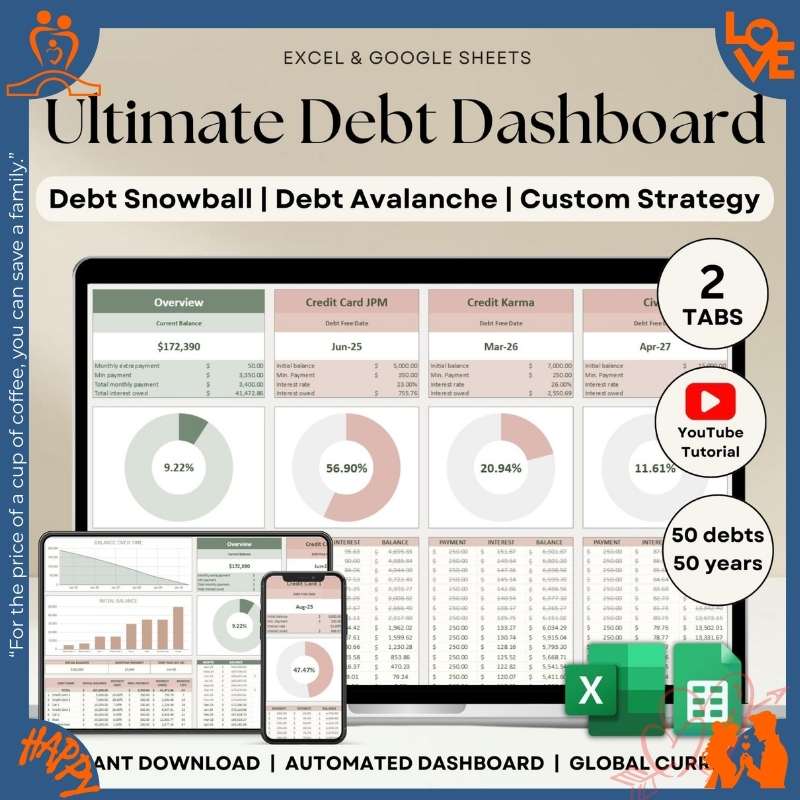

Debt Payoff Tracker Debt Snowball Excel Debt Avalanche Calculator Google Sheets V3.1.3

Original price was: $25.99.$12.99Current price is: $12.99.

$50,000 in Debt? See Your Debt-Free Date — Snowball or Avalanche Method.

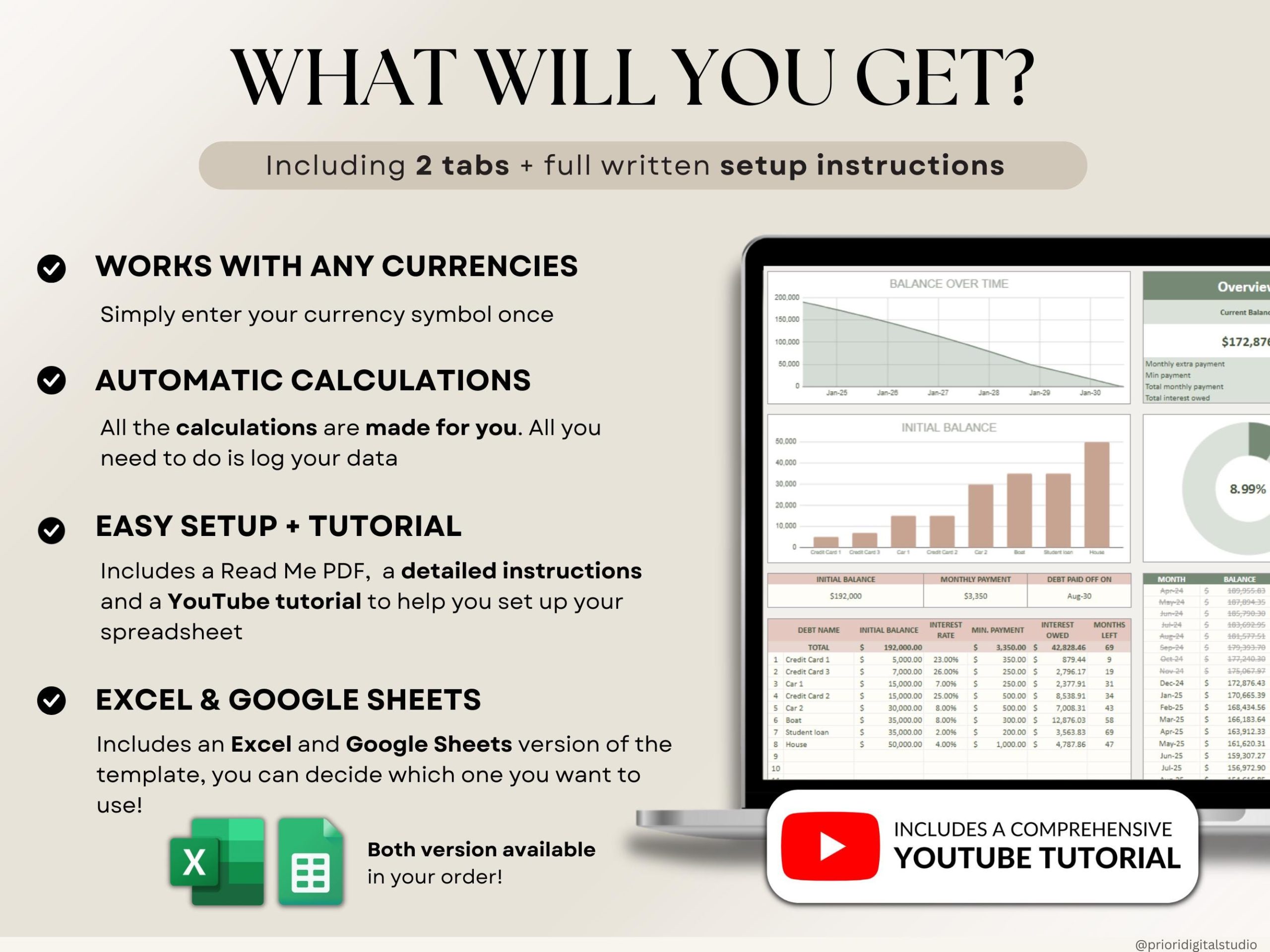

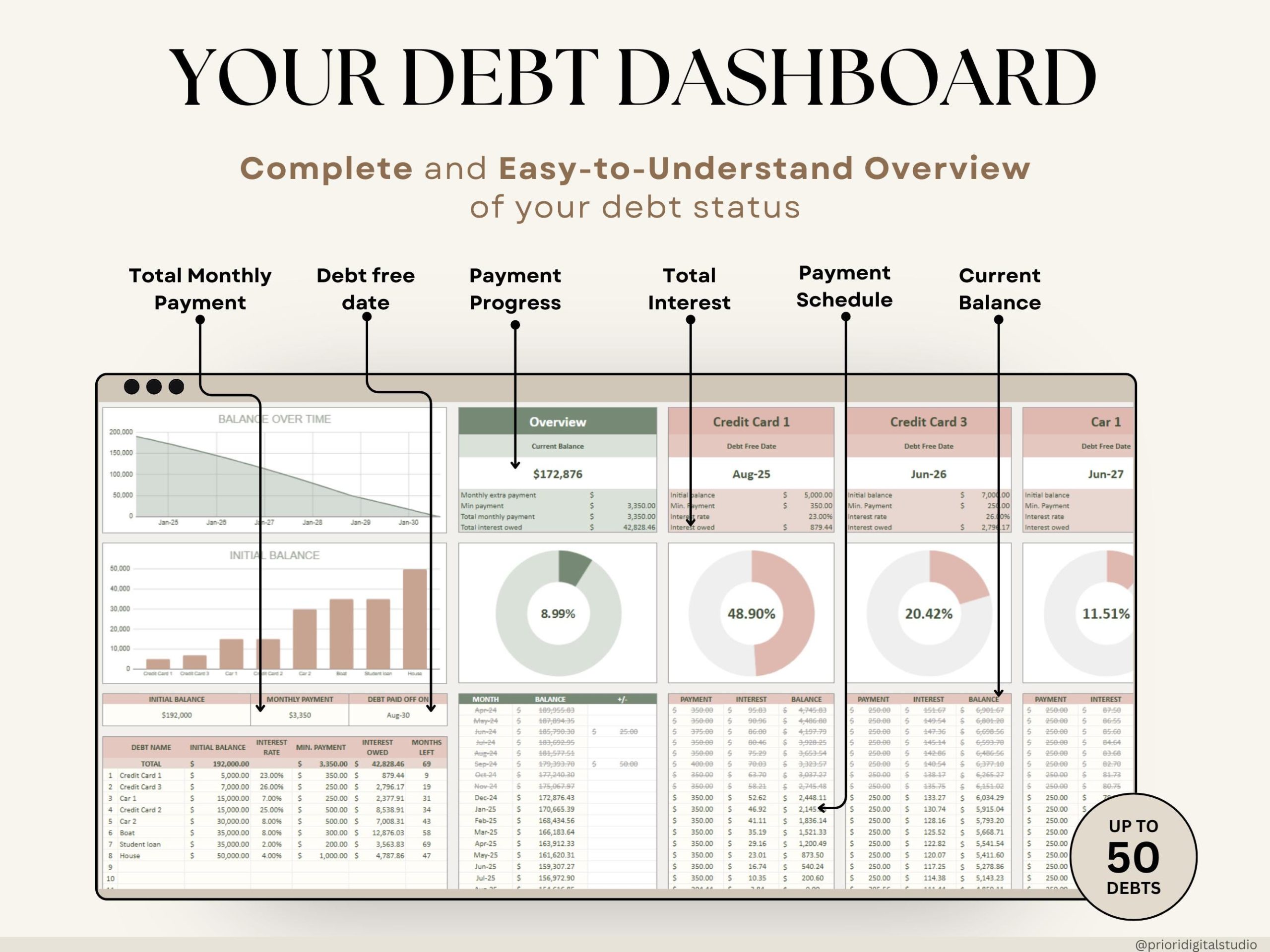

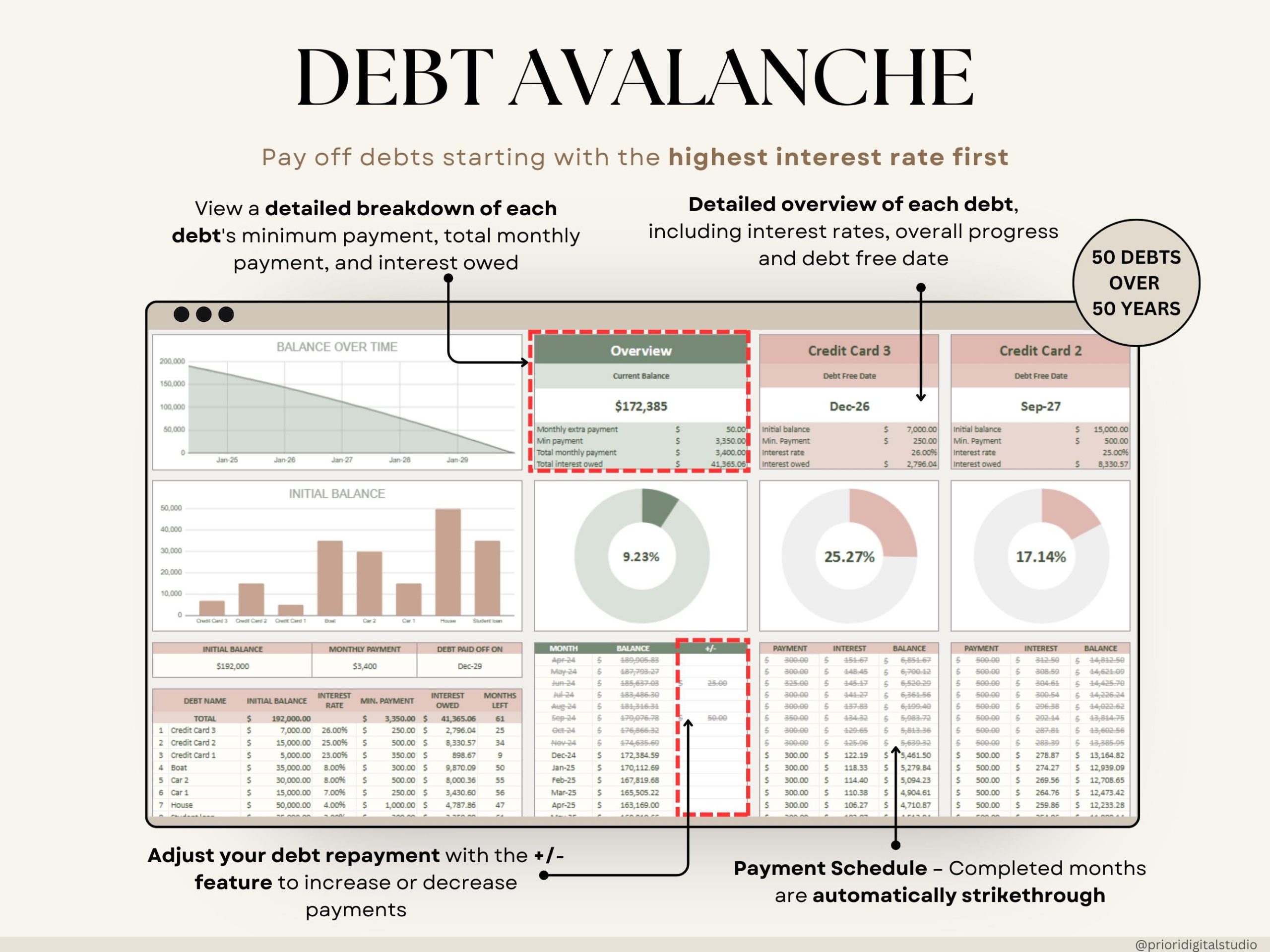

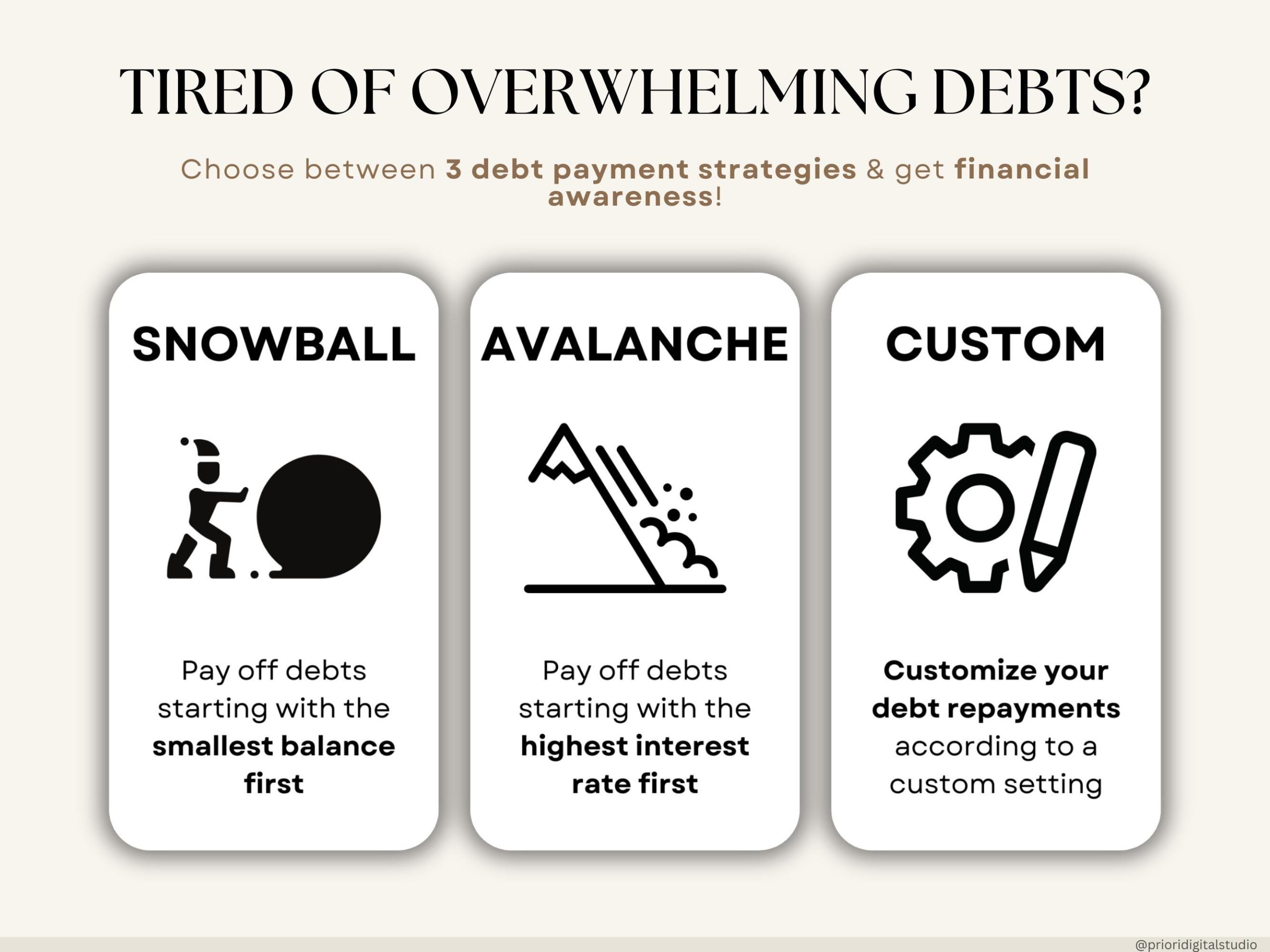

Stop drowning in multiple debts. This tracker consolidates everything—student loans, credit cards, mortgage, car loans. Choose proven payoff strategy (Snowball or Avalanche), see exact debt-free date, track progress automatically.

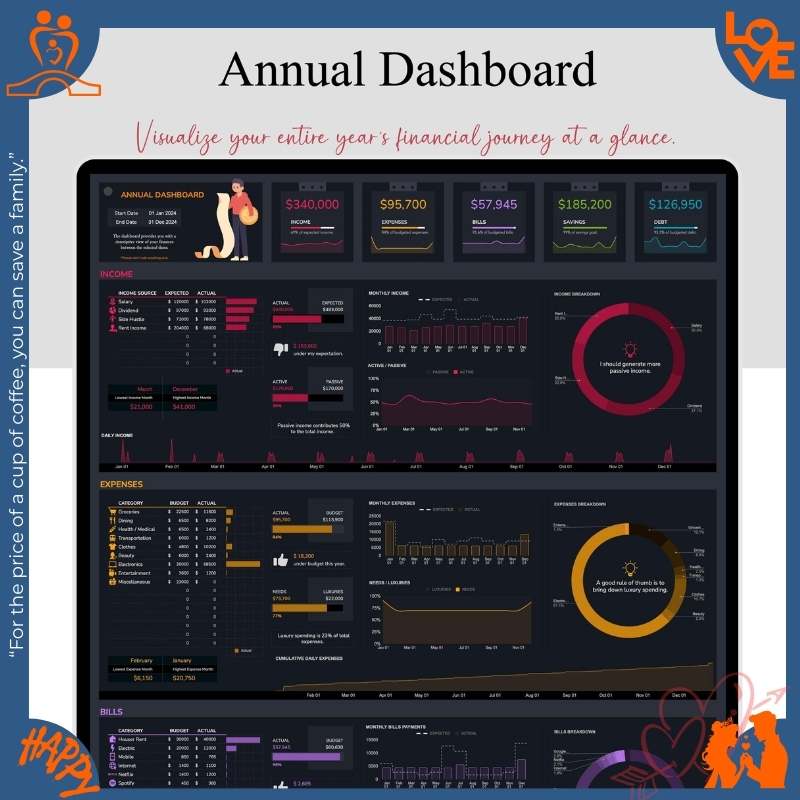

- ✅ Track ALL debt types in one dashboard

- ✅ Snowball method (psychological wins – pay smallest first)

- ✅ Avalanche method (save most interest – pay highest rate first)

- ✅ Auto debt-free date calculator (see light at the end)

- ✅ Visual progress charts (watch total debt drop)

- ✅ “Master Your Finances” guide included

- ✅ Google Sheets & Excel (works anywhere)

Perfect for: 2026 debt freedom goals, multiple debt types, student loan + credit card combos.

$12.99 one-time • Track unlimited debts • Proven strategies included

Which Debt Tracker Do You Need?

| Feature | Credit Card Tracker | This (Debt Payoff) |

|---|---|---|

| Best For | Credit cards only | All debt types |

| Debt Types | Credit cards (12 max) | Student loans, mortgage, car, CC (unlimited) |

| Payoff Strategy | ❌ No strategy | ✅ Snowball & Avalanche |

| Credit Score Focus | ✅ Utilization tracking | ⚠️ Basic tracking |

| Price | $16.99 | $12.99 |

Choose Credit Card Tracker if: You only have credit card debt and want to improve credit score.

Choose Debt Payoff Tracker if: You have multiple debt types and need a payoff strategy.

Samuel Russell –

“I’ve gifted this to 5 family members. Everyone’s payoff date moved up!”

Logan Sanders –

“Caught an error in my bank’s interest calculation using this!”

Chloe Powell –

“I teach finance and use this as my primary teaching tool.”

Harper Brooks –

“My executive dysfunction disappears with this system.”

Orion Hale –

“My consulting business runs on this template.”

Dylan Mitchell –

“As a bankruptcy attorney, I recommend this to clients.”

Knox Davenport –

“I’ve stopped 90% of my forgotten tasks. Priceless!”

Nova Barnes –

“This planner pays for itself in saved time. Reclaimed 10 hours/week!”

Lauren Scott –

“I track 8 rental property mortgages here. The amortization tables are perfect.”

Sparrow Nielsen –

“My nonprofit coordinates volunteers with this.”

Glen Porter –

“The payoff timeline keeps me focused on the goal.”

Vesper Davenport –

“The weekly reset feels psychologically refreshing.”

Dylan Patterson –

“Paid off $85k in 3 years! The weekly progress emails kept me accountable.”

Ethan Harris –

“I’m debt-free after 5 years using this! The progress charts kept me going.”

Vale Montgomery –

“The weekly progress emails are motivating.”

Finn Wallace –

“My startup runs on this template. Scaled to 20 employees smoothly!”

Griffin Stone –

“I feel naked without this planner now!”

Pike Reeves –

“From $40k debt to $10k net worth in 2 years!”

Wren Delgado –

“From debt disaster to financial freedom in 2 years!”

Christopher Diaz –

“This helped me negotiate lower APR on my cards! The interest comparison was eye-opening.”

Pike Cameron –

“From $65k debt to $20k net worth in 3 years!”

Maxine Hopkins –

“My PhD dissertation got completed early thanks to this tracker!”

Juniper Rhodes –

“My real estate team shares this. Conversions up 27%!”

Daniel Kim –

“My credit score jumped 150 points in a year by following this system!”

Vale Spencer –

“The interest savings projections keep me motivated.”

Indigo Maxwell –

“The visual motivation tools are game-changers.”