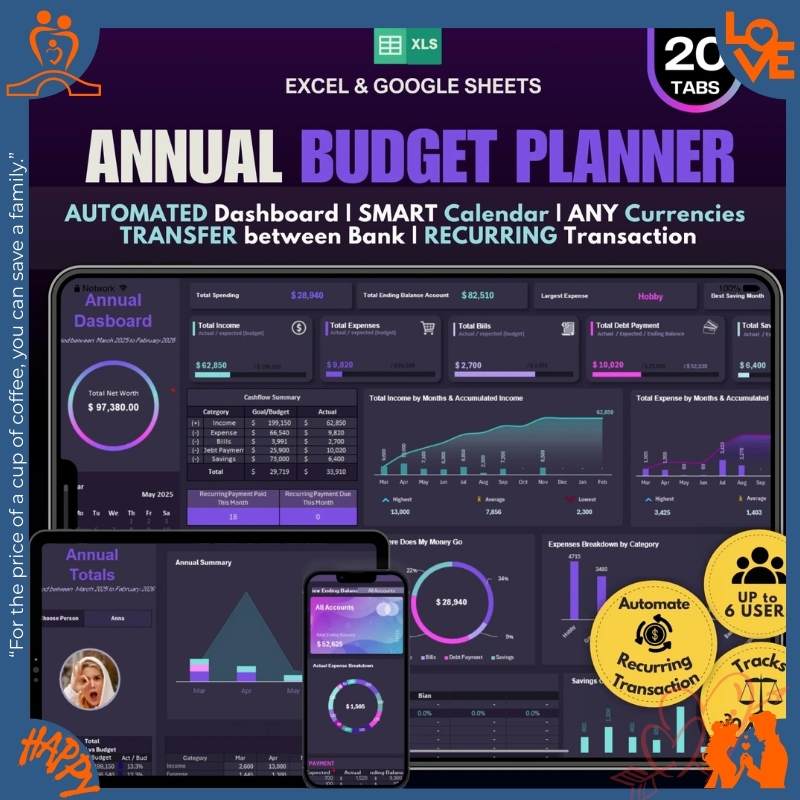

Annual Family Budget Tracker & Financial Planner Spreadsheet Google Sheets & Excel V4.6.8

“You Bought WHAT?!” — End Money Arguments. Track Family Spending Together.

67% of couples fight about money. Root cause: One spouse doesn’t know what the other spent. This family budget tracker gives both parents full visibility—shared income, shared expenses, shared goals. Track groceries, kids’ activities, bills, savings. No surprises. No fights.

- ✅ Family dashboard (both parents see same numbers)

- ✅ Pre-set monthly tabs (Jan–Dec, plan entire year)

- ✅ Multiple income tracking (Mom’s salary + Dad’s salary + side hustles)

- ✅ Kid expenses categorized (daycare, school, activities, clothes)

- ✅ Shared savings goals (vacation fund, emergency fund, college fund)

- ✅ Bill payment tracker (never miss mortgage or utilities)

- ✅ Visual spending breakdown (where family money actually goes)

- ✅ Works on all devices (update from phone, tablet, computer)

Perfect for: 2026 family financial goals, dual-income households, families with kids, couples planning together.

$13.99 one-time • Stop money fights • Share with whole family

👨👩👧👦 Why Family Budgeting ≠ Personal Budgeting

😰 Common Family Budget Problems

1. The Transparency Issue

“I thought we had $500 left.”

“No, I spent $300 on kids’ shoes yesterday.”

2. The Double-Spending

Mom buys groceries Monday: $150

Dad buys groceries Tuesday: $120

(Fridge now overflowing)

3. The “Your Money vs My Money”

“That’s YOUR spending category.”

“Why do YOU get more fun money?”

4. The Kid Expense Chaos

School fees, sports, clothes, doctor

Lost in “miscellaneous” category

Result: 67% of couples fight about money.

✅ With Family Budget Tracker

1. Full Transparency

Both parents see same dashboard

Real-time updates from both devices

“Left to Spend” shows true balance

2. Coordinated Spending

Check before shopping: “$200 left in groceries”

No duplicate purchases

No overdrafts

3. Unified “Our Money”

Combined income tracking

Shared spending categories

Fair allocation visible to both

4. Kid Expenses Organized

Dedicated categories: School, Daycare, Sports, Clothes

See exactly what kids cost

Result: Financial peace. No surprises. No fights.

👨👩👧👦 2026: MASTER YOUR FAMILY FINANCES

Beautiful. Complete. Easy to Use. The Family Budget System You've Been Looking For.

Is Your Family Budget Scattered Chaos?

- You have NO IDEA how much your kids' activities actually cost (soccer, dance, piano add up fast)

- Your partner asks "Did you pay the electric bill?" and you're not sure because bills are tracked in your head

- 3 kids = 3 different school lunches, field trips, birthday parties—expenses come from EVERYWHERE

- You want to save for family vacation but have no clue how much household expenses actually total each month

- Other budget apps are ugly, confusing, or built for single people—not families with kids

The FamilyBridge Family Budget Planner PRO is the most beautiful and complete family budget system available. Track household expenses, kids activities, shared budgets, savings goals—all in one gorgeous, easy-to-use spreadsheet. Built specifically for families with children.

This is the PRO version with enhanced design, visual dashboards, and comprehensive family financial planning. Perfect for couples with kids who want to finally get their household finances organized.

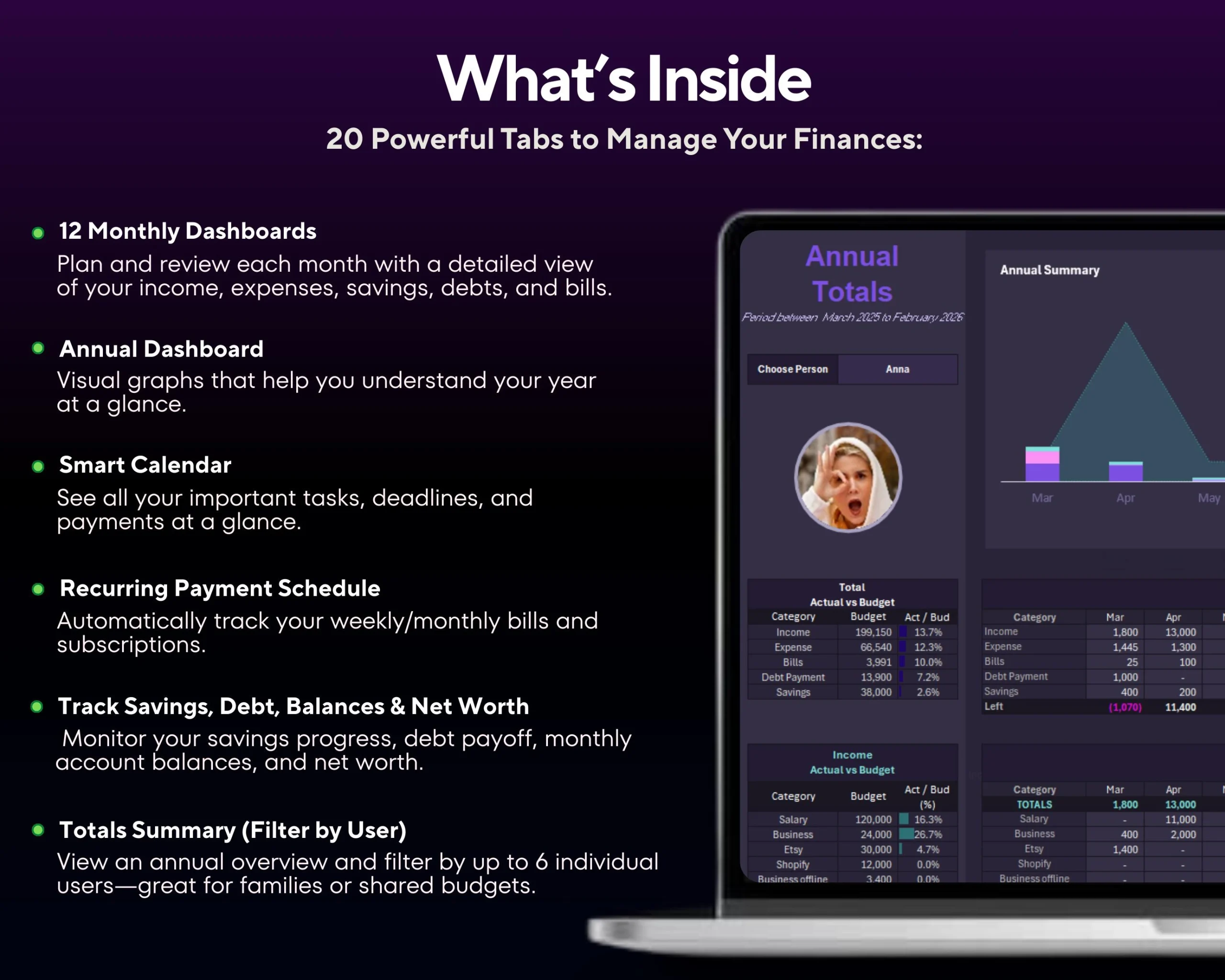

🎨 Why This Is the Most BEAUTIFUL Budget Planner

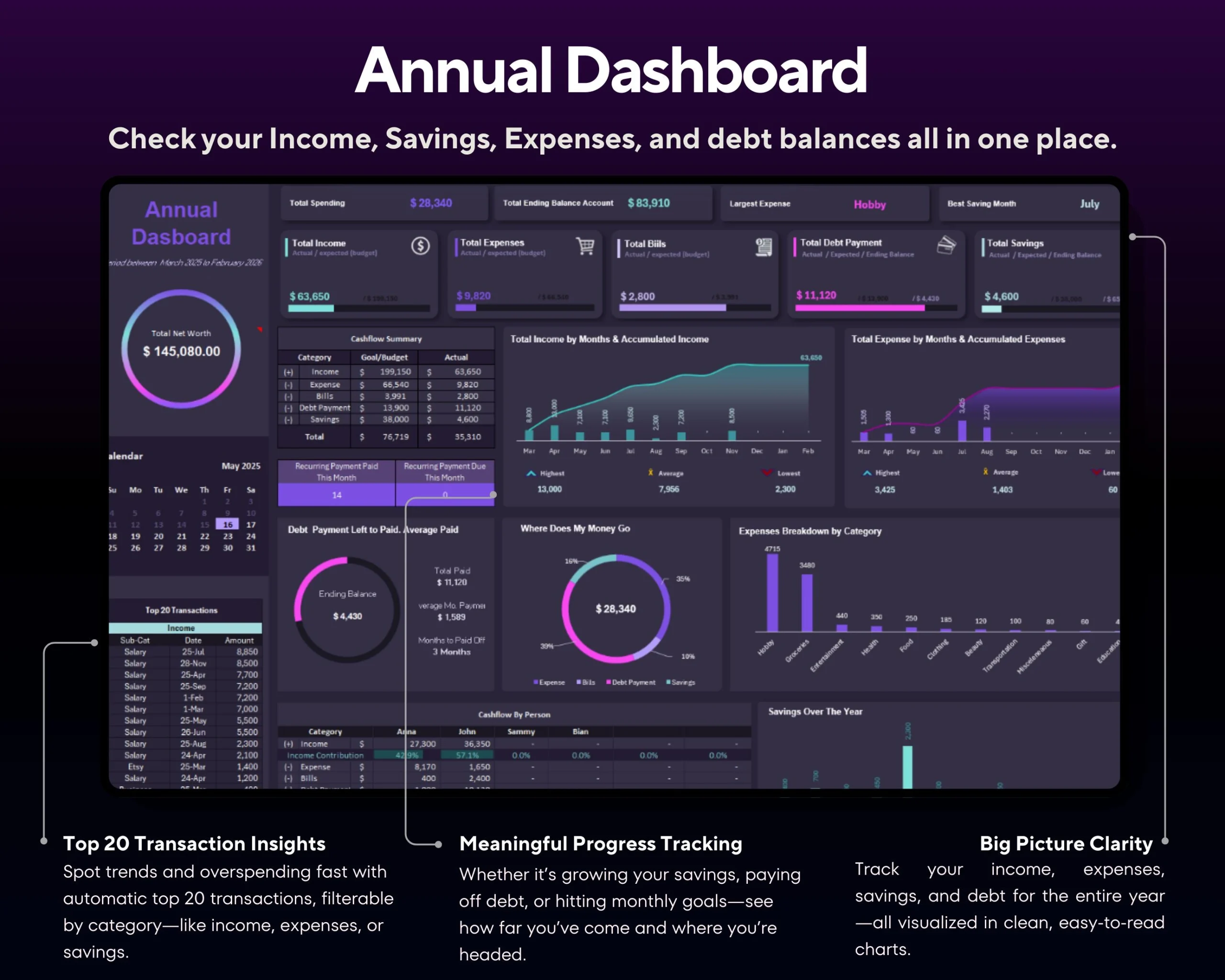

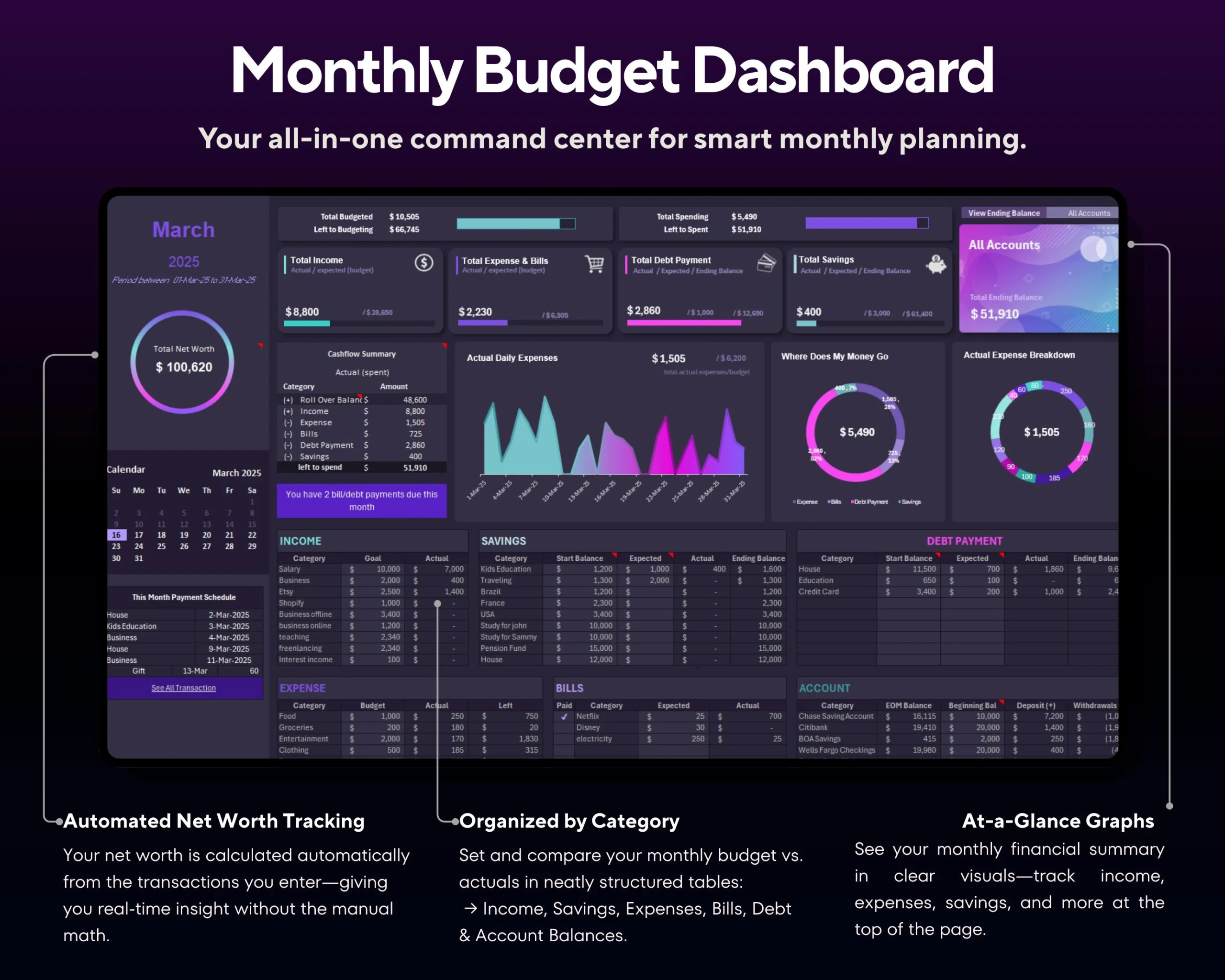

Visual Dashboards

(See everything at a glance)

Color-Coded Categories

(Easy to navigate)

Beautiful Charts

(Progress motivation)

Professional Design

(You'll actually use it)

Other budget spreadsheets look like 1995. This looks like 2026.

👨👩👧👦 Track Every Family Member's Expenses

Dad's Budget

Work lunches: $180

Gas: $220

Personal: $100

Mom's Budget

Groceries: $650

Kids clothes: $200

Personal: $100

Emma (12)

Soccer: $120

School lunch: $80

Allowance: $40

Jake (8)

Piano: $100

School lunch: $80

Allowance: $20

Family Total: $1,890/month. NOW you know where every dollar goes.

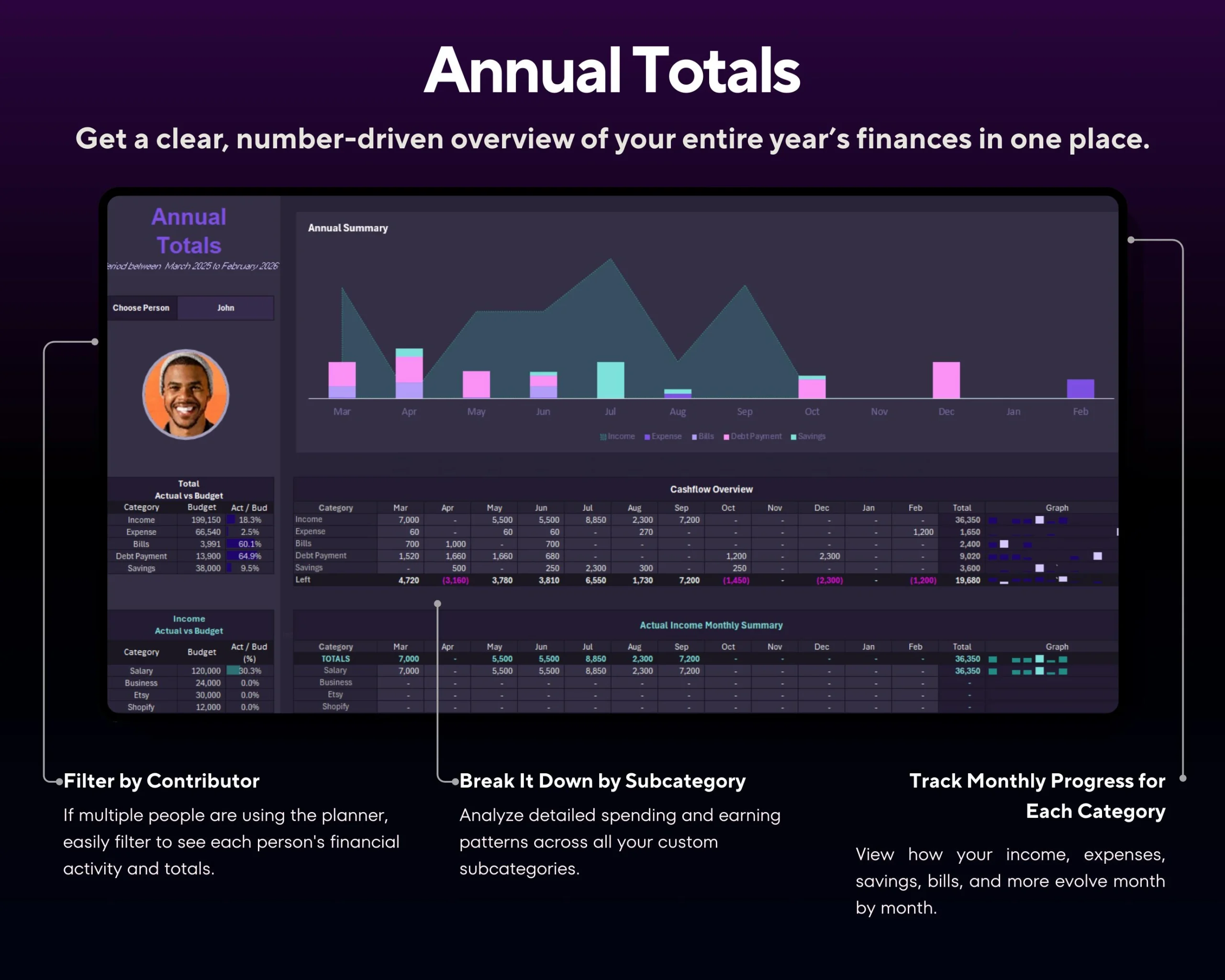

✅ Complete Family Financial System (PRO Features)

- Family Member Budgets (track each person separately)

- Kids Activities Tracker (sports, music, clubs)

- School Expenses (lunches, field trips, supplies)

- Household Bills Dashboard (utilities, mortgage, insurance)

- Shared Budget View (both partners see everything)

- Visual Dashboards (beautiful charts + graphs)

- Monthly + Annual Planning (full year overview)

- Savings Goals (vacation, college fund, emergency)

- Birthday/Holiday Budget (plan for special occasions)

- Grocery + Meal Planning (integrated food budgeting)

- $12.99 one-time (vs EveryDollar Premium $79.99/year)

👨👩👧👦 Family Budget Science: Families who track household expenses save an average $487/month compared to families who don't budget. Kids activities (sports, music, clubs) average $3,200/year per child—most parents underestimate by 40%. Couples who budget together report 60% fewer money fights than couples who don't discuss finances.

📊 Real Family Budget Results

$487

Saved Per Month

$5,844

Saved Per Year

-60%

Fewer Money Fights

100%

Know Where $ Goes

Results from families who use this system consistently.

💎 Which Version Is Right for Your Family?

| Feature | Basic ($6.99) |

Debt PRO ($9.99) |

Family PRO ($12.99) |

|---|---|---|---|

| Best For | Singles/couples | Debt payoff | Families with kids |

| Monthly Budget | ✅ Basic | ✅ Enhanced | ✅ Family-optimized |

| Visual Design | ⚠️ Functional | ⚠️ Calculator-focused | ✅ BEAUTIFUL |

| Annual Overview | ✅ Yes | ✅ Yes | ✅ Yes |

| Family Member Budgets | ❌ No | ❌ No | ✅ YES |

| Kids Activities Tracker | ❌ No | ❌ No | ✅ YES |

| School Expenses | ❌ No | ❌ No | ✅ YES |

| Shared Budget View | ❌ No | ❌ No | ✅ YES |

| Visual Dashboards | ❌ No | ⚠️ Basic | ✅ BEAUTIFUL |

| Birthday/Holiday Budget | ❌ No | ❌ No | ✅ YES |

| Grocery/Meal Planning | ❌ No | ❌ No | ✅ YES |

| Debt Snowball/Avalanche | ❌ No | ✅ YES | ⚠️ Basic tracking |

| Expense Tracker | ✅ Yes | ✅ Yes | ✅ Yes (enhanced) |

| Savings Goals | ✅ Yes | ✅ Yes | ✅ Yes (family-focused) |

Basic Budget ($6.99)

- ✅ For: Singles/couples

- ✅ Monthly budget

- ✅ Expense tracker

- ✅ Savings goals

- ⚠️ Functional design

- ❌ No family features

- ❌ No kids tracking

Debt PRO ($9.99)

- ✅ For: Debt payoff

- ✅ Snowball/avalanche calculators

- ✅ Debt-free date

- ✅ Payment schedules

- ⚠️ Calculator-focused design

- ❌ No family features

- ❌ No kids tracking

✅ Family PRO ($12.99)

- ✅ For: Families with kids

- ✅ Family member budgets

- ✅ Kids activities tracker

- ✅ School expenses

- ✅ BEAUTIFUL visual design

- ✅ Shared budget view

- ✅ Birthday/holiday budget

- ✅ Grocery/meal planning

🤔 Which Version Should You Buy?

Choose BASIC ($6.99) if:

✅ You're single or childless couple

✅ You want simple personal budgeting

✅ You don't need family-specific features

✅ Functional design is fine

Choose DEBT PRO ($9.99) if:

✅ You have 2+ debts to eliminate

✅ You want snowball/avalanche calculators

✅ You want to know exact debt-free date

✅ Debt payoff is your #1 priority

Choose FAMILY PRO ($12.99) if:

✅ You have kids (especially 2+ kids)

✅ You want to track each family member's expenses

✅ Kids activities, school costs add up fast

✅ You want a BEAUTIFUL, complete family system

✅ You're tired of ugly, confusing spreadsheets

💡 95% of families with 2+ kids choose Family PRO. The visual design + family features are worth $12.99.

✨ Family PRO Features That Make Budgeting Easy

👨👩👧👦 Family Member Budgets

Track Mom, Dad, each kid separately

See who spends what

Teach kids about money management

⚽ Kids Activities Tracker

Soccer, dance, piano, karate, etc.

Track monthly fees + equipment costs

Finally know REAL cost of kids' activities

🏫 School Expenses

Lunches, field trips, supplies, uniforms

Track all education-related costs

Plan for back-to-school season

🎨 Beautiful Visual Dashboards

Color-coded categories (easy to read)

Charts + graphs (see trends)

Professional design (you'll actually use it)

👥 Shared Budget View

Both partners access same spreadsheet

Real-time updates (no more "Did you pay?")

Collaborate on family finances

🏠 Household Bills Dashboard

Mortgage, utilities, insurance, etc.

See all recurring bills in one place

Never miss a due date

🎂 Birthday & Holiday Budget

Plan for birthdays, Christmas, vacations

Set aside money monthly

No more "surprise" holiday stress

🛒 Grocery & Meal Planning

Integrated grocery budget

Plan meals + shopping

Reduce food waste

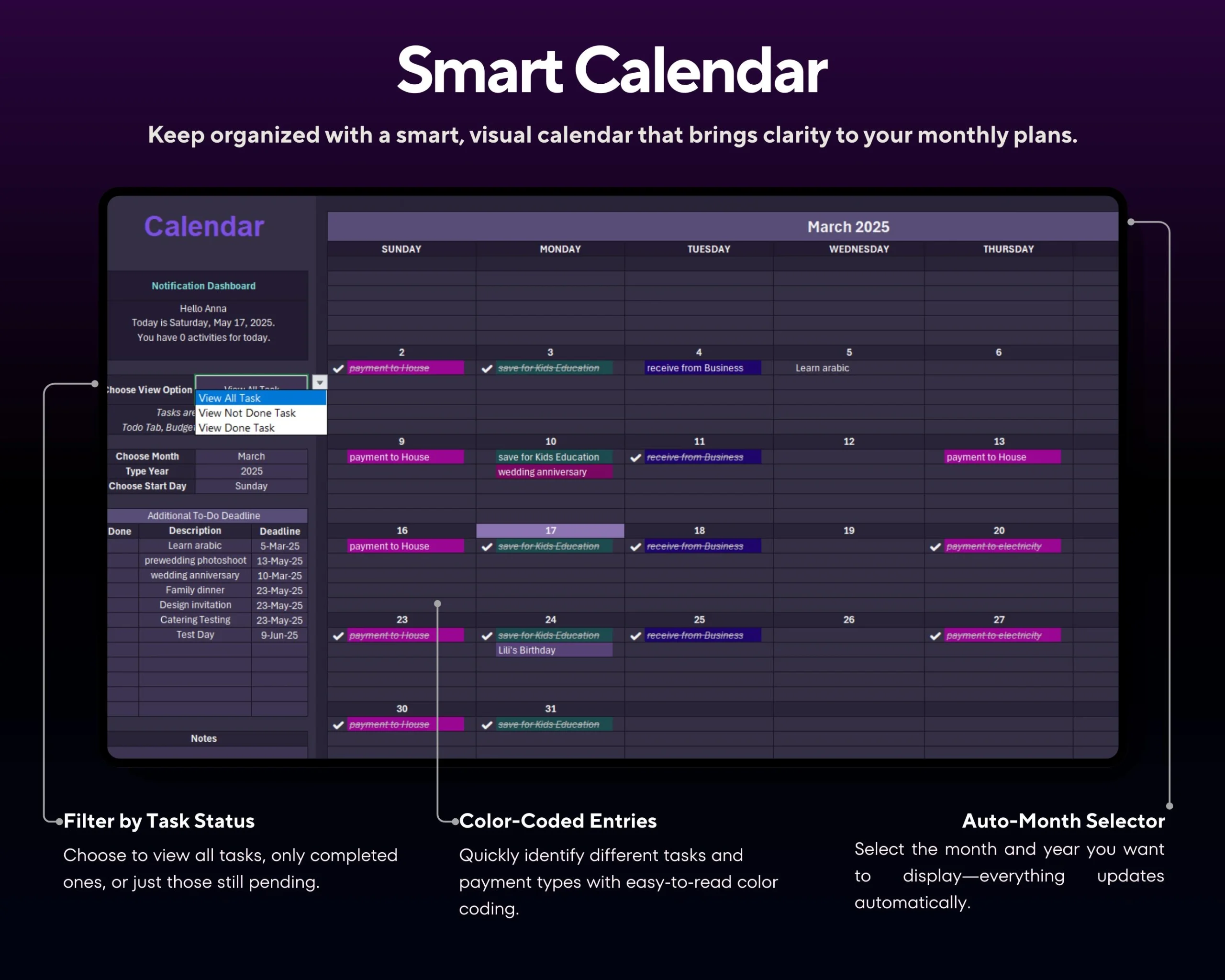

📊 Monthly + Annual Planning

See entire year at a glance

Plan for seasonal expenses

Track year-over-year trends

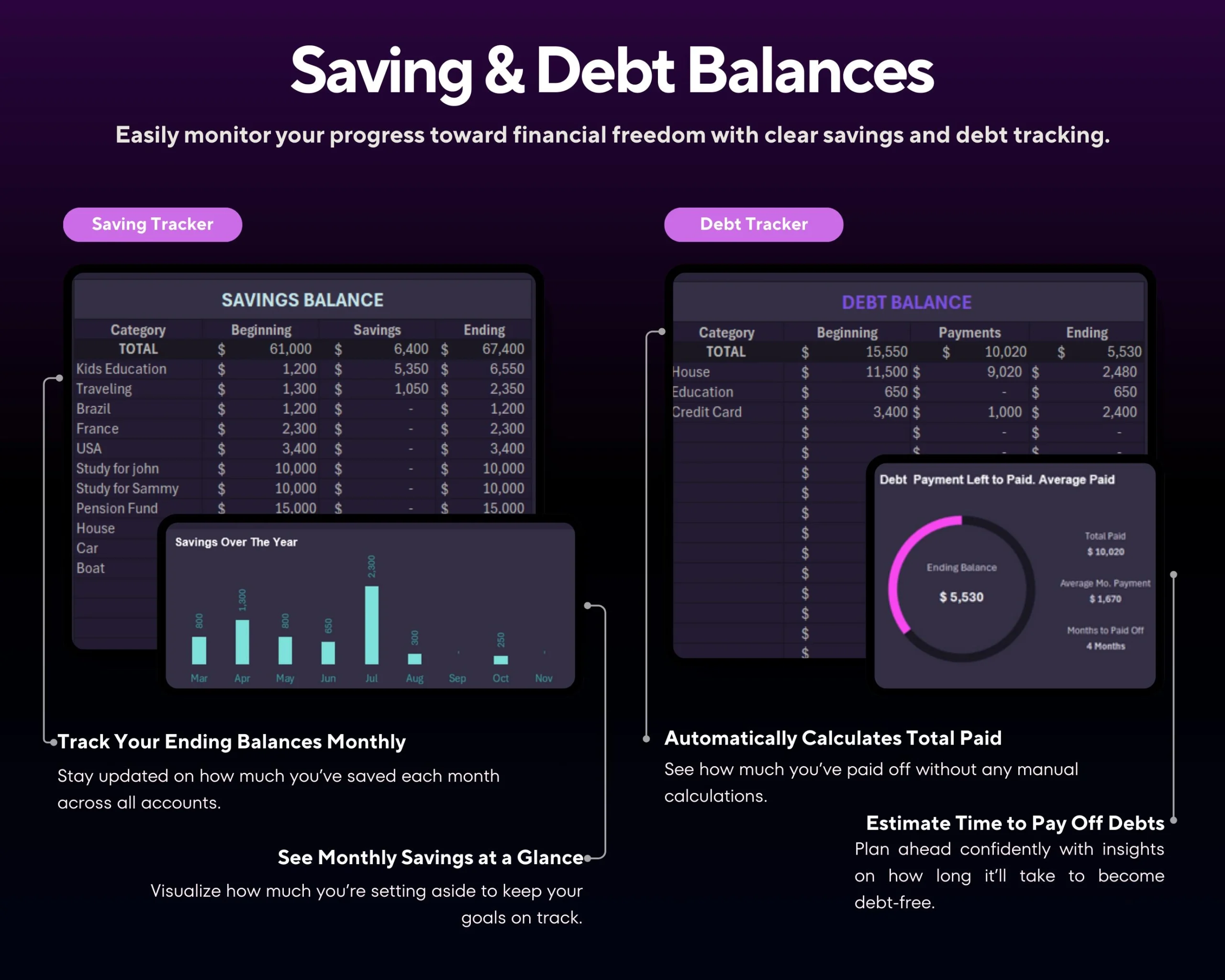

💰 Family Savings Goals

Vacation fund, college savings, emergency

Track progress toward goals

Involve kids in savings mindset

📈 Spending Analysis

See where family money goes (charts)

Identify overspending categories

Make data-driven budget adjustments

💎 Complete Financial System

Budget + expenses + savings + goals

All in one beautiful spreadsheet

Stop juggling multiple tools

🌉 Perfect for Every Family Stage

📍 Young Family (1-2 Young Kids):

Track daycare costs, diapers, baby gear. Plan for birthdays + holidays. Start emergency fund while kids are young.

"2 kids under 5. Daycare was $2,400/month—didn't realize how much other baby costs added up ($800+). This tracker showed everything. Started saving $300/month." — Sarah M., Mom of 2

📍 Growing Family (School-Age Kids):

Soccer, piano, dance add up FAST. School lunches, field trips, supplies. Track it all separately per kid.

"3 kids in activities. Thought we spent $300/month. Reality: $720/month! This tracker showed exact costs per kid. Made hard decisions: each kid picks ONE activity." — Mike & Lisa T., Parents of 3

📍 Busy Family (Multiple Kids in Sports/Activities):

Multiple kids = multiple schedules, fees, equipment. Family PRO organizes chaos. See who spends what.

"4 kids ages 6-14. Soccer, basketball, gymnastics, band. Felt overwhelmed. This planner organized EVERYTHING. Color-coded per kid. Sanity restored." — Jennifer K., Mom of 4

📍 Budget-Conscious Family:

Want to save for vacation, college, house upgrade. Need to find $500-1000/month. Track household expenses ruthlessly.

"Wanted to save $10k for Disney trip. This tracker showed we spent $680/month on 'random stuff.' Cut to $200. Saved $480/month. Disney here we come!" — David & Amy L., Dream Vacation Savers

📍 Teaching Kids About Money:

Show kids their activity costs. Teach budgeting. Involve them in family finances (age-appropriate).

"Showed my 12-year-old: soccer costs $1,440/year. Her eyes widened. Now she appreciates it more AND helps with household chores to 'earn' it. Life lesson." — Mark R., Dad Teaching Financial Literacy

📦 Complete Family PRO System Includes

- ✅ Family Member Budget Tracker (separate budgets per person)

- ✅ Kids Activities & Sports Tracker (monthly fees + equipment)

- ✅ School Expenses Tracker (lunches, field trips, supplies)

- ✅ Beautiful Visual Dashboards (color-coded, easy to read)

- ✅ Shared Budget View (both partners access same sheet)

- ✅ Household Bills Dashboard (all recurring bills organized)

- ✅ Birthday & Holiday Budget (plan for special occasions)

- ✅ Grocery & Meal Planning Integration (food budgeting)

- ✅ Monthly Budget Planner (all income + expenses)

- ✅ Annual Budget Overview (12-month planning)

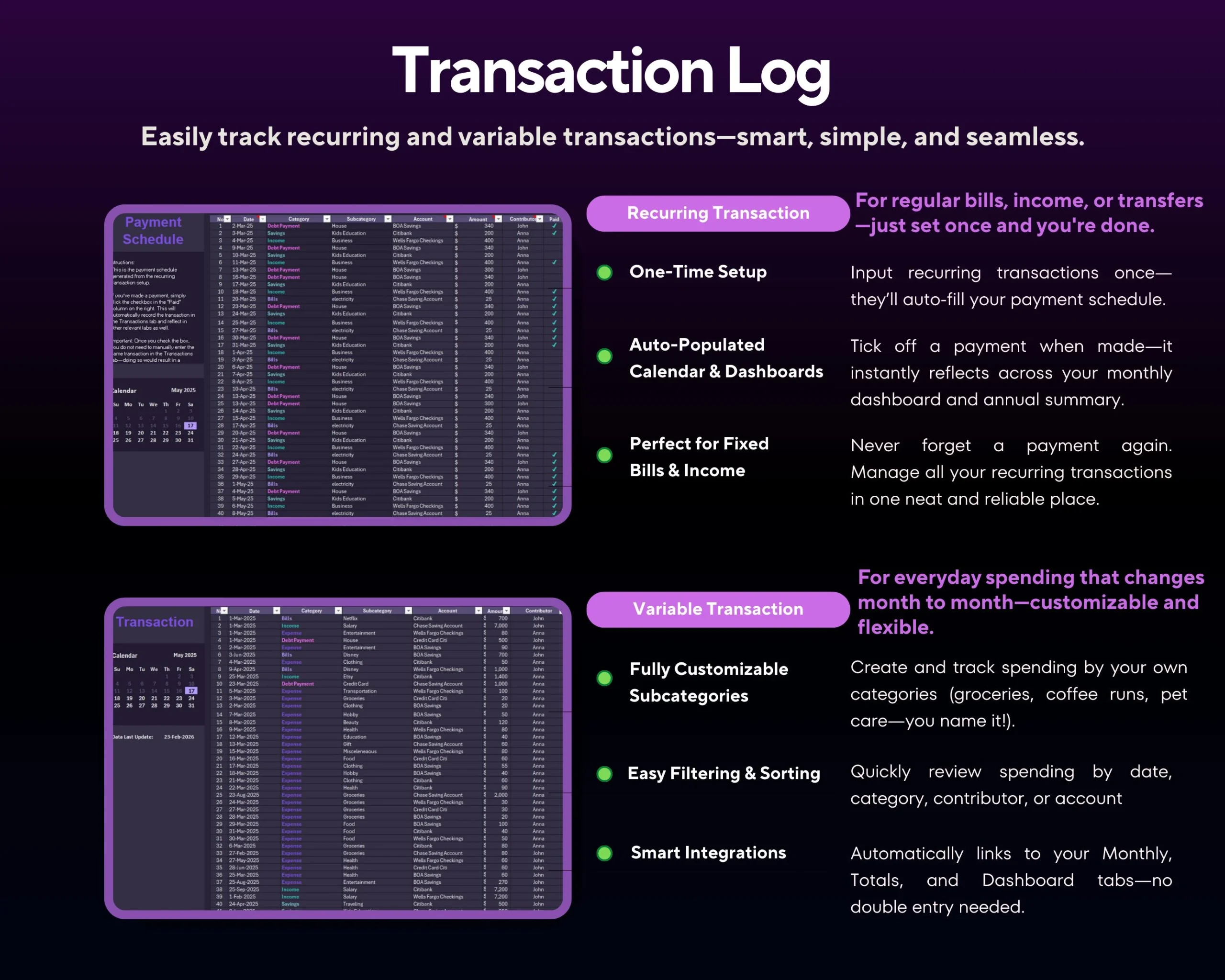

- ✅ Daily Expense Tracker (log every purchase)

- ✅ Family Savings Goals (vacation, college, emergency)

- ✅ Allowance Tracker (kids' allowance management)

- ✅ Spending Analysis Charts (visual spending breakdown)

- ✅ Bill Payment Tracker (never miss due dates)

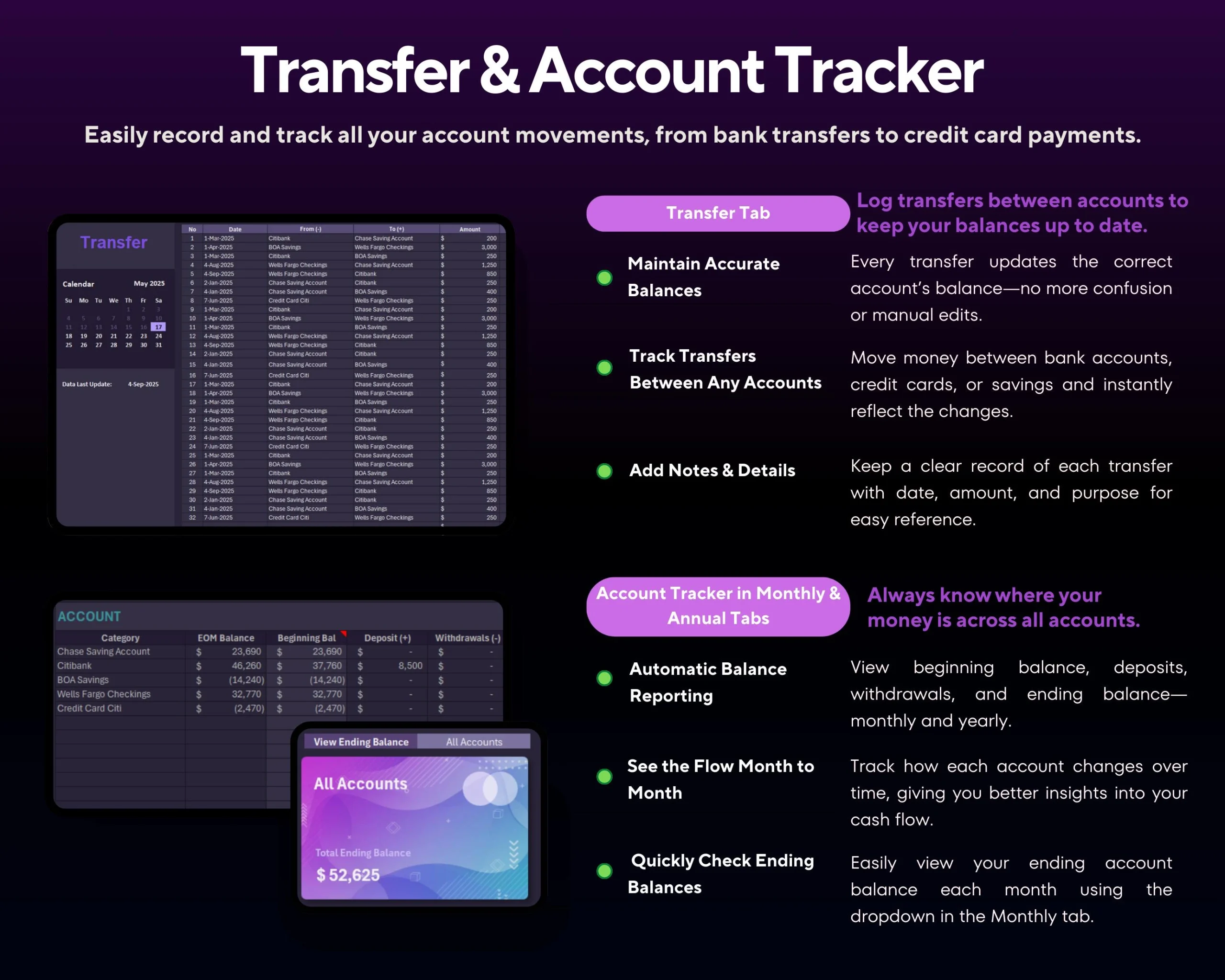

- ✅ Net Worth Calculator (family assets - liabilities)

- ✅ Income Tracker (both parents' income + side hustles)

- ✅ Mobile-Optimized (Google Sheets app for both partners)

- ✅ Lifetime Updates (free forever)

💬 Real Family Budget Success Stories

"Saved $5,844/year we didn't know we were wasting."

Family of 4. Made $92k/year but always broke. This tracker showed: $380/month on eating out (didn't realize), $220/month on subscriptions we forgot about, $280/month on impulse Target runs. Cut all three by 70%. Saved $487/month = $5,844/year. Now have emergency fund + saving for Disney.

— Sarah M., 34, Mom of 2

"Kids activities were costing $720/month. We thought $300."

3 kids: soccer, gymnastics, piano. Fees seemed "manageable." This tracker showed REAL costs: $720/month (fees + equipment + gas + snacks). Nearly $9,000/year! Made hard decision: each kid picks ONE activity. Now $240/month. Saved $480/month for college funds instead.

— Mike & Lisa T., 39 & 37, Parents of 3

"Stopped fighting about money. Now we budget together."

Married 8 years. Fought about money CONSTANTLY. I thought he overspent. He thought I did. This shared budget showed us BOTH overspent in different areas. Started budgeting together weekly. Money fights down 80%. Marriage stronger. Best $12.99 we ever spent.

— Jennifer & David K., 35 & 36, Married 8 Years

"The visual design actually made us WANT to budget."

Tried 4 other budget apps. All ugly. Quit after 2 weeks every time. This Family PRO is BEAUTIFUL. Color-coded categories, gorgeous charts. My wife (graphic designer) actually ENJOYS opening it. We've used it 9 months straight. First budget that stuck. Design matters.

— Mark R., 41, Dad of 2

🛡️ Risk-Free Purchase

❓ Family PRO FAQ

Why is Family PRO $12.99 vs Basic $6.99?

Family PRO has 10+ features Basic doesn't have. Family member budgets, kids activities tracker, school expenses, shared budget view, beautiful visual design, birthday/holiday planning, grocery integration. Basic = simple personal budget. Family PRO = complete household financial system. If you have kids, the extra $6 is worth it.

Can both parents access the same budget?

Yes! That's a key Family PRO feature. Share the Google Sheet with your partner's email. Both can view + update in real-time. No more "Did you pay the electric bill?" Both see everything. Most couples review budget together weekly using shared view.

How do I track each kid's expenses separately?

Family PRO has separate sections per family member. Enter Emma's soccer ($120), school lunch ($80), allowance ($40). Enter Jake's piano ($100), school lunch ($80), allowance ($20). See total per kid. See family total. Finally know exactly what each kid costs monthly.

What makes this "more beautiful" than other budgets?

Professional design vs ugly spreadsheets. Color-coded categories (easy to read), beautiful charts + graphs (visual progress), clean modern layout (looks like 2026, not 1995). Other budget spreadsheets look boring/confusing. This looks GOOD. Design matters—you'll actually WANT to use it.

Do I need Family PRO if I only have 1 kid?

Family PRO is worth it even with 1 kid. The shared budget view (for you + partner), beautiful design, kids activities tracker, school expenses—all valuable with one child. Most 1-kid families choose Family PRO for the visual design + shared view alone. Basic is really best for singles/childless couples.

Can I use this to teach my kids about budgeting?

Yes! Many parents use Family PRO for financial education. Show kids: "Your soccer costs $1,440/year." Teaches appreciation + responsibility. Track their allowance + spending. Age-appropriate financial literacy. Some parents give older kids (12+) view-only access to see household budget. Real-world money education.

Is Family PRO better than EveryDollar Premium?

Family PRO: $12.99 once. EveryDollar Premium: $79.99/year ($400 over 5 years). EveryDollar has bank sync (auto-import transactions). Family PRO requires manual entry BUT gives you more control, better visual design, family-specific features EveryDollar doesn't have. If you want to save $400+ over 5 years and prefer beautiful design, Family PRO wins.

Can I upgrade from Basic to Family PRO?

Yes, but you'll pay full price ($12.99). No upgrade discount. If you have kids now, buy Family PRO from the start. You'll save time + money. Most families with kids regret buying Basic first—end up buying Family PRO anyway and spending $19.98 total instead of $12.99.

273 reviews for Annual Family Budget Tracker & Financial Planner Spreadsheet Google Sheets & Excel V4.6.8

Related products

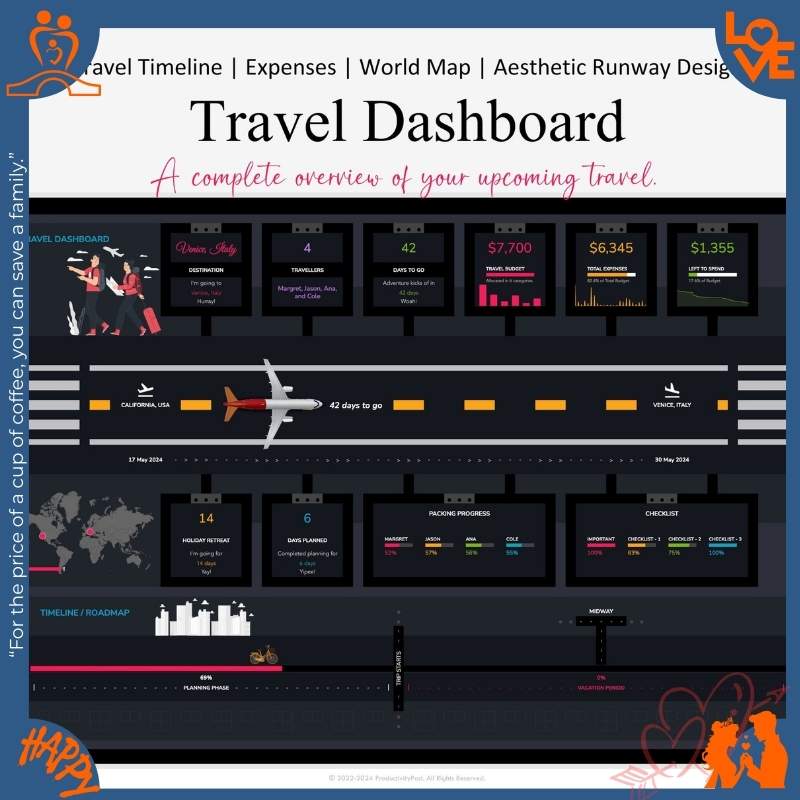

Travel Planner Google Sheets, Travel Itinerary, Travel Packing List, Trip Expense Tracker V3.6.5

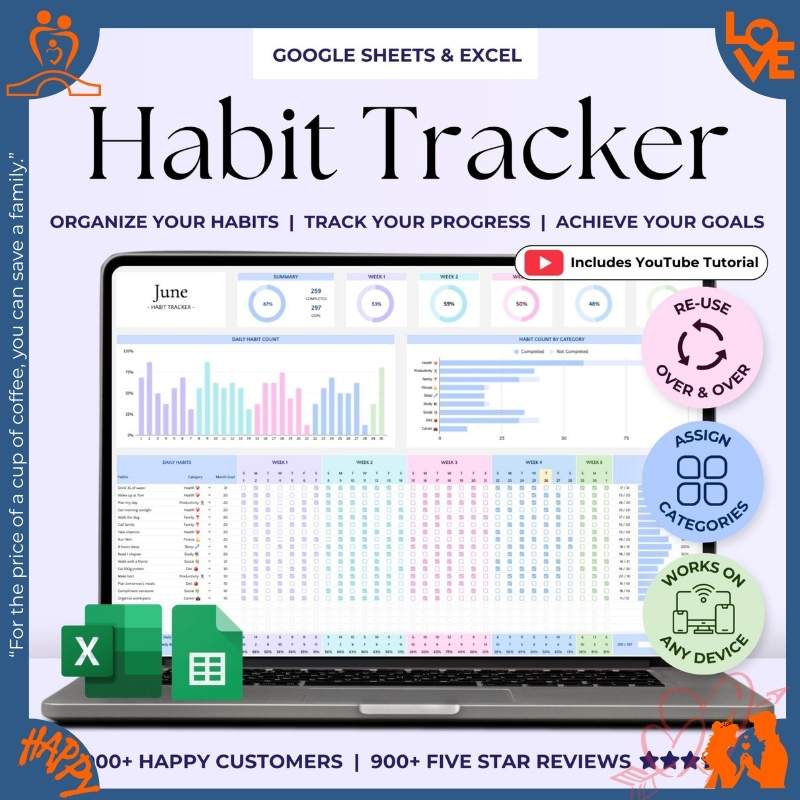

Rated 4.41 out of 5$15.99Original price was: $15.99.$9.99Current price is: $9.99.Habit Tracker Daily Weekly Monthly Spreadsheet 2026 Habit Tracking Template V 2.3.4

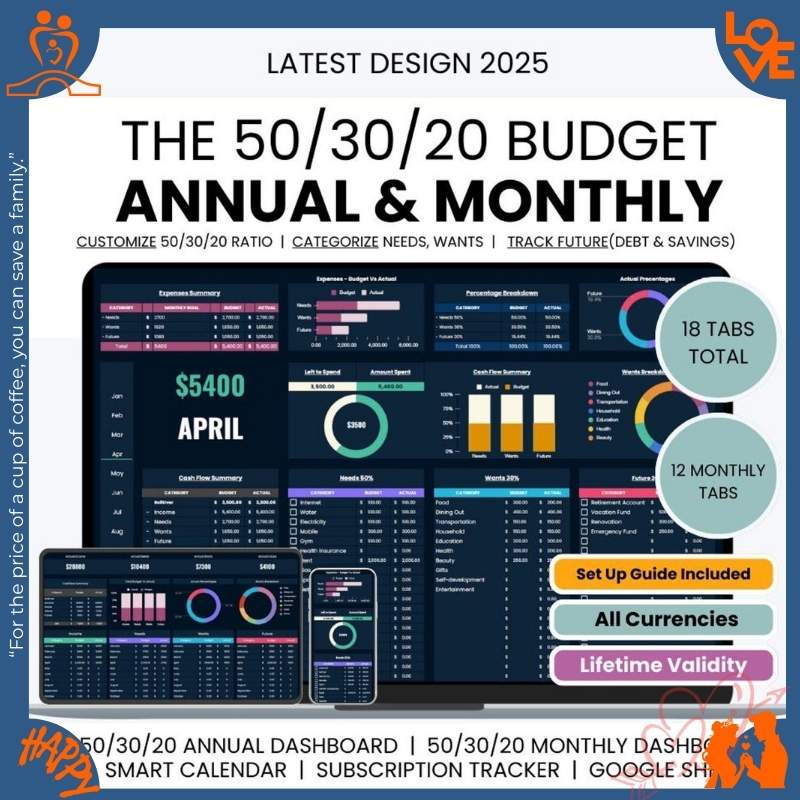

Rated 4.41 out of 5$13.99Original price was: $13.99.$8.99Current price is: $8.99.Budget personal finance templates | Annual and Monthly V1.8.9

Rated 4.37 out of 5$12.99Original price was: $12.99.$6.99Current price is: $6.99.Couples Budget Planner | Annual & Monthly Expense Tracker | Simple Shared Finance Organizer V3.6.2

Rated 4.50 out of 5$11.99Original price was: $11.99.$7.99Current price is: $7.99.

Joshua –

We discovered that this template has gave me confidence to handle my finances and now we feel more in control. It was exactly what we were looking for.

John –

For someone like me, a newlywed, it has reduced our money stress and arguments which made our life so much easier. It turned out to be more useful than I expected.

Clara –

As a single parent, I found this tool has made budgeting a stress-free part of our lives and everything feels organized now. It opened our eyes to where money goes.

James –

For someone like me, a remote worker, it has organized all of our bills and income perfectly and it completely changed our habits. It was exactly what we were looking for.

Clara –

From the first week, this template has allowed us to finally plan for vacations and everything feels organized now. It was exactly what we were looking for.

Sophie –

Honestly, this budgeting tracker has gave us clarity and control over spending which made our life so much easier. It was exactly what we were looking for.

Mia –

Using this spreadsheet as a freelancer has organized all of our bills and income perfectly and now we feel more in control. This has been a big help for our family.

Ella –

In just a few weeks, this tool has gave me confidence to handle my finances and it completely changed our habits. It gave us a fresh way to organize our budget.

Harper –

From the first week, this template has turned our finances from chaos into order and everything feels organized now. I appreciate how much difference it made for us.

Stella –

Honestly, this budgeting tracker has helped us save more each month and now we feel more in control. It’s like a reset for our household finances.

Nathan –

From the first week, this template has made budgeting a stress-free part of our lives and now we feel more in control. Our approach to planning has improved completely.

Joseph –

Using this spreadsheet as a stay-at-home dad has reduced our money stress and arguments and it has been a relief. I appreciate how much difference it made for us.

Ryan –

In our family, this tracker has helped us see where money was leaking away and now we feel more in control. Our approach to planning has improved completely.

Stella –

From the first week, this template has organized all of our bills and income perfectly which made our life so much easier. It turned out to be more useful than I expected.

Liam –

As a teacher, I found this tool has motivated us to track every dollar and it completely changed our habits. It was exactly what we were looking for.

Sarah –

For someone like me, a young couple, it has gave me confidence to handle my finances and everything feels organized now. This has been a big help for our family.

Leo –

Honestly, this budgeting tracker has motivated us to track every dollar and now we feel more in control. It’s like a reset for our household finances.

Benjamin –

In just a few weeks, this tool has motivated us to track every dollar and it completely changed our habits. We finally feel safe about our spending.

Emily –

From the first week, this template has gave me confidence to handle my finances and it has been a relief. We now manage money much better than before.

Hannah –

As a freelancer, I found this tool has turned our finances from chaos into order and now we feel more in control. It opened our eyes to where money goes.

Liam –

For someone like me, a newlywed, it has reduced our money stress and arguments and it has been a relief. It opened our eyes to where money goes.

Sophia –

Using this spreadsheet as a remote worker has allowed us to finally plan for vacations and it completely changed our habits. I appreciate how much difference it made for us.

Ethan –

In just a few weeks, this tool has helped us see where money was leaking away and it completely changed our habits. It was exactly what we were looking for.

Jessica –

As a teacher, I found this tool has turned our finances from chaos into order and now we feel more in control. I appreciate how much difference it made for us.

Zoe –

Using this spreadsheet as a dad of three has turned our finances from chaos into order and it completely changed our habits. This has been a big help for our family.

Hazel –

Using this spreadsheet as a traveler has turned our finances from chaos into order and it has been a relief. We now manage money much better than before.

Mason –

Using this spreadsheet as a college student has organized all of our bills and income perfectly which made our life so much easier. We finally feel safe about our spending.

Amanda –

Using this spreadsheet as a engineer has turned our finances from chaos into order and everything feels organized now. It gave us a fresh way to organize our budget.

Ethan –

We discovered that this template has helped us save more each month and everything feels organized now. It’s like a reset for our household finances.

Matthew –

We discovered that this template has gave me confidence to handle my finances which made our life so much easier. It gave us a fresh way to organize our budget.