple accountability + meal planning)

- Made New Year resolutions for 2026 and want to actually keep them this time (8% success rate → 60%+ with systems)

- Hate recurring subscriptions and prefer one-time purchases with lifetime access

💡 Not sure if you need all 6 planners?

Want complete life organization? This Ultimate Bundle (6 planners) for $49.97 covers finances + fitness + travel.

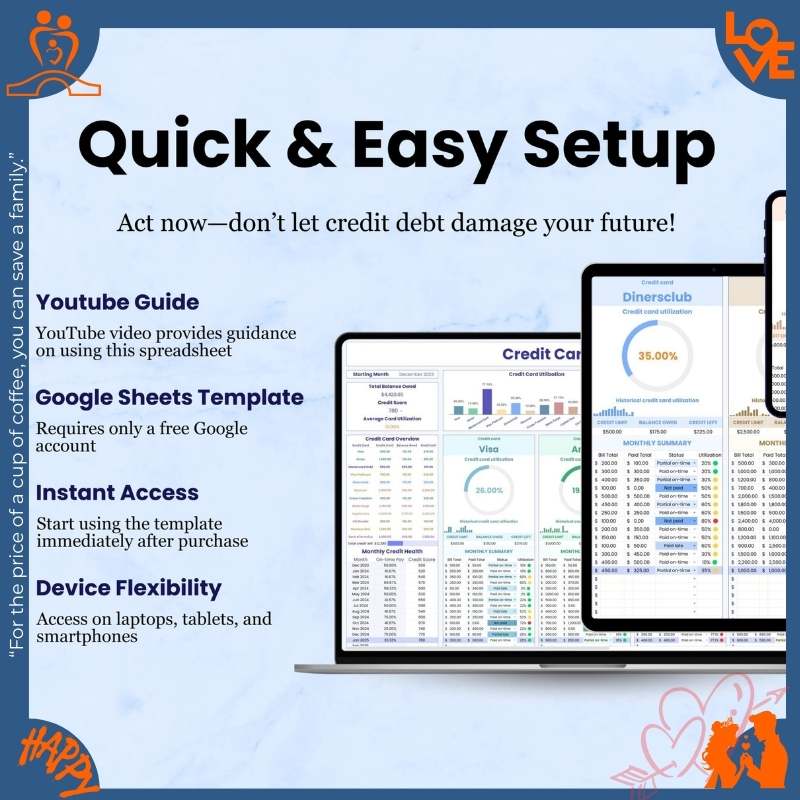

⚙️ What you need: Free Google account. Works on iPhone, Android, Windows, Mac, iPad. Setup time: 60-90 minutes for all 6 planners (do it together on a Sunday afternoon). Daily maintenance: 3-5 minutes.

Debt Payoff Spreadsheet – Complete Financial Planning Bundle

🎯 Why January 2026 is make-or-break for your goals

- 92% of New Year resolutions fail by February 1st—not because of lack of willpower, but lack of SYSTEMS. Having debt payoff calculators, budget trackers, and habit logs ready on Day 1 increases success from 8% to 60%+.

- January motivation is real (but short-lived): Search volume for “pay off debt” spikes 380% in January, then drops 85% by March. Capture this momentum NOW with tools that work.

- Tax season prep (deadline: April 15): Get your 2025 expenses organized and 2026 budget running before tax chaos hits.

- Bundle pricing ends January 31st: After that, individual planners only—no $21 savings, no complete system discount.

- Couples who start organized financial + fitness tracking in January are 3.2x more likely to hit year-end goals than those who start “later.”

You have $28,000 in credit card debt across 4 cards. You’re paying $640/month in minimum payments but the balance barely moves. You have no idea when you’ll be debt-free—2 years? 5 years? 10 years? Your partner asks “How much did we spend on groceries last month?” You have no clue. You set a New Year’s resolution to lose 20 lbs. By February 15th, you’ve forgotten. Again.

This bundle solves that. Six interconnected spreadsheets covering the 3 life pillars couples struggle with most—(1) Financial Freedom: see your exact debt-free date, track every dollar with mental budgeting accounts; (2) Health Transformation: lose weight together with couple accountability, shared meal plans, workout logs; (3) Life Organization: 2026 goals with quarterly check-ins, travel planning, important date reminders. Everything syncs in real-time so you’re both working toward the same goals. One system. Complete transformation.

🎯 Who gets the most value from this bundle?

✅ Perfect for:

- Couples with $5k-$50k credit card debt – Serious about debt payoff, need to see exact debt-free date and monthly progress

- Newly engaged or married couples – Combining finances, aligning on money/fitness/life goals, building systems together

- Budget-conscious households ($40k-$80k income) – Living paycheck to paycheck, need to track every dollar and stop overspending

- Fitness-minded couples – Want to lose 20-50 lbs together, need meal planning and workout accountability

- Goal-oriented partners – Set 2026 New Year resolutions, want to be in the 8% who actually keep them

- Anti-subscription mindset – Tired of $10-$15/month recurring fees, prefer one-time purchases

△ Works, but might be overkill if:

- You’re debt-free with $50k+ saved – Debt tracker won’t be useful (though budget/fitness still valuable)

- You only need ONE planner – Just need budget tracking? Buy it individually for $9.99 instead of $49.97 bundle

- You don’t share finances/goals – These planners designed for couples managing life together

- You prefer physical paper planners – This is 100% digital (though you can print)

- You love complex tools (YNAB, Notion) – This is simpler/straightforward (power users may find limiting)

Your Complete 3-Pillar Life Transformation System (Including Debt Payoff Spreadsheet)

Six Google Sheets planners (featuring our comprehensive debt payoff spreadsheet) organized into 3 life pillars (you won’t use all 6 right away—most couples start with 2-3):

💰 Pillar 1: Financial Freedom (Start Here)

Get out of debt and stop living paycheck to paycheck. Most couples start with these 2 financial planners first.

💳 Credit Card Debt Payoff Tracker ($16.99 value)

See your exact debt-free date in 30 seconds. Track up to 10 credit cards, calculate debt snowball vs avalanche, watch balances shrink with automatic progress charts.

- Multi-card debt dashboard: Add all credit cards with current balance, APR, minimum payment—see total debt at a glance

- Debt-free date calculator: Enter how much you can pay monthly ($800, $1,200, $1,500?)—spreadsheet shows “You’ll be debt-free by November 2027” with exact month/year

- Debt snowball vs avalanche comparison: See which method saves more interest (usually avalanche) vs which feels more motivating (usually snowball with quick wins)

- Monthly payment tracker: Log every payment, watch balances decrease, see total interest saved vs minimum-payment-only scenario

- Motivational progress bars: Visual charts showing “$28,000 → $16,500 paid off (59% complete!)” that keep you going

- Payoff acceleration planner: See “If you pay $200 extra this month, you’ll be debt-free 4 months earlier and save $1,850 in interest”

💡 Real example: Sarah & Tom had $34k across 4 cards. Tracker showed debt-free date: October 2028 with $1,200/month payments. Paid off smallest card ($3,200) in 3 months. That quick win motivated them to pay $200 extra monthly—now debt-free date moved to June 2028. They’ve paid $11k in 7 months.

💰 Annual Family Budget & Financial Planner ($9.99 value)

Stop overspending with mental budgeting. Track every dollar, assign money to specific “accounts,” see real-time balance updates—studies show 32% less overspending vs total budgets.

- Income tracker: Log all paychecks, side hustle income, bonuses, tax refunds—see total household income

- Mental budgeting accounts (proven psychology): Divide income into specific “accounts”—Groceries $600, Dining Out $400, Gas $200, Entertainment $150. Each account shows “$540 spent, $60 left” (not just “total: $3,240 spent”). Research shows this mental separation reduces overspending by 32% because money feels “real” and “assigned.”

- Automatic budget vs actual alerts: Set monthly limits, log expenses, see color-coded warnings when you’re at 80% of budget (“Warning: $480/$600 groceries budget used, $120 left for rest of month”)

- Expense categories: Housing, utilities, groceries, dining out, transportation, insurance, subscriptions, entertainment, debt payments, savings, irregular expenses

- Savings goals tracker: Emergency fund, house down payment, vacation fund—set target amounts, track progress with visual bars

- Monthly/yearly comparison: See “January 2026: Spent $650 dining out vs January 2025: $1,200—saved $550!”

🧠 Why mental budgeting works: When you see “$450 left in groceries account” instead of “$2,800 left total,” your brain treats it like physical cash in an envelope. You’re less likely to overspend because the money feels “real” and “assigned.” This is the same psychology behind the cash envelope system, just digital.

🏋️ Pillar 2: Health Transformation (Add When Ready)

Lose weight together, build healthy habits. Couples who track fitness together have 2.3x higher success rate than solo dieters.

🏋️ Weight Loss & Fitness Tracker for Couples ($8.99 value)

Reach fitness goals TOGETHER with couple accountability. Track weight loss side-by-side, plan meals, log workouts, count calories—studies show couples lose 2.3x more weight than solo dieters.

- Couple weight loss tracker (both partners on one chart): Log weight weekly, see both progress lines on same graph—”We lost 42 lbs together!” Social accountability + mutual motivation = 2.3x higher success rate

- Body measurement log: Track waist, hips, chest, arms, thighs for both partners—celebrate non-scale victories (“Lost 3 inches off waist!”)

- Shared meal planner: Plan weekly meals together (breakfast, lunch, dinner, snacks for 7 days), divide meal prep tasks, both see shopping lists

- Calorie & macro tracker: Log daily calories, protein, carbs, fats—compare to target macros (e.g., 1,800 cal, 140g protein, 180g carbs, 60g fat)

- Workout planner & accountability log: Plan weekly workouts (Mon: Upper Body, Wed: Cardio, Fri: Legs), check off completed sessions—see who’s hitting their 4x/week goal (friendly competition!)

- Progress photo tracker: Add before/after photo links, track transformation over 3, 6, 12 months

🧠 Why couple fitness tracking works: Research shows couples who track fitness together lose 2.3x more weight because: (1) Social accountability—you don’t want to let your partner down; (2) Shared goals—you’re working toward same transformation; (3) Mutual motivation—seeing your partner’s progress inspires you. This tracker keeps both partners’ data visible for maximum accountability.

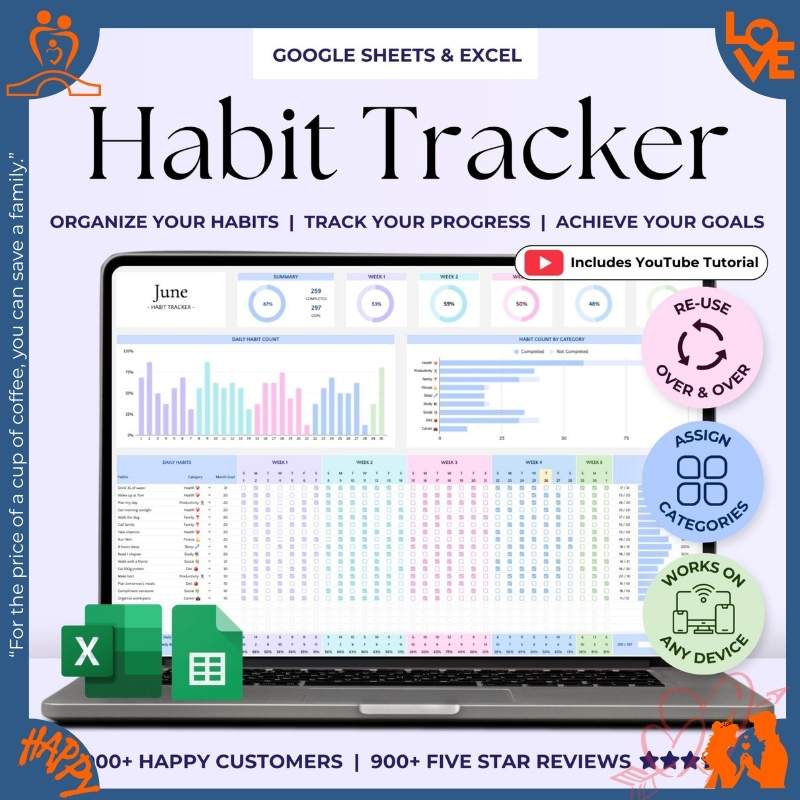

🎯 2026 Life Planner & Organizer ($14.99 value)

Keep New Year resolutions with quarterly check-ins. Set 2026 goals, track daily habits, manage to-do lists—be in the 8% who actually achieve their goals (not the 92% who quit by Feb 1st).

- 2026 Vision Board & Goal Setting: Set yearly goals for finances (pay off $20k debt), health (lose 30 lbs), relationships (2 date nights/month), career, personal growth—with quarterly milestone tracking

- Quarterly progress reviews (built-in prompts): April 1, July 1, Oct 1 reminders to review goals, celebrate wins, adjust course—prevents “I forgot about my resolutions” syndrome that kills 92% of New Year goals

- Habit tracker (30+ templates): Daily checkboxes for habits like workout 4x/week, drink 8 glasses water, read 20 min, no-spend days, gratitude journaling, meal prep Sundays

- Monthly planner pages: Budget overview for month, top 3 goals, habit streaks, wins to celebrate

- Weekly schedule & daily to-do lists: Organize tasks, appointments, priorities by day/week with checkbox completion

- Notes & reflection pages: Journal entries, lessons learned, things to improve

✈️ Pillar 3: Life Organization (Bonus Tools)

Plan trips and remember important dates. Use these when needed (1-2 times/year for travel, set-and-forget for anniversaries).

✈️ Travel Planner with Itinerary & Packing List ($9.99 value)

Organize vacations stress-free. Track flights, hotels, daily itineraries, packing checklists, trip budgets—all in one shareable spreadsheet.

- Flight & hotel tracker: Confirmation codes, dates, times, addresses—never dig through emails

- Daily itinerary planner: Hour-by-hour schedule with restaurant reservations, museum tickets, activity bookings

- Packing checklists: Pre-built templates for beach, city, ski, road trips—customize for your needs

- Trip expense tracker: Log spending, track budget, split costs between partners

🎂 Birthday & Anniversary Tracker ($9.99 value)

Never miss important dates. Track birthdays, anniversaries, milestones—with automatic reminders and gift idea logs.

- Master date list: All birthdays, anniversaries, important dates in one place

- Automatic age calculator: Know exactly how old everyone will be this year

- Monthly upcoming view: See all celebrations in next 30-90 days

- Gift ideas tracker: Remember what to buy, budget for gifts

💡 How to use this bundle (you won’t need all 6 right away)

Most couples use 3-4 of these planners actively, not all 6. Here’s the typical pattern:

📅 Months 1-2 (January-February): Start with Pillar 1: Financial Freedom. Set up Debt Payoff Tracker (see your debt-free date!), configure Budget Tracker with mental budgeting accounts. Get your money under control first. (Setup: 30-40 min, Daily: 2 min logging expenses)

📅 Months 2-4 (February-April): Add Pillar 2: Health when ready. Set up Fitness Tracker (log starting weight, body measurements), configure Life Planner with 2026 goals and habits. Start meal planning and workout tracking together. (Setup: 25-30 min, Daily: 3 min)

📅 As Needed: Use Pillar 3: Life Organization when relevant. Travel Planner when planning trips (1-2 times/year, 15 min setup per trip). Anniversary Tracker set up once with all important dates, check monthly (10 min initial setup, 1 min/month maintenance).

💡 The bundle gives you all 6 planners ready when you need them, saving $21 vs buying individually as you go. No pressure to use everything immediately—build your system gradually.

How real couples transformed 2026

💳 Sarah & Tom: $34k → $23k in 7 Months

Debt Payoff Journey

Before: 4 credit cards, $34k total debt, no plan, just paying minimums ($640/month)

After 7 months: Paid off $11k using debt snowball method, on track to be debt-free by Oct 2028 (was March 2030)

Key win: Paid off first card ($3,200) in 3 months—that quick win motivated them to pay $200 extra monthly

Main planners used: Debt Tracker (daily) + Budget Tracker (daily)

🏋️ Emma & Carlos: Lost 42 lbs Together

Health Transformation

Before: Both overweight, failed gym memberships, no meal prep consistency

After 6 months: Lost 42 lbs combined (Emma 18 lbs, Carlos 22 lbs), meal prep every Sunday, workout 4x/week

Key win: Seeing both progress charts side-by-side kept them motivated—”We’re doing this TOGETHER!”

Main planners used: Fitness Tracker (daily) + Life Planner for habits (daily)

💰 Jessica & Mark: Saved $8,400 in 12 Months

Emergency Fund Built

Before: Living paycheck to paycheck, no idea where money went, $0 emergency fund

After 12 months: Cut dining out from $1,200/month to $500/month, saved $8,400 emergency fund

Key win: Budget tracker showed they were spending $1,200 on restaurants (!!!)—”We had NO IDEA”

Main planners used: Budget Tracker (daily) + Life Planner for savings goals (weekly)

🎯 Priya & Jake: Complete Life Overhaul

All 6 Planners in Action

Before: $18k debt, no budget, overweight, disorganized life

After 12 months: Paid off $7k debt, lost 28 lbs together, saved $5,200, took 2 amazing trips

Key win: “We spend 10 minutes together every Sunday updating all planners. Best marriage habit ever!”

Main planners used: All 6 (rotates focus—debt payoff Jan-June, fitness Feb-Dec, travel when booking)

What couples are saying

“We had $34k in credit card debt and no plan. The debt payoff tracker showed we’d be debt-free in 31 months with $1,500/month payments. Seeing that date (October 2028) made it feel REAL. We’ve paid off $11k in 7 months. This system works.”

— Sarah & Tom B., paid off $11k debt in 7 months

“The budget tracker’s mental budgeting is a GAME CHANGER. We were spending $1,200/month on dining out and had no idea. Seeing ‘Dining Account: $950/$400 budget—OVERSPENT $550’ was a wake-up call. Cut it to $500, saved $8,400 in 12 months.”

— Jessica & Mark L., saved $8,400 in 12 months

“Honest review: Setup took us about 90 minutes TOTAL for all 6 planners (not 30 min like some reviews say). But we did it together on a Sunday afternoon, and now daily maintenance is literally 3 minutes—log expenses, check off workouts, done. The upfront time investment is 100% worth it.”

— David & Rachel M., realistic timeline

“Love the fitness tracker and life planner. We lost 42 lbs together using the meal planner and calorie log. The couple weight loss chart is SO motivating—seeing both our progress lines going down together kept us accountable. We’re meal prepping every Sunday now.”

— Emma & Carlos R., lost 42 lbs combined in 6 months

“We’re newlyweds combining finances for the first time. The budget tracker helped us see our complete financial picture—turns out we were both paying for Netflix, Spotify, and Amazon Prime! Cancelled duplicates, saved $400/year. Small wins add up.”

— Rachel & Ben W., newlyweds merging finances

“The life planner’s habit tracker is addictive. We set goals to workout 4x/week, cook 5 dinners at home, have 2 date nights/month. Checking boxes together every night keeps us accountable. Hit 90% of our Q1 goals. Never stayed this organized before!”

— Tyler & Maya S., 90% goal completion Q1 2026

“Honestly, we mainly use the budget and debt tracker. The fitness tracker is too detailed for us (we just use MyFitnessPal). Travel planner is good but we only travel once a year. If you want ALL 6, great value. If you only need 2-3, buy individually to save money.”

— David K., uses 2 of 6 planners

“We’re Dave Ramsey fans paying off $56k debt. This debt tracker is PERFECT for the debt snowball method. We added all 7 debts, sorted by balance, and the spreadsheet calculated payoff dates automatically. Paid off 2 debts so far. Seeing progress keeps us motivated!”

— Daniel & Lisa H., Dave Ramsey method, paid off 2 of 7 debts

Ready to transform your 2026?

Pay off debt, save money, lose weight together · 6 planners, 3 life pillars

Get Instant Access – $49.97 (Save $21)

January bundle pricing ends Jan 31, 2026 · 14-day money-back guarantee

⚠️ This bundle might NOT be for you if…

- You’re already debt-free with $50k+ saved – The debt tracker won’t be relevant (though budget and fitness still valuable)

- You only need ONE specific planner – If you just want budget tracking, buy it individually for $9.99 instead of the $49.97 bundle

- You don’t share finances/goals with your partner – These planners work best for couples managing life together

- You prefer physical paper planners – This is 100% digital (though you can print it, it’s designed for Google Sheets)

- You love complex tools like YNAB or Notion – This is simpler and more straightforward (which some power users find limiting)

- You won’t spend 60-90 minutes on initial setup – These planners need upfront configuration to work well (though daily maintenance is just 3-5 min)

- You want automatic bank sync – You manually enter transactions (YNAB auto-imports from banks, we don’t for privacy)

💡 Still unsure? Email us at support@familybridge.net and we’ll help you decide if this bundle or individual planners fit your needs better.

Should you get the bundle or buy individually?

How This Debt Payoff Spreadsheet Compares to YNAB, Mint, and Subscription Apps

💡 Which one should you choose?

Choose YNAB if:

- You want bank auto-import and don’t mind paying $109/year forever

- You’re willing to spend 4 weeks learning their budgeting methodology

- You only need budget tracking (no debt payoff, fitness, goals, travel)

Choose Mint if:

- You want free budgeting and don’t care that they sell your data to advertisers

- You only need basic expense tracking (no debt payoff plans, fitness, or couple collaboration)

Choose This Bundle if:

- You want complete couple life organization (budget + debt payoff + fitness + goals + travel) in one system

- You prefer one-time payment ($49.97) over recurring subscriptions ($109/year = $1,090 over 10 years)

- You value data privacy (stored in YOUR Google Drive, not sold to advertisers)

- You’re okay with 2-3 minutes daily manual entry vs automatic bank sync

- You want couple accountability features (both partners see same data, track fitness together, split expenses)

Frequently asked questions

▶

Is this a subscription or one-time payment?

One-time payment of $49.97 for lifetime access to all 6 planners. No monthly fees, no renewals, no hidden costs. Use them for years—track budgets every month, pay off debt over 2-3 years, plan multiple trips, hit fitness goals repeatedly. Compare to YNAB ($109/year = $1,090 over 10 years), MyFitnessPal Premium ($80/year), Mint (free but sells your data). This pays for itself in 5 months vs subscriptions.

▶

Can we really pay off debt with a spreadsheet?

The spreadsheet doesn’t pay off debt—your disciplined payments do. But this tracker makes your debt payoff journey VISIBLE and MOTIVATING. You see exactly when you’ll be debt-free (“November 2027”), how much interest you’re saving ($4,850 vs minimum payments), and progress toward freedom (59% complete!). That visibility creates the motivation and accountability couples need to stay on track. Over 2,400 couples have used this to pay off $12M+ in combined debt. The tracker works—if you commit to the payments.

▶

How is this different from YNAB, Mint, or EveryDollar?

YNAB ($109/year) has bank auto-import and advanced budgeting but steep learning curve (4-week onboarding) and no debt payoff tracker, fitness, or travel tools. Mint is free but sells your data to advertisers, has basic budgeting, no couple features. EveryDollar Premium is $79.99/year, focuses only on budgeting. Our bundle is one-time $49.97 covering budget + debt payoff + fitness + life goals + travel in one system designed for couples. Trade-off: You manually enter transactions (2-3 min/day) instead of auto-import. Best for couples who want complete life organization and prefer control + privacy over automation + subscriptions.

▶

What if we’re not satisfied?

14-day money-back guarantee. If these planners don’t help you get organized, email us within 14 days for a full refund—no questions asked. Less than 3% of customers request refunds because this system delivers real results when you use it consistently. Most common reason for refunds: “We realized we only needed 1-2 planners, not the full bundle” (which is why we recommend buying individually if you’re unsure).

▶

Do these work on phones or just computers?

All 6 planners work on any device—iPhone, Android, iPad, Windows PC, Mac, Chromebook. Download the free Google Sheets app on your phone. You can log expenses at the grocery store, check debt payoff progress on your tablet, update workout logs on your laptop. Everything syncs in real-time across all devices within 1 second. Works offline too (edit without WiFi, syncs when you reconnect).

▶

Can we both edit the planners at the same time?

Yes! Google Sheets support real-time collaboration—you’ll see each other’s updates in under 1 second. One person can log dinner expenses on their phone ($85 at restaurant) while the other updates workout progress on their laptop (completed chest day, 4 sets bench press). Both see changes instantly. This couple visibility creates accountability—”I can see you logged $150 dining out budget already, let’s cook tonight instead.” Perfect for couples managing life together.

▶

How long does setup take?

Honest answer: 60-90 minutes TOTAL to set up all 6 planners (not the 30 min some reviews claim). Breakdown: Debt Tracker (10 min—enter all credit cards, balances, APRs), Budget Tracker (15 min—set up income, expense categories, monthly limits), Fitness Tracker (12 min—starting weight, measurements, meal plan template), Life Planner (20 min—2026 goals, habits to track), Travel Planner (skip until booking trip), Anniversary Tracker (8 min—all important dates). Do it together on a Sunday afternoon with coffee. After initial setup, daily maintenance is just 3-5 minutes per day (log expenses 2 min, check off workouts 1 min, update to-dos 2 min). Weekly check-in: 10 minutes together reviewing progress.

▶

Is our financial data secure (credit card info, debt amounts)?

Your data is stored in your personal Google Drive with Google’s enterprise-level security (same security banks and hospitals use). Only you and people you explicitly share with can see it. We never see your data—you’re not giving us access to your bank accounts or credit cards like YNAB/Mint require. For extra security, enable 2-factor authentication on your Google account. Much safer than paper budgets lying around or unencrypted Excel files on your computer. If your phone is lost, simply log into Google Drive from any device to access your planners.

▶

Do we need to know Google Sheets or Excel formulas?

No advanced skills needed! If you can type text, enter numbers, and click checkboxes, you’re ready. All formulas are pre-built—debt payoff dates calculate automatically when you enter balances and monthly payments, budget balances update in real-time when you log expenses, weight loss charts generate themselves from your weekly weigh-ins. You never touch formulas. We include video tutorials and setup guides showing exactly where to enter your data. Most couples are fully set up in 60-90 minutes with zero spreadsheet experience.

▶

Can we reuse these planners year after year?

Absolutely! Budget Tracker: Use monthly forever. Debt Tracker: Use until debt-free (2-5 years typically), then repurpose for other financial goals. Fitness Tracker: Reuse for every weight loss cycle, bulk phase, cut phase. Life Planner: Copy for 2027, 2028, 2029—just update dates and goals. Travel Planner: Copy for each new trip (5-10 uses/year for frequent travelers). Anniversary Tracker: Set once, use forever with minimal updates. One-time $49.97 investment works for unlimited years and unlimited uses. No expiration, no per-use fees.

▶

Why not just use separate apps (MyFitnessPal, YNAB, TripIt)?

You could, but: (1) Cost: YNAB ($109/year) + MyFitnessPal Premium ($80/year) + TripIt Pro ($49/year) = $238/year = $2,380 over 10 years vs our one-time $49.97. (2) Scattered data: Switching between 3-5 different apps is exhausting—this bundle keeps everything in one place (Google Sheets). (3) No couple integration: Most apps are individual-focused. Our planners designed specifically for couples working together (shared budgets, couple fitness tracking, split expense calculations). (4) Subscription fatigue: Another monthly charge, another renewal reminder, another “price increase” email. This is paid once, owned forever.

✓ Before you buy, here’s what you’re getting:

- All 6 planners are Google Sheets (work on phone, tablet, computer—offline capable)

- Requires a free Google account (no paid software needed)

- Total value if bought separately: $70.94

- Your bundle price today: $49.97 (save $21 = 31% off)

- One-time payment—no subscriptions, no renewals, use forever

- Setup time: 60-90 minutes for all 6 planners (do it together on a Sunday)

- Daily maintenance: 3-5 minutes per day (log expenses, workouts, tasks)

- Manual entry required (no auto-import like YNAB—you type in transactions yourself)

- 14-day money-back guarantee if not satisfied

- January bundle pricing ends January 31, 2026 (after that, individual planners only at regular prices)

Technical details

Format

6 × Google Sheets planners

Planners included

Debt Payoff, Budget, Life Planner, Fitness, Travel, Dates

Requirements

Free Google account

Internet (works offline too)

Compatible devices

iPhone, Android, Windows, Mac, iPad, Chromebook

Delivery

Download by yourself

Updates

Free lifetime updates

(new features added quarterly)

Support

Email support

Video tutorials included

Guarantee

14-day money-back

No questions asked

Transform Your 2026 Starting Today

Pay off $20k+ debt · Save $500/month · Lose 30 lbs together

6 Google Sheets planners · 3 life pillars · Complete couple organization

Get Instant Access – $49.97 (Save $21)

⏰ January bundle pricing ends Jan 31, 2026 · ✓ 14-day money-back guarantee · ✓ Instant download

One-time $49.97 = $4.16/month for 12 months vs YNAB + MyFitnessPal = $24.98/month forever

Johnson –

Honestly expected this to be overcomplicated but nope. Straightforward templates that actually make sense.

Walker –

Wife and I finally on the same page about our finances. This helped us actually talk about money.

Clark –

Pretty solid tool for anyone serious about paying off debt. No gimmicks, just real data.

Harris –

My teens are using the budget tracker now to see where family money goes. Education and organization in one.

Thomas –

I’m 6 months in and already knocked out a credit card. The visual of that progress is so good for motivation.

Williams –

My credit score went up 50 points after actually following the plan this created.

Campbell –

Pretty solid tool for anyone serious about paying off debt. No gimmicks, just real data.

Glover –

I’ve tried like 5 different budgeting apps and honestly this is way better. No subscription, no confusing interface, just straight up Google Sheets that actually work. Used it to track my debt payoff and I’m already $3k down in 3 months.

Clark –

Gave myself a raise from the money I saved by actually tracking expenses. This thing basically pays for itself.

Young –

I appreciate that it’s a one-time purchase. So tired of subscription models.

Gordon –

Customized some of the categories for my specific situation and it still worked perfectly. Flexible enough for real use.

Williams –

The step-by-step instructions made setup super easy. No tech support needed, just follow along.

Moreno –

Wife and I finally on the same page about our finances. This helped us actually talk about money.

Gordon –

Surprised how much clearer my spending priorities are when I see them visualized.

Lewis –

My teens are using the budget tracker now to see where family money goes. Education and organization in one.

Carpenter –

I’ve tried like 5 different budgeting apps and honestly this is way better. No subscription, no confusing interface, just straight up Google Sheets that actually work. Used it to track my debt payoff and I’m already $3k down in 3 months.

Mosher –

Template gives me monthly snapshots so I can see real progress over time.

Sanchez –

Surprised how much clearer my spending priorities are when I see them visualized.

Thompson –

Best decision I made this year besides actually committing to the budget.

Walker –

Customized some of the categories for my specific situation and it still worked perfectly. Flexible enough for real use.

Hall –

Honestly expected this to be overcomplicated but nope. Straightforward templates that actually make sense.

Evans –

My teens are using the budget tracker now to see where family money goes. Education and organization in one.

Salazar –

The debt payoff calculator is sick. Shows me different scenarios if I pay more or less. Really helps with planning.

Lopez –

Easy enough for my mom to understand but detailed enough for actual planning.

Mosher –

The monthly checkup is my new favorite day. Actually seeing progress printed out.

Austin –

My family struggled with money management for years. This finally gave us structure. Everyone knows where we’re at financially now.

Evans –

As someone who likes to control their finances, this is perfect. It’s not fancy but it gets the job done. I can see all my numbers at a glance which is exactly what I wanted.

Savage –

Spent 30 bucks instead of paying $15/month for some app. After a year I’ve saved $150 plus I actually use this one.

Perez –

Not just a tool, it’s actually a system that works if you use it consistently.

Edwards –

Could’ve saved myself years of financial stress if I’d had this earlier.